When assessing the Argentinian agribusiness sector, one of the cornerstones of the production, value addition and export is the thriving oil industry that has consolidated in our country since the end of last century to the present. When analysing the products processed by the agribusiness cluster, soybean stands out remarkably, with an approximate share of 92% of the total, followed by sunflower, with a much lower figure of 6%. At the same time, peanut, cotton, rapeseed and flax represent as a whole less than 1% of the total.

Next, we present an approximation to a strengths, weaknesses, opportunities and threats (SWOT) analysis of the Argentinian oil industry. Based on what we mentioned in the paragraph above, the focus lies on the soybean crop due to the greater relative importance of its share in the industry’s total processing, although we do not dismiss the importance of each one of the remaining products destined to industrialization.

Strengths

1. Processing capacity

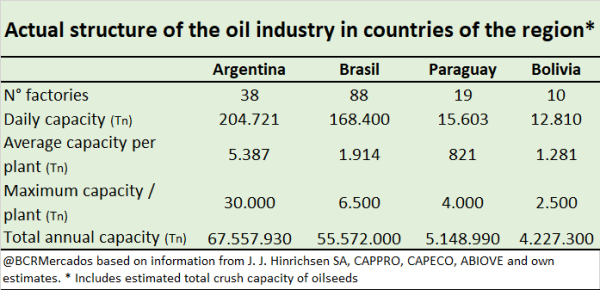

As seen in the following chart, Argentina has a great oilseed processing capacity, with 67.5 million tons per year, according to data by J.J. Hinrichsen and our own estimates for year 2020. In comparison to other countries of the region, Argentina does not have a great amount of factories, like Brazil does, but its productive scale stands out, since its median processing capacity per plant (5,387 t) is much higher than that of the rest of the countries of the region.

In this way, this productive scale, added to other factors such as the closeness of production to factories with access to a waterway gives great efficiency to the chain of value and international competitiveness to Argentinian meals and vegetable oils.

2. Exportable balance of oils and meals

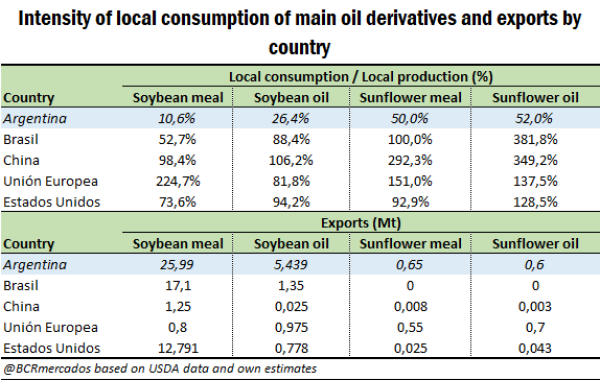

When analysing the exportable supply of the main oilseed by-product producing countries that compete with Argentinian production, our country is characterized mainly by its low ratio of local consumption in comparison to the total production of by-products. In the case of soybean meal, domestic use is only 10.6%, while for soybean oil, 26.4%. In the case of sunflower by-products (meal and oil), the use is higher and close to 50%.

Although Argentina is not the largest producer of soybean, the low domestic consumption allows it to boast a big exportable balance, which makes our country the main global supplier of those by-products. In the case of sunflower, a much smaller market dominated by Russia and Ukraine, our country is also among the first places due to the exportable balance that shows for oil, as well as for meal.

3. Closeness of the production to Rosario city agribusiness cluster

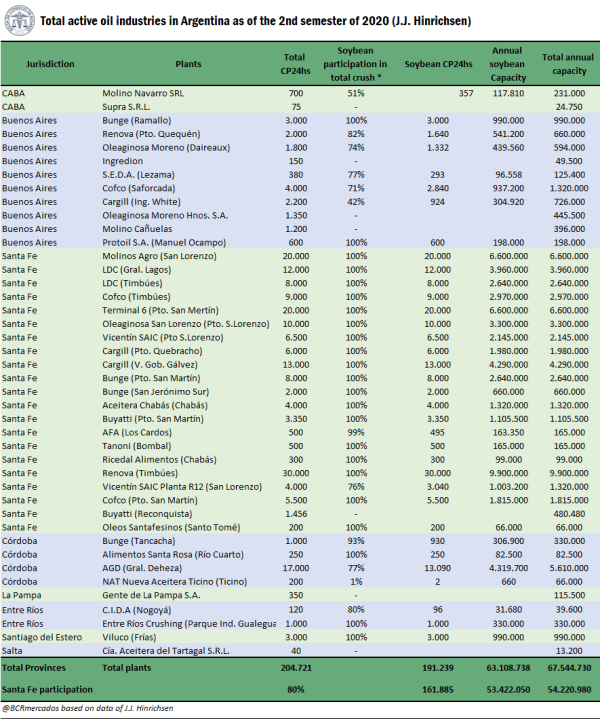

Regarding the geographical location of the group of oilseed industrializing factories, the main part of the installed capacity is on the banks of the Paraná river, in the region of Rosario.

As can be observed in the next chart, 80% of the installed capacity of oilseed crushing is in Santa Fe, and almost its totality is located in the towns near Rosario. Under this manufacturing structure, an element of great importance is the closeness of production to this industrial area focused on export. Approximately 78% of the Argentinian soybean production, the main crop locally industrialized, is within a 300 km radio from the port factories around Rosario city, being this and the exporting profile of the industry what has fundamentally determined the localization of the largest part of the oil plants in the region. In this way, the great productive scale, the closeness of production to the factories and, at the same time, to the exporting exit, give the sector a great strength and competitiveness on an international level.

Opportunities

1. Price forecast favourable for meals and vegetable oils.

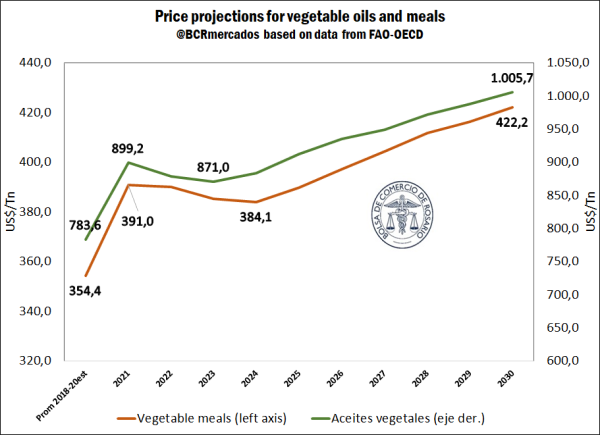

Following the FAO and OECD forecasts for period 2021-2030, the price of oilseeds and by-products presented a great rise during the second half of 2020, due to the fact that world demand grew faster than supply. Although a downward correction is expected for the next few years, better outlooks for production are forecast, and the gradual elimination of logistic restrictions to trade related to COVID-19. From that moment on, prices are forecast to rise slightly in nominal terms, although there could be expected a certain reduction in real terms towards the long-term trend.

As for key decisive factors of oilseed price trends, the perspective of an increase of the real price of crude oil and the sustained economic growth after the recovery from COVID-19 should back the price of oilseeds and their by-products until 2030, while the continuous improvements in productivity would impose a downward-pressure on real prices.

2. Upward trend of global meat consumption above population growth

One of the most important uses of vegetable meals is animal feed. In that sense, the evolution of meat production and consumption is key to consider the demand of those oilseed by-products.

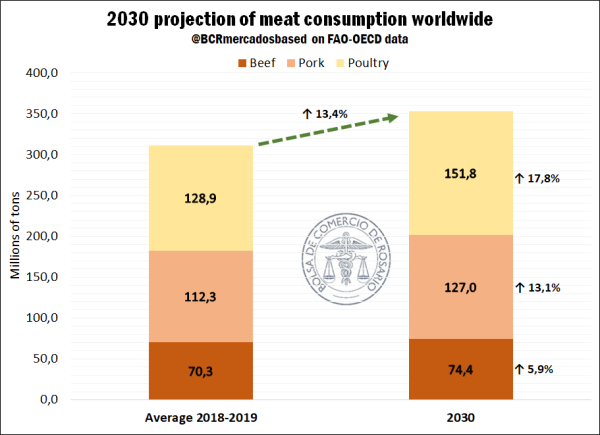

After the last forecasts of FAO-OECD 2021-2030, expectations of an important growth of meat consumption for the current decade are registered, which would be a favourable factor for the production and trade of grains and vegetable meals. Focusing the analysis on beef, pork and poultry, a 13.4% increase over total consumption is forecast. Per type of meats, the highest relative increase is for poultry (17.4%), followed by pork (13.1%) and beef (5.9%).

Among the determining factors, the growth of the world population is the main driving force of animal protein consumption, with a forecast increase of 11% for the decade 2021-2030. In that sense, the increase in meat consumption would be above this indicator, due to the strong rise of consumption in developing countries, which is connected to the rise of per capita income.

Weaknesses

1. The high idle capacity of the industry

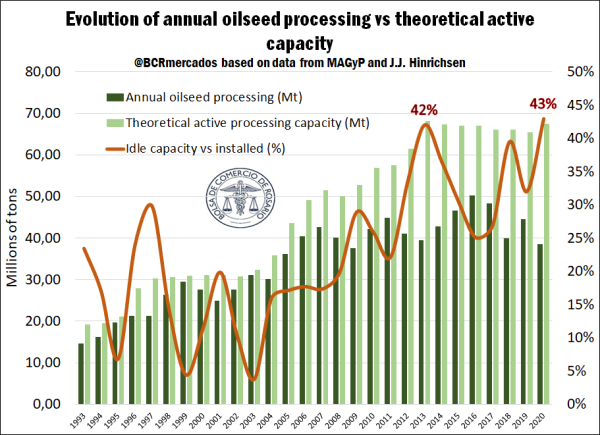

Despite the great commitment of the Argentinian oil industry to increasing its installed capacity, especially between 2003 and 2013, there has not been a concurrent increase of equal proportions of the supply of oilseeds, neither domestic nor imported. We need to remember the limitation to temporary imports of grain of non-Argentinian origin for its local processing and subsequent export as oil and/or meal, limitation that worked as a growth incentive for the oil industry in the neighbouring country of Paraguay. A rising trend has consolidated regarding the idle capacity of the industry, reaching a peak of 43% for 2020 estimate. This situation is presented as a weakness, as it must weigh the high fixed costs in a lower volume of production due to the impossibility of local factories to have a greater quantity of grains to industrialize, either through the Argentine supply or from neighbouring countries, mainly soy-producing countries.

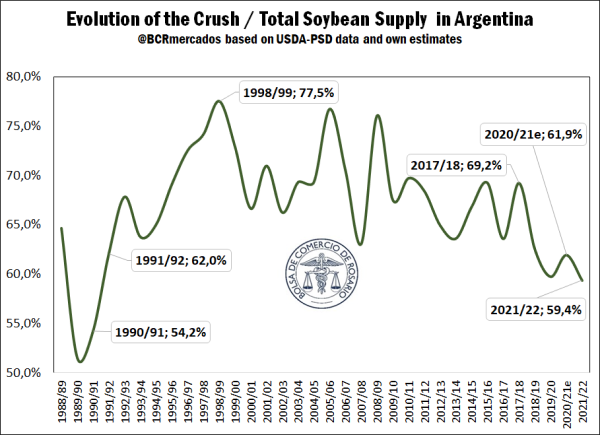

In the specific case of soybean, in the following chart we can observe an important fall in the crush (processing) ratio versus the total supply of the grain feasible to be industrialized per crop season. During crop season 2021/22, a ratio of 59.4% for this indicator is forecast, that is to say, the lowest figure since crop season 1990/91.

2. High export duties for oils and meals

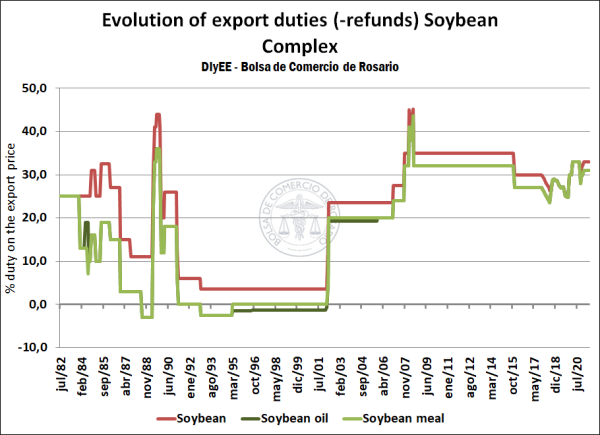

As for the limits to exports, we can mention the export duties, which subtract added value to the participants of the productive chain. The oilseeds and most relevant by-products in a productive sense present tax rates above zero. This is the case of the soybean complex, which is the most affected by export duties ranging from 29 to 33%, depending on the product. In the following chart, we can observe the historical evolution of those export duties for the main exported products of the soybean complex.

On the other hand, in the case of the sunflower complex, the current export duties are between 4.5 and 7%, depending on the exported product, just as the peanut complex. It is important to emphasize that some by-products of those complexes may have a 0% tax rate, but are the ones of the least importance for foreign trade.

Another important matter to highlight is that there is an obligation for exporters to settle those export duties shortly after presenting the Export Sworn Statements (DJVE, for its Spanish acronym), which adds an important financial cost to the export business. Added to the fact that the taxable base is the official FOB price and not the one actually paid in the operation, what can implicitly generate an export duty tax rate even higher, if the official FOB price is significantly above the actual FOB price of effective operations.

3. Stagnation of the oilseed local production

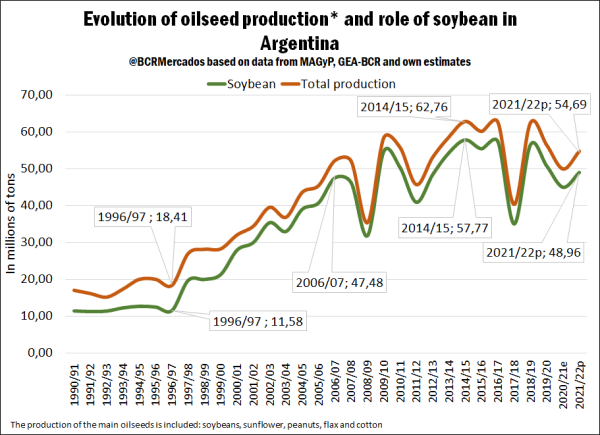

An element of great relevance at the time of analysing the evolution of the oilseed industrialization is the performance of the local production, since on that total depend, to a large extent, the processing possibilities. As can be observed in the following chart, soybean is the main oilseed locally produced, and a determining factor in the productive trend of the oilseed crops as a whole.

Between crop seasons 1996/1997 and 2006/2007, soybean production had a spectacular 310% increase, which motivated large capital investments by industries in order to increase the processing installed capacity from 2003 until 2013, approximately. In that sense, it can be assumed that a sustained continuity of the productive increase was forecast in order to reach higher crushing levels. However, production stagnated because although there was a productive peak in crop season 2014/15, in the case of soybean, the productive forecast for 2021/22 is only 3% above crop season 1006/07, and with a similar figure of growth for the total of oilseeds cultivated.

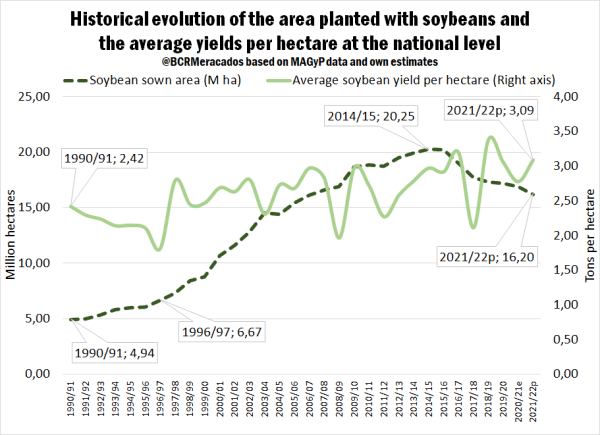

If we analyse the determining factors of the production, there are two key elements: the cultivated area and the yield per hectares, which is largely connected to good weather and the technology used. In the case of soybean, there is a great growth of the agricultural frontier since 1990 until 2015, with a subsequent sustained drop of the area, which for crop season 2021/22 is forecast in 16.2 M ha, reaching the minimum in the last 15 years.

In the meantime, from the point of view of yields, there were no advancements in historical terms that allow to maintain the production increases. In the period between ends 1990/91 and 2021/22, there is a forecast rise in the national average yield per hectare of only 28%, in comparison to the 100% obtained for the case of corn during the same period, this being a crop that competes directly in planted area with the oilseed.

This way, the lower planting intention of the crop added to the low improvement of the yields become a threat for the oil industry in terms of the available supply for industrialization of soybean for the future. To such factors, we must add the structural disincentives generated by the high export duties, which subtract profitability from the producer and makes the cultivation of other crops a priority.

4. Regulatory changes in the biofuel industry

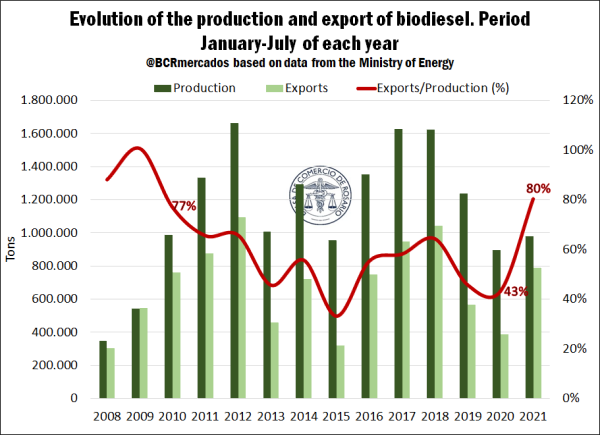

In the case of soybean oil, an important source of domestic consumption for that production is the manufacture of biodiesel. Such production of biofuels is key for the continuity of the productive chains and addition of value of the oil industry.

However, Law No. 26,093, passed on year 2006, which established the “Regimen of Regulation and Promotion of the Production and Sustainable Use of Biofuels” has recently stopped being in force. This regulation has been key to the promotion of the sector that, since then, has established a cut rate between gas oil and biodiesel that reached a 10%, and that has recently been reduced to 5%, with the possibility of cutting up to 3%, depending on the price situation of soybean oil. Such changes in the rules of the game affect the development of the industry and the strengthening of the value chain, that last year was severely affected by the lack of updating of the reference prices for biofuels for the domestic market.

In the following graphic we can observe that the situation of the production during period January-July 2021 has not improved greatly from year 2020, with an obtained volume of 0.98 Mt of biodiesel. In comparison to year 2019, there is productive fall of 20%. At the same time, a greater internationalization of production can already be perceived, due to the inability for placing great volumes of biodiesel in the domestic market, with a share on exports over production of 80%, in maximum levels since 2010.

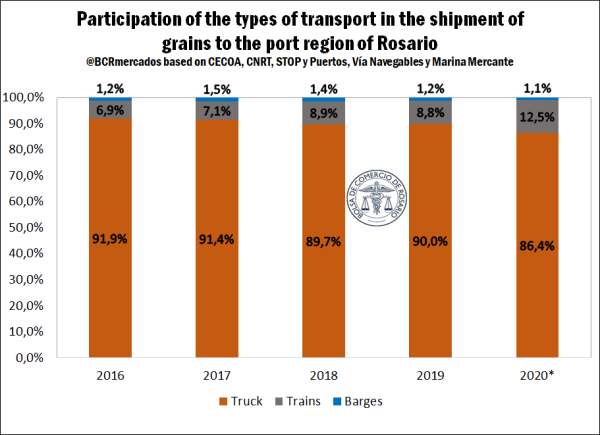

5. Lack of adequate infrastructure for the transport of grains

At the level of infrastructure, domestic logistic costs in Argentina have a heavy weight for the producer, due to the prevalence of the truck for moving grains versus other, more efficient means of transport, such as train or waterway for longer distances. Although the closeness of a good share of production to export ports lessens its impact, the goods that are farther away -mainly the ones coming from the North of Argentina- lose great competitiveness and profitability, added to the impact of export duties on the producer, which has implications on the incentives for grain planting.

In the following graphic we can observe how the truck boasts an estimated share of 86.4% in the grain transport to Rosario city in year 2020, while railway has 12% and with an upward trend with regards to previous years. In this sense, developments made on the lines of Trenes Argentinos, Cargas y Logística (TACyL) have been very important for the increase of the transported volume through that means. In the meantime, the waterway shows a marginal share in comparison to other means of transport.

6. Historical trend of Argentinian soybean protein content

A long-standing issue in the industry is the drop of soybean protein, especially in the case of meal, which hampers the compliance of international trade standards, situated at 47-48% of protein content, which eventually increases costs in order to prepare the goods. For more information, please refer to the report “Soybean chain to lose 575 million dollars due to the reduction of soybean protein during crop 20/21” published on the Edition N° 2014 of the Weekly Report.

It is considered a threat, since such a trend in Argentinian soybean standards makes locally industrialized by-products less attractive in import markets, and means a loss of competitiveness in comparison to the rest of the supplying markets, hand in hand with the higher preparation costs and premiums over FOB prices.

Threats

1. World exports of vegetable by-products key to Argentina do not grow at the same rate as the global consumption of those products.

If we perform a historical analysis of the evolution of consumption in comparison to world exports of soybean, sunflower and peanut oils and meals, it can be observed an uneven result between the most relevant agribusiness products for the local industry, taking as base year crop season 1990/91, according to USDA data.

In the case of soybean meal, there is a very similar growth of world consumption and exports until crop season 2008/09. From that point on, there is a great increase in consumption, while exports had a much lower increase. In order to comprehend this dynamics, it is relevant to mention the role acquired by China as the main soybean importer with the aim of locally industrialize it for its subsequent consumption as forage. That is to say, the Asian country is currently key in the world consumption of soybean meal for its meat production, but enforcing an important policy of local industrialization of grains, despite having a low soybean production, which subtracts export possibilities to countries with exportable balance.

Regarding soybean oil, there is a major growth of exports in versus consumption until crop season 2010/11, with a subsequent fall in exports, remaining below the sustained growth of global consumption until the present.

Later, in the case of sunflower, global consumption has shown a growing trend, mainly since beginnings of the century, which has strongly revitalized the export volume at world level, with its consequent possibilities of placing productive surplus on foreign markets. For peanut by-products, in the meantime, the situation is similar to that of soybean, with a global consumption dynamics above the increase in exports.

In this sense, it is not only interesting the world consumption dynamics of the main oilseed by-products, but also the forms of supply. That is to say, if the global economies as a group favour the local production of those oilseed by-products, threats come up to the export possibilities, as can be observed in the case of soybean and peanut.

2. Possible long-term effects of the low water level of the Paraná river on Rosario city agribusiness region

The water question of the Paraná-Paraguay waterway has become an issue of great uncertainty not only for our country, but also for neighbouring countries of the region, such as Brazil, Paraguay and Bolivia, which are frequent users of this waterway for the transport of goods.

Among the impacts the low water level of the river is having on the oil industry are the difficulties and extra costs of having to bring the goods from the North of Argentina and Paraguay, the lower loading possibilities of grains and oils from the Rosario city region, the increases in the risk premiums over the FOB price for the export of oils and meals from Argentina, and several additional costs within the industry due to the slowdown of the shipping rate. For more information, please refer to the article Low level of Paraná River to cost near US$ 315 million over 6-month period to the agribusiness export complex and Argentinian farmers published in the Weekly Report N° 2009.

Currently, the level of the Paraná river on the banks of Rosario is 0.34 meters on August 30, 2021, a level far below the 2.47 meters where the franchisee Hidrovía S.A. had to guarantee 34 feet of draft until the recent finalization of the franchise. Since year 2019 river depths far below the normal have been measured, reaching historical minimums. For the future, there is uncertainty as if this situation will become a structural phenomenon that will last several years or if the adequate levels for a normal development of the foreign market of the oil industry and general export will be recovered.

The higher logistical costs associated with exports due to a lower river flow, if maintained in the long term, could retract the productive frontier, particularly affecting exports from the areas furthest from the ports, in the north of Argentina.

3. Productive trends of substitute goods that compete with processed by-products

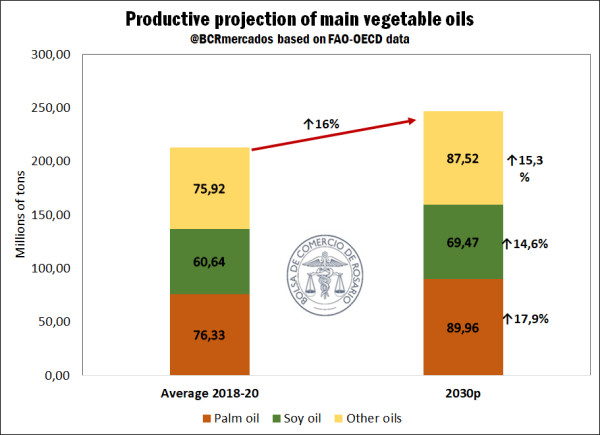

Regarding the vegetable oil market, a 16% increase in production is projected for the year 2030. As for the different types of oils, an increase for palm oil of 17.9% is estimated, which would represent the 40% of the total production increase in this type of by-product. While soybean oil would increase less in relative terms than the general average with an expected rate of 14.6% and a contribution to the production increase of oils of only 26%. Finally, the rest of the oils would increase their production by 2030 by 15.3%, above soybean oil. In this sense, the vegetable oil market will continue to be dominated by palm oil and with a slight drop in global participation by the main oil produced in Argentina, soybean oil.

However, even though the outlook indicates a slight loss of representativeness of soybean oil, the scope for increasing palm oil production in Indonesia and Malaysia will increasingly depend on replanting activities and necessary improvements in production yields. In turn, sustainability concerns also influence the expansion of palm oil production, as demand in developed countries favours oils that are not associated with deforestation and consumers demand sustainability certifications.

4. Set of tariff and para-tariff barriers and product specificities

Among the uncontrollable external factors that can affect the performance of the industry or the possibilities of placing our products in the world, are the set of tariff or para-tariff barriers.

Over the past few years, biodiesel has faced various barriers to exports from external markets. A recent ruling against exports by the United States Department of Commerce stands out due to a possible situation of dumping due to subsidies to local production. In the domestic market, the biofuel industry has been hit hard by the decrease in cut rates in diesel. This has affected the possibilities of internal sales and it is therefore sought to capture new markets in which to place production without having to reduce production.

Requirements related to sustainability are other barriers that may arise and demand rapid adaptation from the local productive sector. Currently, import markets due to various international agreements between countries tend to increase the specificities of the products in demand, with consequent certifications of different types -including environmental ones- that can become key elements for the future to remain and capture new markets.