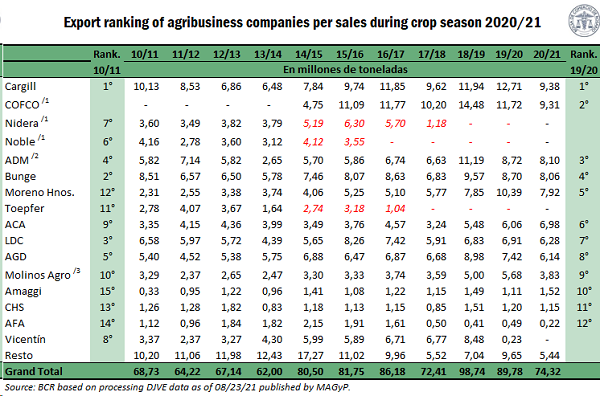

During crop season 20/21 of the various cereals, oilseeds and by-products exported by Argentina to date (wheat, corn, barley, sorghum, sunflower, rice, peanut, among grains, plus meals and vegetable oils, and some legumes) a total of 74.32 Mt (million tons) have been recorded through the system of Export Sworn Statements (DJVE, for its Spanish acronym). This value is almost 10 Mt above the export sales recorded by the same date in year 2020 and 800,000 tons above year 2019 by the same date, when we had a record crop season of grain export. This volume of registered exports and the good international prices explain largely the record entry of foreign currency during the first semester of the year.

The US-capital firm Cargill heads the ranking of Argentinian grains and by-products exporters in year 2021 with 9.4 Mt of export sales. The company exported mainly corn, being the second biggest exporter of the cereal during crop season 20/21, with 5.2 Mt. However, it ranks third in wheat exports, with 1.4 Mt of export sales recorded. As for soybean by-products, it is fifth in soybean meal exports, with shippings for 1.7 Mt, and second in external sales of soybean oil, with 471 thousand tons, among others.

In the second place, the Chinese holding COFCO is slightly below Cargill in the exporters ranking, with 9.3 Mt of export sales. The holding stands out as exporter of several agribusiness products, going from corn, where it is third in the export ranking with 4.6 Mt of sales exports recorded; wheat, being the main exporter of Argentina with 2.1 Mt of wheat in export sales; soybean by-products, holding the 7th place as soybean meal exporter, and the 5th place in export sales of soybean oil.

In the third, fourth and fifth place in the export ranking are ADM, Bunge and Oleaginosa Moreno, with 8.1, 8.1 and 7.9 Mt, respectively (decimals were rounded off). They rank high in the export of different products, detailed below:

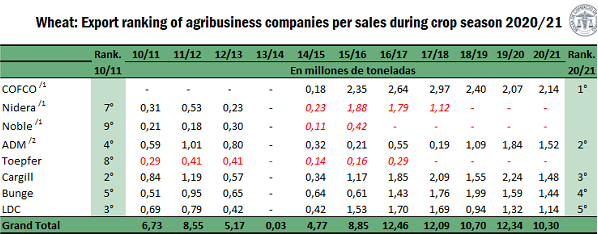

As mentioned before, the main exporter of wheat in Argentina in crop season 20/21 is the holding COFCO, with 2.14 Mt of export sales. It is closely followed by ADM (1.52 Mt), Cargill (1.48 Mt), Bunge (1.44 Mt), and LDC (1.44 Mt).

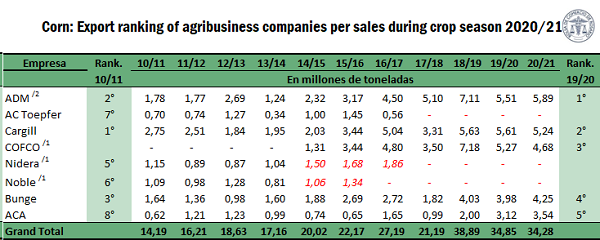

As for corn sales exports, they are leaded by the firm ADM, with 5.89 Mt of export sales registered. It is followed by Cargill (5.24 Mt), COFCO (4.68 Mt), Bunge (4.25 Mt) and the local cooperative ACA (3.54 Mt), which strongly increased its share in the last two crop seasons, after the launch of its port facility in Timbúes.

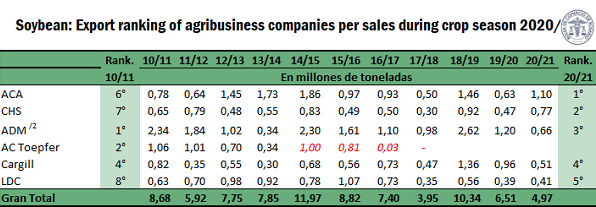

In the export of soybeans during crop season 20/21 to date, the national capitals firm ACA has been the main Argentinian exporter, with 1.10 Mt. In the second place, we can find another US-owned cooperative, CHS, with 770,000 tons of soybean sold abroad. The podium is completed with ADM (0.66 Mt), Cargill (0.51 Mt) and LDC (0.41 Mt). It can be said that in the main grains exported by Argentina (in terms of volume), the dominant positions are held by exporters of the ABCD+ (group made up of the seven global trading companies Cargill, ADM, Bunge, Wilmar, LDC, Glencore and COFCO) of multinational grain export companies and the national capitals cooperative ACA.

As for oilseeds by-products (meal, soybean expellers, sunflower, peanut, rapeseed, flax and cotton, excluding oil) the main exporter during crop season 2020/21 so far has been Oleaginosa Moreno, with export sales registered for 3.72 Mt. It is closely followed in the exporters ranking by AGD and Molinos Agro. In the case of soybean oil, the firm Oleaginosa Moreno holds the first place, with 0.68 Mt registered export sales for crop season 2020/21. It is closely followed by Cargill, Molinos Agro, AGD and COFCO with oil exports between 0.47 and 0.34 Mt. The exporters ranking of oilseed by-products, where the main export product is soybean meal, goes hand-in-hand with the ownership and capacity of the soybean crushing facilities held by each business group on the banks of the Paraná river. At the same time, the capacity to import soybean from Paraguay in order to rise the protein content of the soybean meal exported by Argentina is key in this business. In the case of soybean oil, its conversion into biodiesel is of the utmost importance when selling it to foreign markets.