Differences: Brazil exports 1 ton of meat for every 3 tons of soybean meal. Argentina, on the contrary, 1 in 25

In a previous article, we analysed the uneven evolution of grain corn and meat exports from Brazil and Argentina during the last two decades was analysed. In line with that analysis, on this occasion it will be considered how Brazilian and Argentinian exports of soybean meal and meat changed over time.

Argentina is the fourth world producer of soybean meal and the largest exporter, concentrating, as a matter of fact, over 40% of the global export market. This leap from the fourth producer position to the first and undisputed place as an exporter can be explained by the low domestic consumption of meal in Argentina, added to the productive surplus. Other large soybean meal producers, including Brazil, have lower exportable balances of the product, since they enjoy a very strong domestic demand for animal feed (either because they have a large domestic market to feed, because they have a highly developed export meat industry, or both).

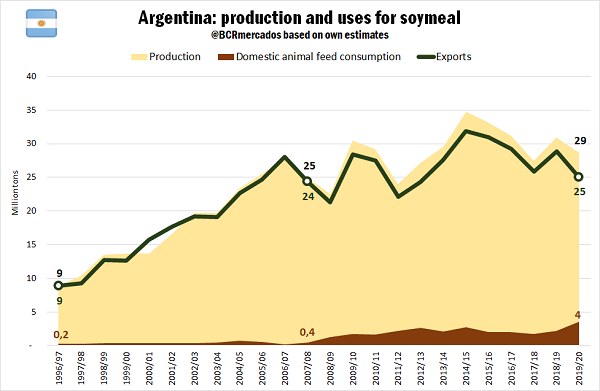

The data series on the production and uses of soybean meal in Argentina, included below, shows how even before the beginning of the second millennium, the use of soybean meal for animal feed was very low in relation to the meal produced. During crop season 1996/97, only 3% of the soy by-product was used in animal breeding. Currently, domestic demand for animal consumption amounts to 4 million tons, that is, just above 12% of production. Therefore, in the period under consideration, this demand quadrupled, also improving its relative share, although it is still extremely low.

In the period considered, thanks to the strong private investment in large-scale industrial plants and to the expansion of the oilseed production frontier, the national meal production tripled, going from 9 million tons in 1996/97 to 29 Mt in 2019/20. This higher volume of product had basically two major sources of demand to turn to: direct export or domestic industries (mainly meat industries). History has proved that Argentina maintained a clear export orientation in the soybean meal segment. 82% of this higher volume achieved by the oilseed industry in the period under consideration went to exports, and only 17% to local industries.

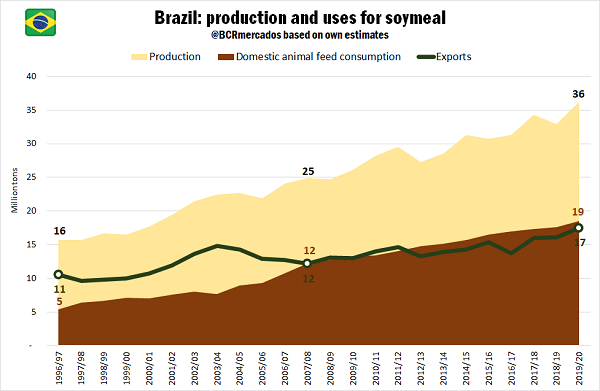

If we analyse the same indicators for Brazil, observations are substantially different. In 1997, the neighbouring country already had a domestic demand of soybean meal that absorbed 34% of its local production. During the period considered, Brazilian meal production doubled, going from 16 million tons in 1996/97 to 36 Mt in 2019/20. It should be noted that, in contrast to what happened in Argentina, 64% of the increase of Brazilian production went to domestic industries and only 34% contributed to higher meal exports.

In this way, Argentina has proportionally increased its production of soybean meal more than Brazil in the last two decades, but only a smaller portion of this growth has been transferred to the domestic market as an input for other industries. This becomes particularly relevant when the great export potential that Argentina has in terms of meat and the difference in the value of exports of meal and meat is taken into account. As a reference, in 2020 the average value of the exported ton of Argentinian soybean meal was US$ 323, while the average price of the exported ton of meat was US$ 2,780.

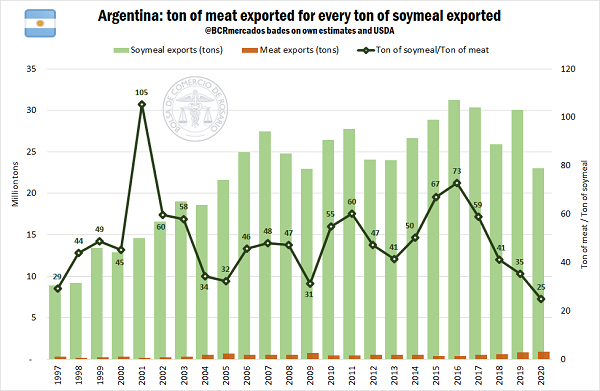

Argentina currently exports 1 ton of meat (beef, pork and poultry) for every 25 tons of soybean meal shipped. Although this relationship is the lowest in the series under study, it is not far from the relationship that existed between exports of both products in 1997. With this, it is possible to observe some cycles with more favourable relationships towards meats and others cycles more favourable to soybean meal, which is caused by fluctuations in harvests or changes in economic policies that affect both sectors. It is not possible, however, to identify a clear trend for this indicator.

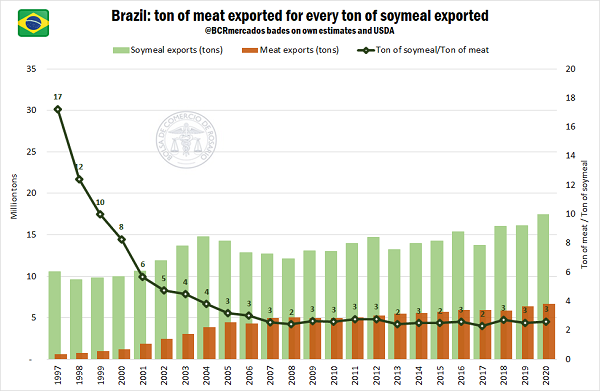

Brazil, on the other hand, has followed a firm path in recent decades towards maximizing meat exports. In 2020, the South American giant exported 1 ton of meat for every 3 tons of soybean meal. Not only is the Tn soybean meal/Tn meat ratio today over 5 times lower than in 1997, but it is also the result of a sustained development of the meat industry, a model that Brazil has been deepening and that in recent years has allowed to supply much of China's spectacular demand for animal protein.