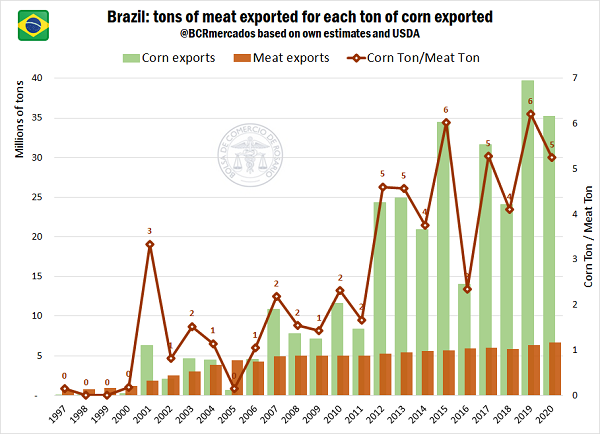

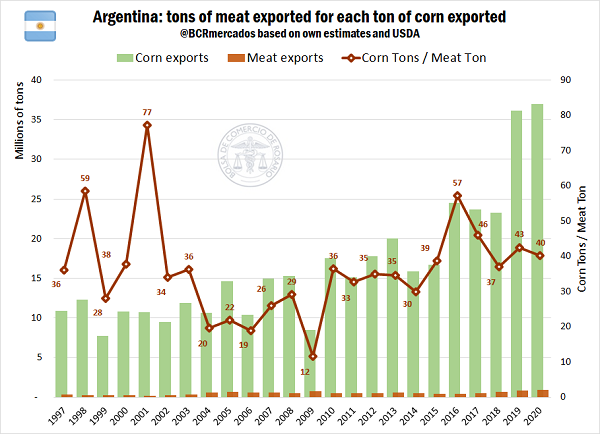

Differences: Brazil exports 1 ton of meat for every 5 tons of corn. Argentina, on the contrary, 1 in 40

Brazil and Argentina are the two major South American food suppliers but, although sharing an agri-exporting profile, the composition of these exports is considerably different.

Brazil is the third largest producer of corn and the second exporter of this yellow grain worldwide. In the last 20 crop seasons (1999/00-2019/20), Brazilian corn production tripled, resulting in large exportable balances that led to a 5-fold increase in exports of yellow grain. Yet, not all the domestic productive growth led to corn exports, but it served as an input to boost the development of the meat sectors, which already had strong roots in Brazilian rural activity. In the period under consideration, exports of beef, pork and poultry grew almost 7 times.

The chart below illustrates how Brazil went from exporting more meat than corn in 1999 to currently shipping 5 tons of corn for every ton of meat exported. Although the exports of the meat industry could not keep up with the shipments of corn, they have a very close relationship that is vital if we take into account the prices paid for both products in international markets. As a reference, in 2020 the average value of the exported ton of Brazilian corn was US$ 170, while the average price of the exported ton of meat was US$ 2,300.

Argentina, which is the fourth largest producer and third exporter of corn in the world, has followed a very different path. In the last 20 crops (1999/00-2019/20), Argentinian corn production tripled, leading exports to multiply 3.5 times their volume. Unlike Brazil, where meat exports grew in greater proportion than unprocessed grain, meat shipments in Argentina had a threefold increase during this period, below the growth of grain exports.

With a greater exportable balance of corn in the late 1990s than Brazil, Argentina was unable to take advantage of the input to boost exports of higher value-added products, such as meat. In fact, these shipments were limited by quotas or high export duties during a great portion of the period. In 1997, the country exported 1 ton of meat for every 36 tons of corn. This difference was reduced during the first years of the new millennium, but it currently stands at 40 tons of corn per ton of exported meat, approximately.

This composition of exports deprives the Argentinian economy of capturing the added value derived from transforming the export of vegetable protein into animal protein. In 2020, the average value of the exported ton of Argentinian corn was US$ 160, while the average price of the exported ton of meat was US$ 2,780.

Brief account of Argentina’s foreign trade of meat during the last 20 years

To understand the fluctuations of Argentinian meat exports along the last two decades, it is essential to review the main economic and political events that affected the market.

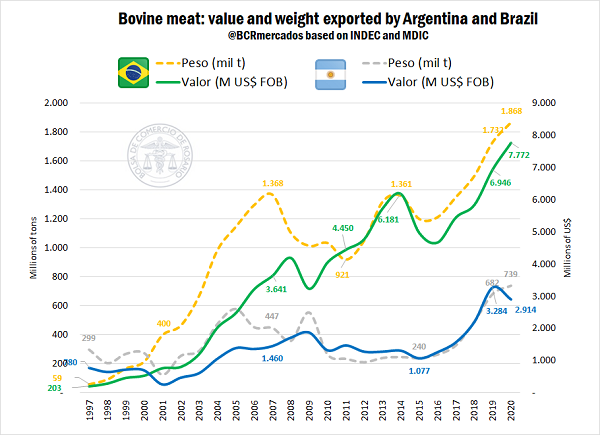

In 1991, Argentina dissolved the National Meat Board (Junta Nacional de Carnes), eliminating export restrictions and withholdings. By the end of the decade, foot-and-mouth disease was considered eradicated, a fact that allowed the reopening of international markets for Argentinian meat. In 1997, the starting year of the time series charted, Argentina exported 299,000 tons of beef (worth US$ 780 million FOB). That is to say, it shipped 5 times Brazil's exports, obtaining a FOB value almost 4 times the one achieved by the neighbouring country.

In 2001, Argentina suffered a new outbreak of foot-and-mouth disease that resulted in a temporary drop in exports that would regain dynamic growth in subsequent years. However, in 2005, reference prices were reinstated, slaughter weight was limited, reimbursements for meat exporters were eliminated, and export duties of 15% were imposed on meat. In 2006, exports were closed for 180 days due to the breach of Hilton quota commitments. Export quotas (the so-called red Registry of Exports or ROE, after its Spanish acronym) and reserve requirements were added to withholdings, thus entering a stage of managed foreign trade.

At the same time, Brazil had maintained a spectacular growth of its external meat shipments and in 2006 it was already exporting 3 times the volume in tons dispatched by Argentina for a value 2.5 times higher.

After a decade with a heavily intervened market, the placement of Argentinian meat fluctuated between 200,000 and 400,000 tons per year, while Brazil remained above 1,000,000 tons in nine of the ten years.

As of 2016, withholdings on meat exports were revoked and, taking advantage of the booming Chinese demand, they tripled their volume and value in the short period between 2015 and 2019. In December 2019, withholdings on meat increased to 9%. During the current year, the meat sector was again intervened, first with the creation of the Meat Export Sworn Statements and then by the temporary partial cap on exports.

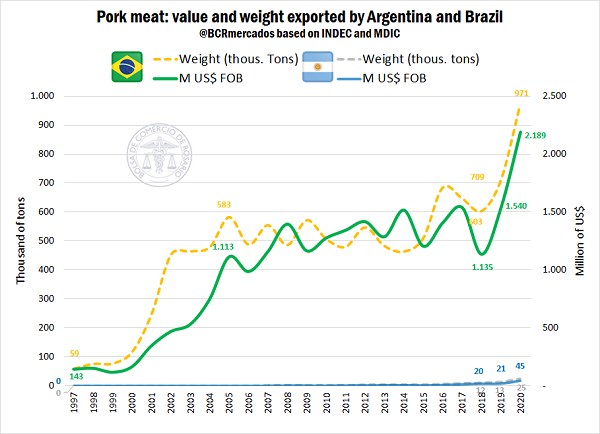

Regarding pork, Argentina has not yet exploited the optimal conditions for pork to see its production and export grow. The swine trade balance was consistently negative in recent years for our country, and although in the last year the export of pork meat doubled and this historical negative balance was changed, the cap on exports in 2021 makes it difficult for foreign trade to grow above this level again. Furthermore, accumulated pork exports until September reached about US$ 39 million, while imports during the same period of 2021 already exceed US$ 66 million.

Within this framework, comparisons of the foreign trade of Argentinian pork with Brazilian pork are out of scale. Brazil has managed to boost its exports with much more impetus than Argentina.

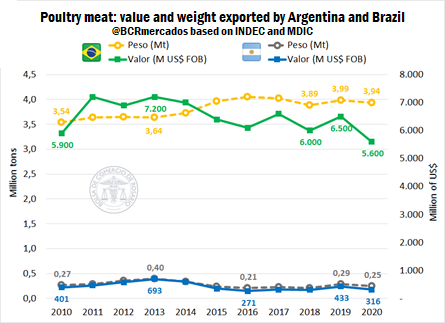

The outlook for the poultry chain in our country is very different. Argentina rarely requires imports of poultry, while it exports these goods in much higher amounts than the foreign trade of pork. However, poultry foreign trade has not yet managed to break the historical exports of 2013, exporting in 2020 less than half of the value traded during that record year.

A reconversion outlook of many countries from chicken importers to chicken producers would limit our country’s possibilities of trade opening. At the same time, sustained recessions in recent years limited domestic consumption of poultry, which in turn resulted in handicaps for taking advantage of opportunities in the sector. Nonetheless, so far this year poultry processing has been recovering steadily in comparison to the fateful 2020, crossed by the pandemic, which can be read as a positive signal for the poultry chain in our country.