EXPORTS

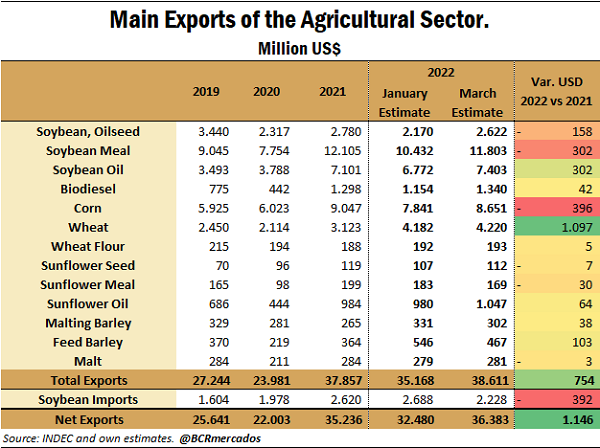

Export forecast of the main agribusiness products

Forecasts for 2022 reached US$ 38,611 million, US$ 3,442 million above January’s estimate, and US$ 754 million above what was exported in the year that ended. The sharp rise in FOB export prices of the main products explains this increase. In this sense, January's exports totalled US$ 2,780 million, a record for the same month of previous years. However, it should be emphasized that this is an aggregate number of the value of agribusiness exports at the country level, which in no way reflects the severe impact that drought has had – at the individual level – on a large number of producers who have seen their yields cut to such an extent that the rise in prices fails to offset costs, and thus present negative margins.

Disaggregated by export complex, shipments of soybean complex are forecast at US$ 23,168 million, US$ 2,640 million more than the amount forecast a month ago. This is due to the sharp rise in FOB prices for all the products in the complex but in particular soybean meal/pellets and soybean oil. However, despite the higher prices, the complex would not exceed the 2021 mark because the quantities exported will fall due to drought. The corn complex would reach shipments for US$ 8,651 million, over US$ 800 million more than expected a month ago. However, like the soybean complex, the price increase does not offset the fall in quantities compared to the previous year.

Forecasts for the wheat complex remain virtually unchanged, with total shipments estimated at US$ 4,413 million for the current year and only US$ 40 million above the amount estimated a month ago. However, the rise in prices along with the increase in quantities would allow this complex to increase the value of its exports by almost US$ 1,100 million compared to the 2021 mark. The sunflower complex would reach exports of US$ 1,328 million and the barley complex of US$ 1,050 million.

Finally, considering that temporary imports of soybean are estimated at US$ 2,228 million, the sector's net exports would reach US$ 36,383 million, some US$ 1,146 million above the previous year.

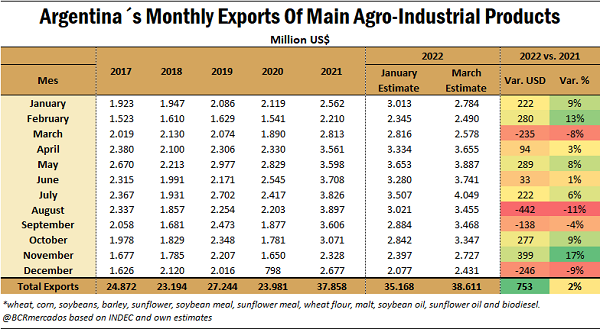

The chart below shows the monthly exports of the main products of the agribusiness sector. It includes forecast export data from the BCR Market Outlook Report – January 2021 and the new forecasts for March.

During January, the value of exports reached US$ 2,784 million, surpassing the previous record of 2021 for January and thus setting a record for the same month in previous years. This confirms the initial expectation about the good yields of fine crop harvest, coupled with high international prices that would leave an improvement in the value of exports over previous years.

On the other hand, another interesting element to highlight is the fact that the rise in prices of soybean products drove an improvement in the export outlook for the second half of the year compared to what was expected a month ago.

PRODUCTIVE AND TRADE BALANCE

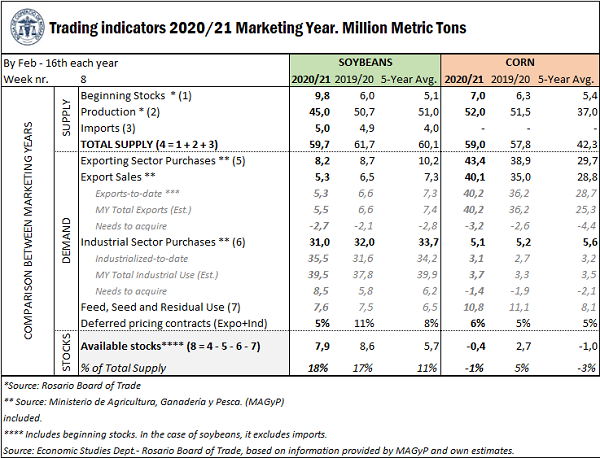

Soybean, Corn, and Wheat Trading Indicators – Crop Season 2020/21.

Soybean: as of February 16th, the export sector has acquired 8.2 Mt of grain, while no new export sales of beans were registered in the last month, so the cumulative total remains at 5.3 Mt, below the figures of previous years at the same date. Meanwhile, actual exports total 5.3 Mt. As for the industry, the sector has acquired 31 Mt of grain, below the volume acquired by this moment in previous years. However, the rate of industrialization of the oilseed remains high, and by January 35.5 Mt had been processed, exceeding by 3.9 Mt the volume industrialized during the previous crop season by the same month, as well as the average of the last five crops.

In this way, the total sales of soybean 2020/21 add up to 39.2 Mt, below the volume traded by this date last year (38,6 Mt) and below the average of the last five years (42,1 Mt). Considering that 7.6 Mt will be destined as seed and for animal consumption, there are still available for purchase 7.9 Mt of the total supply of the crop season (production plus initial stocks). In addition, only 1.8 Mt of the soybean already traded is unquoted, a lower share than what remained unpriced by this point in previous years.

Corn: only a little over two months away from the end of the 2020/21 crop season, 48.5 Mt of the grain have already been traded, an absolute record for the time of year. From this total, the export sector acquired 43.4 Mt, while it has exported 40.1 Mt. Effective exports reached 40.2 Mt as of February between what has already been shipped and what is scheduled to be shipped by that date, the largest volume for the same date in previous years. As for the industry, the sector recorded purchases for 5.1 Mt (a lower rate of acquisitions than in previous years), 3.1 Mt of which have already been processed, a higher volume than the previous crop season.

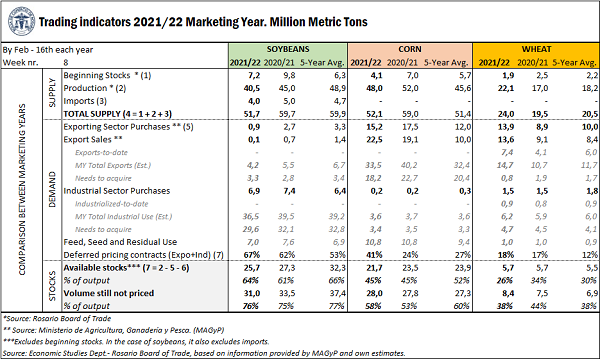

Soybean, Corn, and Wheat Trading Indicators – 2021/22 MY

Soybean: the domestic trade of soybean 2021/22 keeps a lower rate with regards to previous years. The export sector has acquired 900,000 t of bean, both below the volume of purchases of the previous crop season to this date and the average of the last five crop seasons. The industry's purchases, meanwhile, total 6.9 Mt, exceeding the average volume of the last five years, but below the same-date mark of the previous year. On the other hand, the volume of export sales of beans continues to be low, amounting to only 140,000 t, being that a year ago they totalled 700,000 t and the average of the last five years reaching 1.4 Mt.

Considering that the forecast production for the new crop rises to 40.5 Mt and that the use destined for seed and animal consumption totals 7.6 Mt, 25.7 Mt are available for purchase, which equals 64% of the production. In addition, 76% of the volume already sold still needs to be set at a price, in line with what happened in previous years.

Corn: the export sector has acquired 11.3 Mt of grain 2021/22, showing a slowdown in the rate of acquisitions compared to the previous month. In this way, the volume to date was surpassed by the records of the previous crop, although it remains a volume higher than the average of the last five years. Regarding export sales of the cereal, 22.5 Mt have already been committed, a historical record for this time of the year. As for the industry, purchases of the sector amount to 200,000 t, above the volume acquired last year.

Considering that the production of the new crop is forecast at 48 Mt and that the grain destined as seed and for animal consumption amounts to 10.8 Mt, there are still available for purchase 21.7 Mt. Moreover, 41% of what has already been traded is still unquoted, well above the volume of the previous year and the last five years.

Wheat: domestic trade of wheat 2021/22 maintains an uneven outlook between the exporting and the milling sectors. As for the exports, purchases by the sector reached 13.9 Mt, the second-highest record for this moment of the year (only behind 2019/20). The milling sector, meanwhile, has only acquired 1.5 Mt of grain, of which it has already processed 0.9 Mt. In this way, acquisitions in this sector are below what has happened in previous years. Last, the total of wheat declared for export sales reaches 13.6 Mt, that is to say, 51% higher than wheat sales by the same date during the previous crop. Between what was shipped from the beginning of the crop until February 23rd and what is scheduled to be shipped until the end of this month, exports total 7.4 Mt, widely exceeding what was exported in the first two months of the previous crop and also above the average of the last five years. It would be the second-best volume record in history for the first quarter, only below 2019/20.

Last, considering that the production of the current crop is forecast at 22.1 Mt and that 1 Mt will be destined as seed and for animal consumption, only 5.7 Mt are available for sale, equivalent to 26% of the production. Another aspect to highlight is that 62% of the production has already been priced, widely exceeding the volume of last year and that of the last five years.

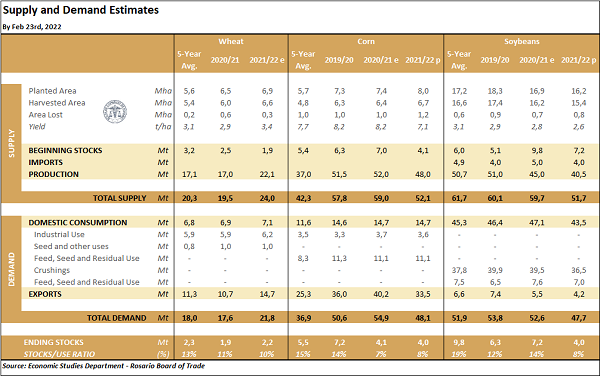

Supply and demand balance forecast of Soybean, Corn, and Wheat.

Soybean: the 2020/21 soybean balance sheet does not change from the January estimates.

The 2021/22 soybean balance sheet presents changes both on supply and use. Regarding supply, imports are expected to fall to 4 Mt (-1.5 Mt) as a result of lower grain availability in the usual oilseed supplying countries. In addition, the production is estimated at 40.5 Mt, some 500,000 t above what was expected a month ago. On the use side, a slight cut in what is destined as seed, animal feed, and other uses, and a marginal increase in bean industrialization are expected. As the cut in total supply is greater than the drop in uses, final stocks are expected to fall from 700,000 t to 4 Mt.

Corn: the 2020/21 wheat balance sheet shows adjustments in the use of the cereal. Estimates of forage use, such as seed, and residual, which fall by 1.2 Mt to 11.1 Mt, were adjusted. In addition, industrial use is also expected to increase slightly to 3.7 Mt (+0.1 Mt) due to increased cereal processing. On the other hand, exports are estimated to increase by 700,000 t to reach 40.2 Mt due to a higher rate of shipments. Thus, given that the cut in the estimates of use as forage, seed and residual is greater than the increase in industrial use and exports, stocks grow to 4.1 Mt (+0.5 Mt).

As for the new crop corn 2021/22, there are changes both on the side of supply as of demand. Regarding supply, production remains at 48 Mt and initial stocks rise above about the final stocks of the 2020/21 crop. Regarding the uses of cereal for the new crop season, a slight cut in domestic consumption is expected to 14,7 Mt (-0.1 Mt). Given that exports remain unchanged at 33.5 Mt, total demand falls to 48.1 Mt. This increase in supply and cut in demand leads to a rise to 4 Mt (+1.7 Mt) in final stocks for the crop season.

Wheat: the 2021/22 wheat balance sheet remains unchanged from January's estimates.