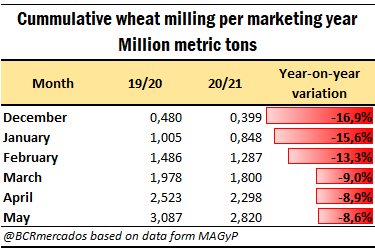

After having presented a notably delayed crop season start with regard to the previous crop, wheat milling catched up during subsequent months, bridging the gap with crop season 2019/20. However, during the last two months, this recovery seems to have come to a halt.

In April of the current year, wheat milling reached 498 thousand tons, while during the same month last year there had been ground 544 thousand tons. As in May, 523 thousand tons of wheat were destined to milling, the highest monthly volume of the current crop season to date. Nonetheless, on the same month of the previous year, 565 thousand tons had already been processed.

Thus, as can be appreciated in the previous chart, when we take into account the value accumulated from the start of the crop season until the last month available, it can be appreciated that the decrease in reference to the previous crop was remarkably reduced between the months of January and March by almost 8 percentage points, while during the last two months only 0.4 pp were cut down.

At present, the 2.8 Mt ground to date represent 48.2% of the 5,85 Mt forecast, while the 3.1 Mt destined to milling during the first six months of 2019/20 represented 50.4% of the total ground during the crop season. This way, unless wheat industrialization regains its pace during the upcoming months, the 5.85 Mt of milling forecast for the current crop will hardly be reached.

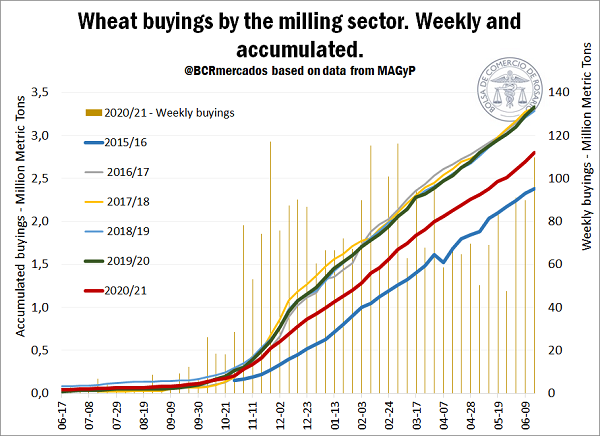

What happens with buyings of the milling sector is in line with what was described ut supra. The sector's 2020/21 wheat buyings to date totalize 2.8 Mt, the lowest volume in six years by the same time of the year, although during the last three weeks purchases by the sector slightly increased and totalized 290 thousand tons. Since one of the distinctive characteristics of the sector is to keep low grain stock levels and to industrialize the cereal as it is purchased, in order to reach the 5.85 Mt mark to grind during the current crop, there still need to be bought 3 Mt of cereal.

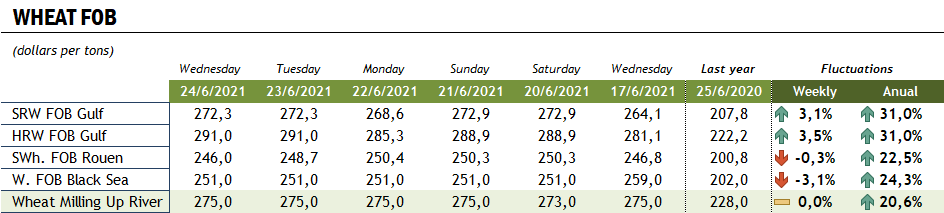

Last, with regard to prices, it is interesting to analyze what is happening with FOB prices at the ports of the main wheat exporting countries. At present, FOB export price in Argentina for July shippings is US$ 275/t, only surpassed by red winter wheat price at the ports in the Gulf. This must not be striking, since the cereal harvest on the northern hemisphere has started during the last few weeks, and therefore a high volume of grain is entering into the markets, which puts pressure on cereal prices on those export poles.

Be that as it may, a fact that is worth mentioning is that the FOB price of bread wheat on UP River Parana Ports is the one with the lowest year-on-year increase of all the prices considered. Regarding the values obtained a year earlier, there is an increase of 21%, while, at the other ports, the increase ranges from 23 to 31%.

In terms of domestic quotes of the cereal, the dollar-equivalent price of the Cereal Abritration Chamber of Rosario showed a fall during the last week. On Thursday, it was US$ 204.5/t a decline of 4% from last week's values. This way, the local price of cereal fell almost US$ 30/t with regard to the maximum values reached a month ago, although the profit is maintained on the year-on-year comparison, since the prices are 12% above the prices a year ago.