With the publication of the Joint Resolution 7/2021 on Argentina’s national official gazette, it was made official the extension until October 31st of article 2 of Decree 408/2021, which prohibits the export of 12 beef cuts, and, of the remaining meat, it permits the export of the exact 50% of the exported monthly average during semester July/December 2020. In this article we will make a brief account of the measures applied along this year, with a particular emphasis on the consequences registered to date. We will later discuss their economic impact.

Which were the measures?

Cattle farming was initially affected in February with the agreement reached between the national government and the supermarket and export sectors, which comprised 6,000 tons of beef made up of 8 meat cuts that would be commercialized under a “Precios Cuidados” or “maximum prices” scheme.

Later, in April, the Resolution 60/2021 by the Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym) and the Joint Resolution 3/2021 by the MAGyP and the Ministry of Productive Development were introduced. The first of these resolutions, in a nutshell, increased the amount of information required from export companies, especially from those that do not have their own plant. The second prescribed the creation of Meat Export Sworn Statements (DJEC, for its Spanish acronym) and the establishment of reference FOB prices. This mechanism is similar to the current system in the grain market with the Export Sworn Statements (DJVE, for its Spanish acronym). In May, the agreement reached in February was expanded to 8,000 tons of beef at “Precios Cuidados”, and 3 more meat cuts were added to the scheme.

Going on with the measures applied during the year, the turning point was on May 19th, with Resolution 75/2021, which stipulated a 30-day suspension of export sales approvals, thus implying a virtual ban on beef exports without distinction of meet cuts, and only allowing shippings to Argentina’s tariff quotas.

Furthermore, 5 days later, reference prices were enforced by the Federal Administration of Public Revenues (AFIP, for its Spanish acronym). Later, on June 22nd, Decree 408/2021 was signed, which suspended until December 31st the export of 12 beef cuts of domestic consumption, while the remaining meat cuts could not be exported temporarily until August 31st, counting on the possibility of extending the measure until October and, later, until December. In effect, this week the measure was extended until October 31st (Joint Resolution 7/2021), generating discontent in the main institutions and Chambers of the sector. Additionally, in the decree published in June, the MAGyP was entrusted to elaborate within 30 days a program for stimulating and developing the beef chain with special short, middle, and long-term incentives.

Why were all these measures applied?

All the regulations based their justification on the prices of beef in the domestic market during the last year, while the productive stagnation and commercial inefficiencies were also alleged. However, available data show that the cocktail of measures applied has had meagre results in relation to consumer prices, while it generates prejudice and uncertainty all along the productive chain.

Mainly since Resolution 75/2021 from May 19th, 2021, which suspended exports of beef for 30 days, the results show a clear worsening of productive indexes.

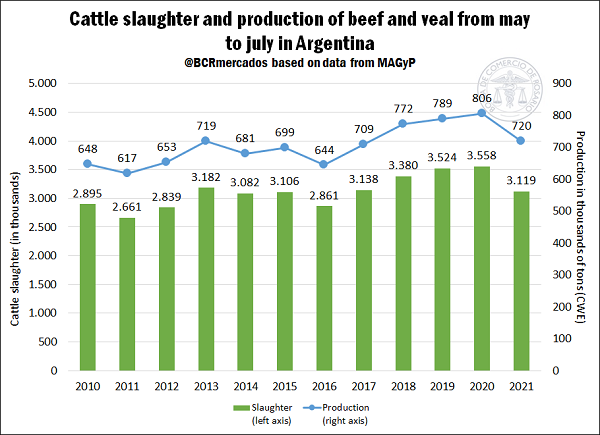

What happened to slaughter and production?

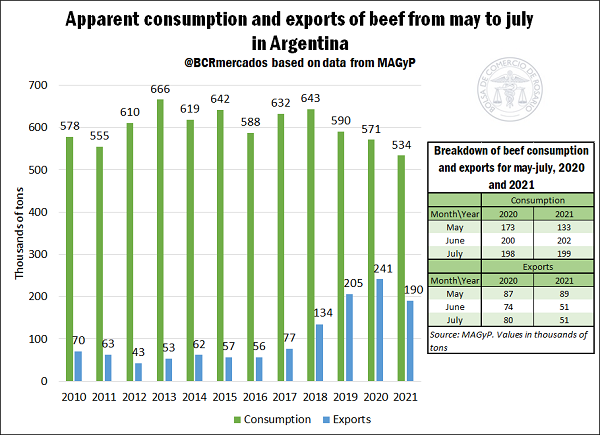

Starting with the slaughter and bearing in mind that the closure of exports started in May this year, we proceeded to compare the months of May, June, and July 2021 to previous years.

From there we can observe that the number of cattle processed in the domestic market during trimester May-July 2021 was the lowest record since year 2016. In addition, the year-on-year fall of the slaughter (2020 versus 2021) is 12.3%, far below the 3.5 million cattle processed in the same period in 2020. Due to this reduction in the processing of beef cattle, the 720,000 tons (bone-in beef equivalent) produced during these 3 months of 2021 are the lowest for this period since 2017. In a similar way to slaughter, production fell 10.7% year-on-year from the 806,000 tons (bone-in beef equivalent) generated a year ago.

What happened to consumption and exports?

If we carry out the same analysis for beef consumption and exports, similar results are obtained. Regarding 2020, the apparent consumption fell 6.5% during these 3 months, while the exports had a reduction of almost 21%. In other words, less meat was consumed domestically, and about a fifth less of the tonnage was shipped abroad. If we assess the difference between the tons exported between May and July 2021 and 2020 at the average prices of the first 6 months of 2021, we can conclude that the drop in foreign currency income is about US$ 150 million.

However, it is important to highlight two aspects:

a) Per capita consumption in May 2021 was the lowest record per inhabitant since the beginning of the statistics presented by the Ministry, with 34.39 kg/capita.

b) If we compare July 2021 to what occurred a year ago, apparent consumption was at very similar levels, since this year 198,770 tons were absorbed domestically, while a year ago 198,000 tons were consumed domestically.

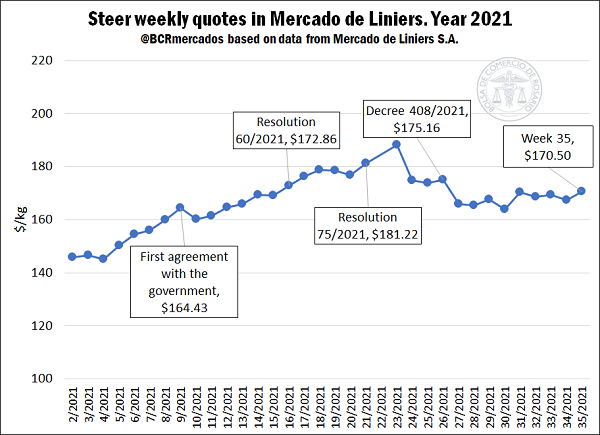

What happened to the prices received by the producer?

As for domestic prices, and especially those for the producers of beef cattle, we can note an upward trend during the first months of the year, with reductions after the application of the more restrictive measures since May for the prices of steer at Mercado de Liniers S.A. In this sense, between the beginning of the year until week 35 (until Saturday, August 8th) the value rose by 16.8%, going from $ 145.9/live kg to $ 170,5/live kg. However, there has been recorded a 6% drop since the application of Resolution 75/2021 (closure of exports in May) until the end of August.

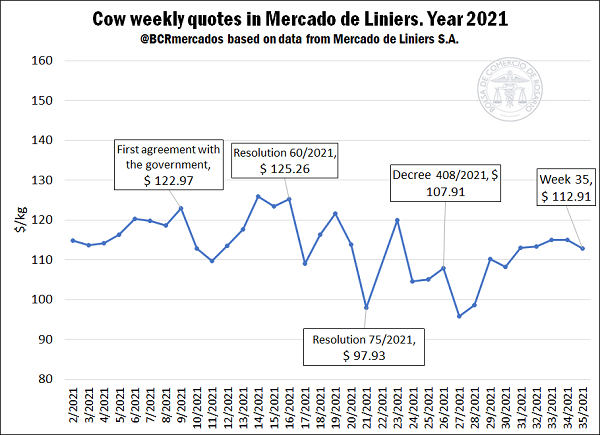

On the other hand, since the beginning of the year, the quotes of Mercado de Liniers for cattle (main group affected by the latest export restrictions and merchandise of Chinese demand) was reduced by 1.7%, going from $ 114.9/live kg to $ 112.9/live kg, while it is far from the $125.3/live kg recorded during the week the Resolution 60/2021 was published in April.

As we can see, it is a discouraging outlook for the livestock producer in an inflationary context. The price of steer is the most affected by the closure of exports in May, but the price of cow is the one that shrank during the current year.

What happened to the consumer prices of meat?

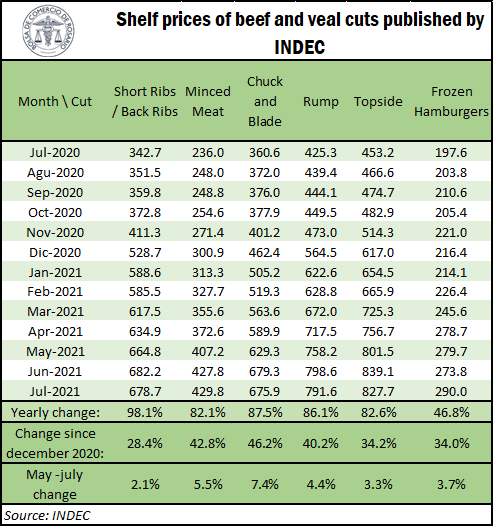

Finally, since the cap on exports to date, consumers have not registered considerable reductions in the shelf prices of the products, as despite the more severe restrictions applied since May, the values of beef cuts have not decreased, but only had less-pronounced increases than the ones registered during the previous months.

Final conclusions:

Over 3 months after the application of more restrictive measures in 2021 to date, there are drops in slaughter, production, consumption and exports. At the same time, the prices paid to farmers decreased and the retail values kept rising, although moderately.

It must be taken into account the uncertainty generated by the closure of exports in the productive sector at the time of making decisions such as rotation, areas destined to pastures and fodder, as well as the reserves of cattle farmers. The period of incumbency of investments comprises extensive cycles, and the absence of clear rules severely damages the trust of investors in the primary and industrial sector. Likewise, it must be considered the reduction of the foreign currency income due to lower export sales, the losses in terms of rural employment hours and in the facilities where there was a reduction in the slaughter of cattle, as well as the notorious impact on the economy of Santa Fe, a province that exports over 40% of the national tonnage.

The Rosario Board of Trade has made clear its position: if Argentina wants to consolidate as a reliable supplier of food at a global level, the suspension of meat exports is a step in the opposite direction. It means places that we will lose and will be occupied by competitor countries.

They are trade-distorting measures that impact severely on the sector, and which constitute negative signals due to the possible repetition of policies that in our country’s recent history have caused productive setbacks very difficult to overcome.

The sector remembers that, when an export restriction system was implemented in the past, the stock of cattle collapsed in over 10 million cattle due to the fall in profitability and the disincentive to investment, which meant a serious de-capitalization of the sector.

The production of beef demands a cycle of around 3 years, which is why it is imperative to count on clear rules, stable through time, that foster investment and promote its development.