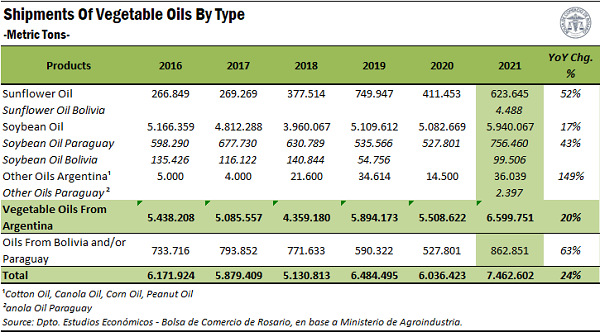

According to the Argentinian Ministry of Agriculture, Livestock and Fisheries, exports of vegoils by vessel totalled nearly 7.5 Mt in the last year, surpassing the 2020 volume by 24% and reaching the highest volume in 14 years (only below the 2007 record). Moreover, it stands out that it was only slightly more than 100,000 t below that record and that it surpassed by almost 1 Mt the best result of the last decade, which was held by 2019 with 6.5 Mt. On the other hand, of this total of oils dispatched, shipments of goods of domestic origin totalled 6.6 Mt, while oils with origin in Bolivia and Paraguay added another 0.9 Mt.

The figure includes the following oils: soybean (both of Argentinian, Paraguayan and Bolivian origin), sunflower (of Argentinian and Bolivian origin), cotton, corn, safflower and canola of Bolivian origin.

Part of this increase is explained by the marked recovery of grain industrialization, which also positively affected meals. Oilseed crushing grew considerably over the last year: soybean crushing increased 18% vs. 2020 while sunflower crushing increased 25%. The higher volume of oilseeds processed in the last year led to an increase in oil production, which increased the exportable balance.

However, there are also other factors specific to vegoils that also explain the higher volume shipped in the last year. On the one hand, world oil consumption grew considerably compared to 2020, which raised demand. Taking the three main oils produced and consumed globally: palm, soybean and sunflower, in the first two the last crop ended with a record in world consumption, while in the third it was the second best.

On the other hand, this higher volume also responds to the lower production of biodiesel. In the last year, the production of biodiesel based on soybean oil grew compared to 2020. However, if we ignore that year because it is a particularly atypical year, it can be seen that biodiesel production during 2021 was the lowest since the diesel and naphtha mandate was imposed in 2010. In addition, mandate sales were the lowest since its implementation, even below 2020. This is due to two factors: on the one hand, biodiesel mandate rate in diesel was temporarily reduced in the first months of 2021; on the other hand, in August last year, a law was enacted that reduced the minimum mandate rate for biodiesel and ethanol in fuels.

As for the first factor, the mandate rate was reduced in January 2021 to 5% (from 10% that was in force in December 2020) to gradually rise to the original 10% in April last year (this did not happen with ethanol, which maintained the mandate percentage at 12% in the first months of the year).

Regarding the second, Law 27,640 regarding Biofuels Regulatory Framework came into effect last August and established a new mandate rate of 5% for biodiesel in diesel and 12% for ethanol in naphtha, with a possible reduction to 9%.

In this way, it is evident that, for most of the last year, the mandate rate of biodiesel in diesel was considerably lower than the 10% in force since 2010 onwards, which sharply reduced domestic demand for biofuels.

Thus, considering that soybean oil is the main input in biodiesel production, the drop in domestic demand for biofuels led to lower production of this biofuel and therefore lower domestic consumption of soybean oil. Therefore, a higher volume was available to send abroad.

In fact, looking at the vegoil shipments in the last year compared to the previous year, it is noted that shipments of soybean oil were the ones that increased most year-on-year in absolute terms: taking the goods of Argentinian origin, in 2021 nearly 900,000 t more were shipped than in all of 2020; while if goods of Bolivian and Paraguayan origin are also included, the increase amounts to almost 1.2 Mt.

In summary, there are numerous factors that influenced this good performance of Argentinian vegoil shipments in the last year that allowed to reach a 14-years high.

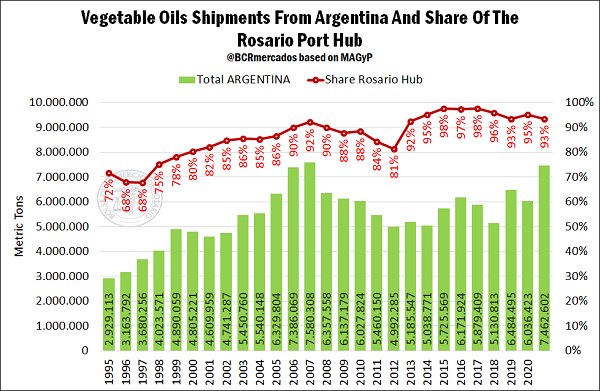

Continuing to unravel the origin of the shipments, it can be seen that 93% of all vegoils shipped in the last year originated in the port terminals of Rosario, while 5% originated in the southern ports of Buenos Aires and the remaining 2% were shipped from the rest of the country's port terminals. While shipments from the Up-River Paraná ports grew considerably year-on-year (21%), total shipments grew in a higher proportion driven by a sharp rise in the ports of southern Buenos Aires (+51% YoY) and above all by phenomenal growth in the rest of the port areas (+169% YoY).

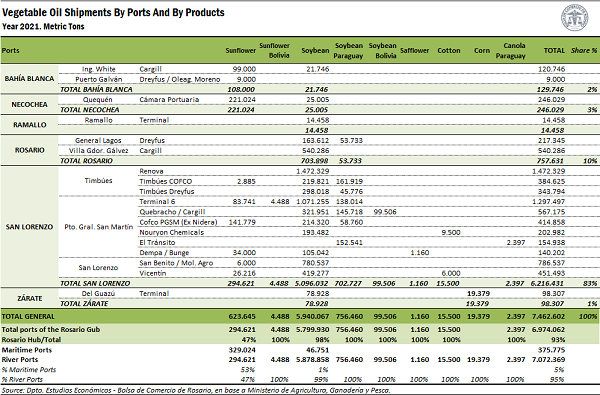

Disaggregating by type of oil, it is observed that virtually all of the soybean oil was shipped in the ports of the region (98%). Moreover, since it is precisely soybean oil that has the largest share of the total vegoil shipments (of the 7.5 Mt shipped in total, 6.8 Mt were of this particular oil, that is, 91%), it is precisely soybean oil which explains the high preponderance of the Up-River Paraná ports.

In fact, shipments of sunflower oils and other oils are much more widely distributed among the different port areas: of the nearly 630,000 t of sunflower oil shipped in 2021, the southern ports of Buenos Aires shipped 52%, while the terminals of Rosario the remaining 48%; of the more than 38,000 t of other oils sent abroad, the Up-River terminals and the other terminals were distributed 50% each.

Thus, in the total aggregate, the share of Rosario cluster in the total shipments of vegoils from Argentinian ports fell in 2021 (the aforementioned 93% vs. 95% in the previous year).

As for the offices per terminal, the three main ones were all from the department of San Lorenzo: San Benito in the third place with 786,000 t; Terminal 6 with 1.3 Mt in the second place; and Renova in the first place with 1.5 Mt. In addition, the exact same podium of the previous year was repeated.

Disaggregating by product, the Port Chamber of Quequen was the one that shipped the largest volume of sunflower oil, while Renova was the one that dominated in shipments of Argentinian soybean oil. The COFCO terminal in Timbúes led the shipments of Paraguayan soybean oil; and Quebracho’s, those of Bolivian origin, while Terminal 6 did the same for the shipments of sunflower oil from the Andean highland country. In addition, it is also noteworthy that all the tons of corn oil were shipped from Del Guazú terminal, while the rest of the vegoils were all shipped at port terminals in the department of San Lorenzo.

Destinations of oil shipments

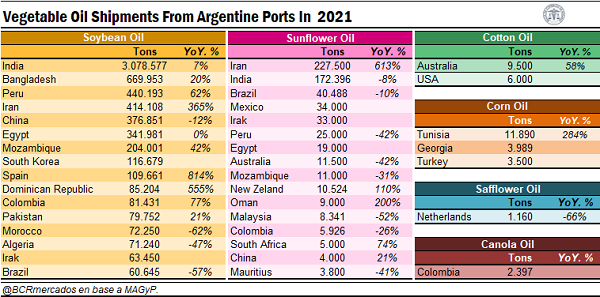

Most of them went to Asia (73% of the total), while America ranked second and Africa third with 13% and 12%, respectively. Europe received about 2% while Oceania, 0.5%.

Disaggregating by subcontinental regions, South Asia was the main destination, with 4.6 Mt (62%) while South America ranked second with just over 700,000 t (9%) and East Asia third with 550,000 t (7%).

Analysing shipments by country and product, it follows that this strong relevance of South Asia is explained by the importance of India. The Asian giant positioned itself as the main destination for soybean oil shipments (3.1 Mt, equivalent to 45% of total shipments of this product). In addition, Bangladesh (670,000 t, or 10% of the total) was second, which is also located in the southern region of the Asian continent.

With regard to sunflower oil, the main destination was Iran, with 227,500 t, equivalent to 36% of the total of this oil shipped in the last year. In addition, a relevant fact is that shipments to that country in West Asia multiplied by 7 between 2020 and 2021. On the other hand, it is also noted that India was the second main destination for shipments of this product.

Finally, Australia was the main destination for cotton oil shipments, while Tunisia was the case for corn oil. All tons of safflower oil went to the Netherlands, while those of canola oil headed towards Colombia.