Structural analysis and current agenda of soybean complex in Paraguay

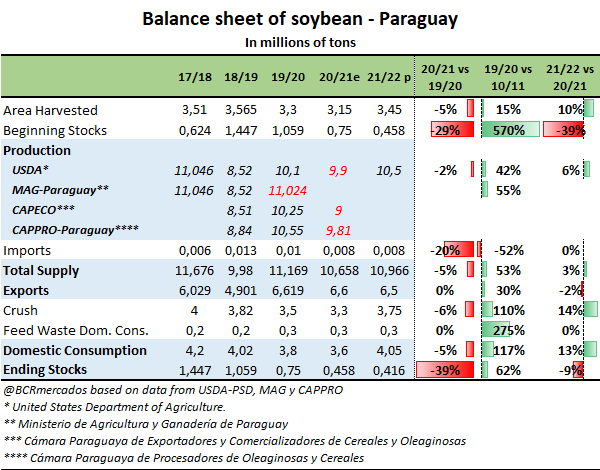

During the last decade, soybean production in Paraguay has increased by 42%, according to USDA data, while the planted area also shows increases, reaching 3.3 M ha during crop season 2019/20.

As for Paraguayan soybean production during 2020/21, it would reach between 9 and 9.8 Mt, according to current forecasts of several local organisms. In the case of the USDA, it forecasts a production of 9.9 Mt. Where the do agree is that they expect a productive drop. During the last crop season, the crop development was affected by an adverse climatic situation. In spite of that, the grain exports are expected to remain solid, while the domestic consumption and the final stocks of the crop season are forecast to decrease.

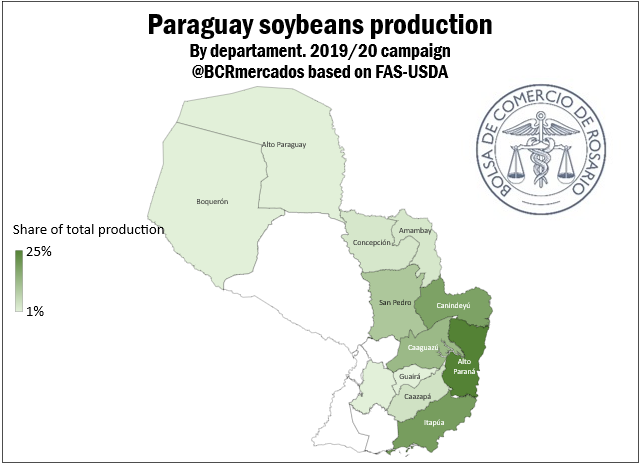

On the other hand, if we carry out a structural analysis of the soybean complex in Paraguay, we can see the distribution of the planted area in that country. The main soybean producing departments are on the South East region, with remarkable productions on Alto Paraná, Itapúa, Canindeyú and Caaguazú, which together concentrate 75% of the Paraguayan soybean production.

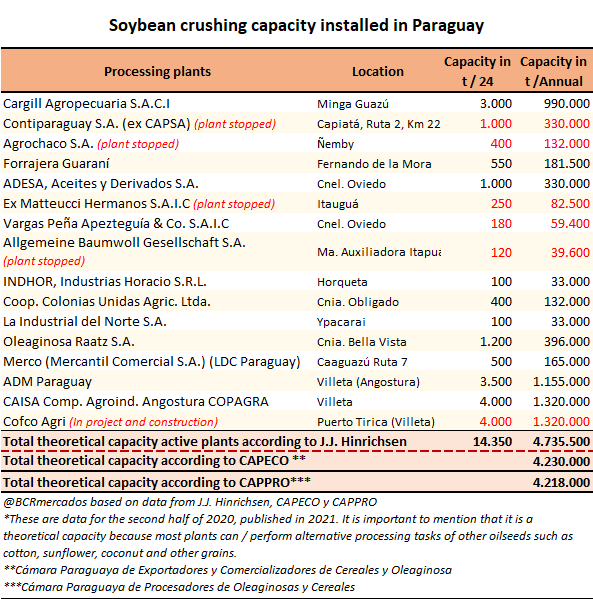

As for the industrial structure, at present, the theoretical maximum capacity of active soybean processing plants identified by J.J. Hinrichsen is of 14,350 tons/24hs and 4,7 Mt on annual terms. It is important to note that these are theoretical values, since most of the plants can or do perform alternative crushing tasks of other oilseeds, such as cotton, sunflower, coconut and other grains.

Besides, the Paraguayan Chamber of Cereal and Oilseed Exporters and Traders (CAPECO, for its Spanish acronym), organism of reference in terms of markets and statistics in Paraguay, estimates a lower annual processing capacity between 4 and 4.2 Mt on general terms.

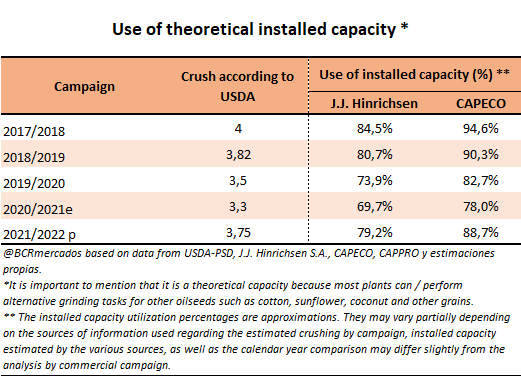

By analysing the use of the theoretical maximum installed capacity during crop season 2020/21, it falls at minimums since at least crop season 2017/18, according to our own estimations calculated on the base of several sources of information regarding processing. In that sense, for crop 2020/21, we calculated a usage estimation of 78%, which is a high figure despite being below previous crop seasons. At the same time, for crop season 2021/22, it is forecast a recovery that would reach 88% of the industrial installed capacity usage, according to installed capacity data from local sources in Paraguay.

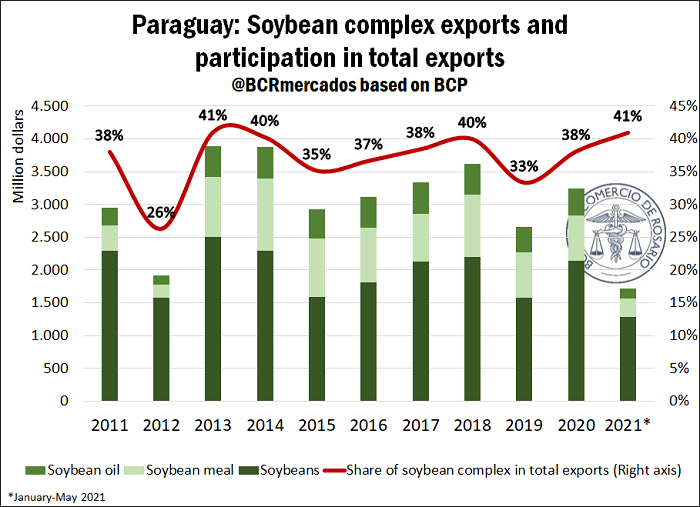

If we analyse the importance of the soybean complex in the Paraguayan export market, we could see that exports of the sector in year 2020 represented the 38% of the total. If compared with previous years, the proportion remains stable, except for particular years like 2012 or 2019. In the meantime, year 2021 until the month of May reached 41% in regard to total exported.

On a product level, the main contribution of the complex to exports is due to shippings of soybean, which during 2020 reached a value of US$ 2,146 million, which represents 66% of exports of soybean complex for the mentioned country.

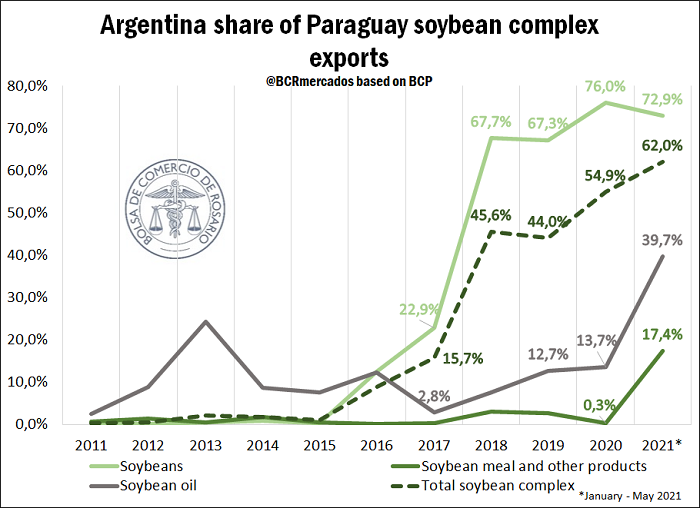

Last, if we focus on export destinations of the soybean complex products, it is remarkable the role of Argentina from year 2016 onward. Among the different products, our country transitioned from absorbing 12.5% of soybean exports from Paraguay to 76% in 2020. Just as previously mentioned, this is the main product of the complex exported by our neighbouring country. This can be verified because there are barges flowing downstream river Paraguay with temporary Argentinian imports of soybean destined to oil industries located in Rosario cluster, in order to improve the quality of soybean meal in our country. On the other hand, a great part of soybean, corn and other commodities exported by Paraguay arrive in Rosario cluster in rail barges to be transferred to vessels stationed at various terminals to ship those commodities to the rest of the world. There is also merchandise arriving in Uruguayan ports with the same purpose. Argentina is the main business partner on that sector, with a representativeness of 62% on year 2020, and most oil companies operate on both countries to carry out these trades.

Soybean agenda in Paraguay

Having researched various qualified sources, CAPECO being one of them, the contribution by specialists Gustavo Picola and Hugo Daniel Vázquez and articles on media, we would like to list the main topics which the sector is dealing with and working on. The following list is absolute responsibility of the authors of the present article:

- The temporary import of soybean into Argentina (mainly by the oilseed crushing cluster located around Rosario city) subtracts availability to Paraguayan crushing capacity.

- The indefinitions over the dredging and beaconing of Paraná River in Argentina.

- In April this year, the start of the dredging of Paraguay river was agreed with Argentina. The dredging is to be made by the firm Terminal Occidental S.A., after the corresponding public tender is made on the Republic of Paraguay. River navigability is key to the growth of Paraguayan production. The low level of Paraguay river would not affect the corn market so much, because between 600 thousand and 1 Mt are sent to Brazil by land (using trucks as a means of transport). The problem revolves around soybean and rail barges that must flow South through rivers Paraguay and Uruguay.

- After strong national and foreign investments to stimulate soybean processing, from 2013 on the soybean production was taxed with the so-called Agricultural VAT. Although that tax stipulated a 100% reimbursement for export of manufactured goods, successive emergencies and decrees prevented the reimbursement of this tax, affecting the whole agribusiness market. Despite the judgement of the Supreme Court of Justice of Paraguay declaring that it is unconstitutional to override tax-deductions of Soybean Complex manufactures, this is insisted upon with new bills to that effect.

- Transfer prices among operations of businesses established in Paraguay and business of the same group in Argentina.

- Draft bill submitted by carriers, which expects to set freight costs and mandatory prices.

- Maximum waste limits and strong agrochemical requirements pushed by the European Union, that could limit foreign trade with the European block.

- Enhancing truck daily capacity between Puerto Indio and Santa Helena, by asphalting routes that allow physical proximity to those cities. Improvement of pavement in general, with many areas of the country with lack of road maintenance.

- Improvement of logistics and daily capacity between Saltos del Guairá, both on the bridge as on rafts. This way, trade among areas close to the Itapú dam will be stimulated.

- Increasing trade on the Triple Frontera: improving and amplifying the dry port capacity in Foz de Iguazú in order to increase the number of trucks that circulate between this Brazilian city and Ciudad del Este.