Soybean industrialization remains high, and corn’s reaches a record

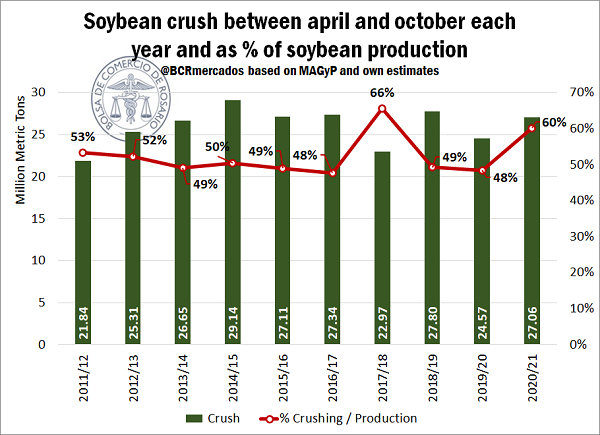

After closing the 2019/20 crop with the second lowest volume of industrialized soy in seven years (only surpassing the figure of 2017/18, when the historical drought strongly reduced the availability of beans in the country), the current crop season presents a high rate of oilseed processing. 3.3 Mt of beans were processed in October, 7% above October 2020. In this way, the accumulated from the beginning of the crop until that month amounts to 27 Mt, some 2.5 Mt above the same period of the previous year.

However, the volume of industrialized grain to date is in line with what happened in previous years (except for the aforementioned 2017/18 and 2019/20). Yet there is something particular about this crop season that stands out above the others, and that is that grain production has not been one of the highest, but quite the opposite. In fact, in 2020/21, 45 Mt of grain were obtained, the second lowest mark of the last nine years (again, only surpassing the fateful 2017/18 crop season). Thus, if we take the total industrialized to date over the total grain obtained in the crop season, we can see that soybean crushing already reaches 60% of production, the second highest share of the last decade, only behind the atypical 2017/18.

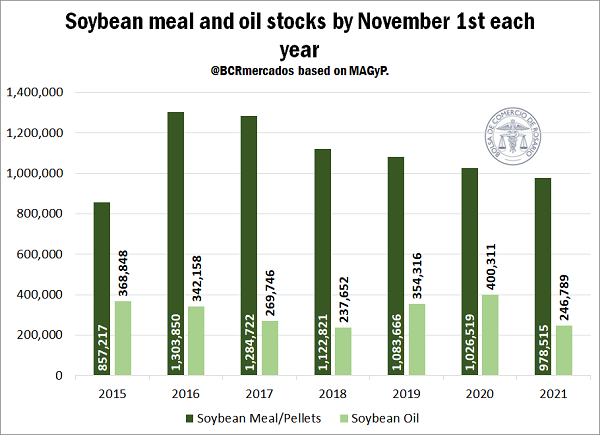

This is mainly due to the high global appetite for oilseed by-products in recent times. From the beginning of the crop until October, 18.8 Mt of soybean meal/pellets have been exported, about 3.5 Mt more than in the same period of the previous season. Furthermore, this volume represents 95.4% of the total tons of meal/pellets obtained between April and October, the highest share of history. This is also reflected in the stocks of this by-product in the industrial plants. As reported by the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), the meal stocks in the industry as of November 1st stood at 978,000 t, the lowest volume for the same month since 2015.

As for oil, exports from the beginning of the crop season to date amount to 3.7 Mt, identical to the volume dispatched during the same period in the previous cycle. However, compared to previous years, this is almost 500,000 t more than the average of the last five years and the highest volume since 2014/15. As with what happened with meal, the high volume shipped is reflected in the low stocks of oil in industrial plants: according to MAGyP, the oil stocks as of November 1st stood at 246,790 t, the second lowest record in the last 7 years.

This high rate of industrialization of soybean has led to an adjustment in the crushing forecasts for the current crop season. As published in the latest edition of the BCR Market Outlook - November 2021, in 2020/21 it is forecast that soybean industrialization will reach 39.5 Mt, a 1.5 Mt increase compared to the previous forecast.

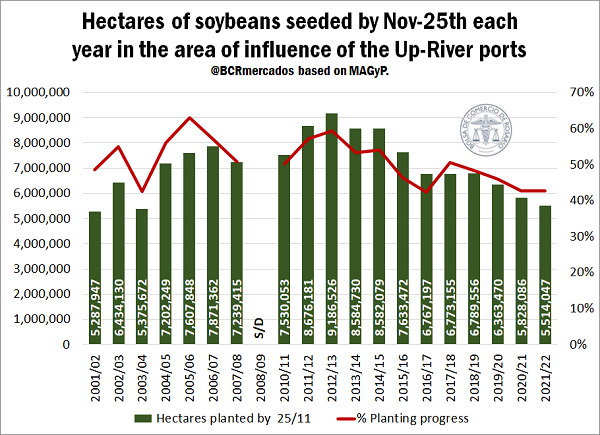

As for soybean 2021/22, planting is progressing at a slower pace than in previous years. On a national level, 41% of the area to be implanted has already been completed, below what happened during the previous crop season (43%) and the average of the last five crops (44%). If we disaggregate between regions, the sowing progress in the region of Rosario reaches 43%, identical to the record of the previous year, but below the average of 46% of the last 5 years.

In any case, considering that the area destined for oilseed would be the smallest in 15 years, the total of hectares planted with soybean in the region of Rosario to date is the smallest in 17 years. As of November 25th, 5.5 Mha have already been planted and we have to go back to 2003 to find a smaller area sown by this time of year (5.4 Mha at that time).

As for oilseed prices, the price of the Cereal Arbitration Chamber of Rosario (CAC, for its Spanish acronym) fell 5.50 dollars per ton from the maximum in 6 months reached on Wednesday of last week, reaching US$ 355.8/t last Wednesday.

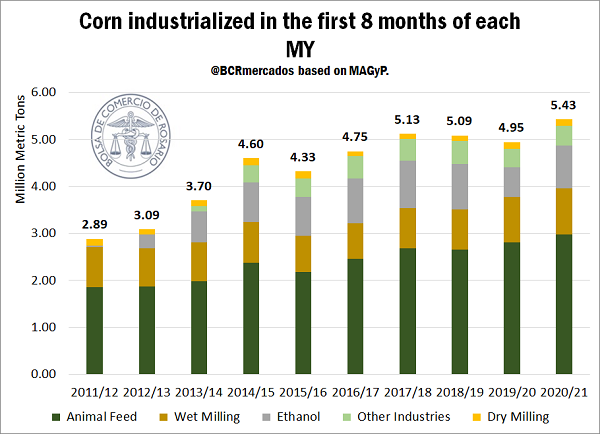

Turning now to corn, it should be noted that the total grain destined for the industry accumulated since the beginning of the crop has reached a historical record to date. Over 5.4 Mt of cereal have been processed, 10% above the amount industrialized on the same date the previous year. Of this total, 3 Mt were destined to the production of animal feed, while 1 Mt was destined to wet milling. In both cases, it is the highest accumulated volume to date compared to previous years.

However, another aspect that deserves to be mentioned is corn destined to ethanol production. This season to date, more than 914,000 t of cereal were used to produce this biofuel, 43% above the first 8 months of the 2019/20 crop season.

This is due to the fact that, during the past year, the irruption of the pandemic and the restrictions on mobility imposed by governments to halt its advance strongly affected the demand for fuels, and, given that the main use of ethanol is precisely for the production of biofuels. As this source of demand was reduced, its production fell considerably.

However, the year 2021 presents a completely different outlook. With the lifting of restrictions and the normalization of the global economy, the demand for energy has recently sky-rocketed, causing a sharp increase in fuel prices. Therefore, the demand of corn for ethanol production has recovered notably and practically reaches pre-pandemic levels (in 2018/19, 965,000 t of corn were destined to ethanol production by this time of year).

Finally, a comment about cereal prices. In recent days, the prices of the Cereal Arbitration Chamber of Rosario rose to US$ 206.5/t on Wednesday, the highest value since early June. This was in line with the events in the Chicago market, which closed the trading day on Wednesday at US$ 230.5/t, marking a maximum since July 1st (it should be clarified that on Thursday the Chicago market did not operate due to Thanksgiving Day celebration in the United States).

As for the Physical Grain Market of the Rosario, most of the buyers remain focused on the new crop season, and the values offered have remained stable: corn for March delivery stood at US$ 195/t on Thursday, identical to the price offered on Friday of the previous week, while the price of corn for July delivery remained at US$ 175/t. One point worth mentioning is that the wide gap between the prices offered for early corn (March) and late corn (July) remained present.