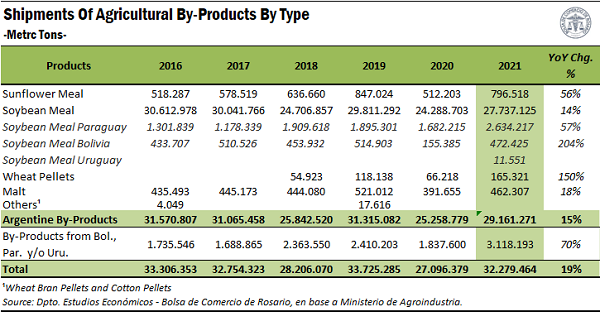

According to data from the Ministry of Agriculture, Livestock and Fisheries of the Nation, Argentina shipped a total of 32.3 Mt of meal and pellets in 2021, 19% more than in all of 2020 and only 4% below the record of 2019. Of that total, 29.2 Mt were meal and pellets of Argentinian origin, while 3.1 Mt were of Bolivian, Paraguayan and Uruguayan origin. The sharp increase over the previous year is explained by an increase in the shipments of all meal and pellets, but particularly soybean meal. In addition, there was also a sharp increase in shipments of products of foreign origin. It should be noted, however, that while the shipments of these products grew considerably from the previous year, they were still below the mark of several previous years (2016, 2017 and 2019).

Despite the fall in primary production of some of the major crops, the high rate of industrialization of the main grains and the high external demand for agricultural by-products boosted this strong growth in the shipments of soybean, sunflower, wheat, cotton, small bran and malt meal and pellets.

Indeed, as shown in the table below, the crushing of soybean, sunflower, wheat and barley grew by 15% in 2021 compared to the previous year. This year-on-year increase was led by a rebound in soybean processing that rose by more than 6 Mt to accumulate 42.4 Mt in 2021, the second highest mark ever, only below the 2016 figure (44.5 Mt oilseed were processed that year). However, not only did soybean industrialization grow year-on-year, but also increased sunflower crushing and barley milling by 25% and 11%, respectively, while wheat fell in line with the lower production during last crop season, although by only 2%.

In this way, the increase in the volume of industrialized grain goes hand in hand with the greater amount of meal and pellets shipped during last year.

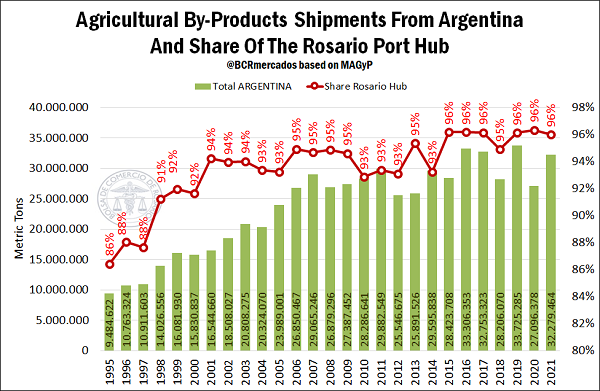

As for the origin of the shipments, the terminals located in Rosario region maintained their wide hegemony over the total shipments of meal and pellets from Argentinian ports. Of the 32.2 Mt shipped, 96% originated from the ports of the region, in line with the historic highs in terms of participation.

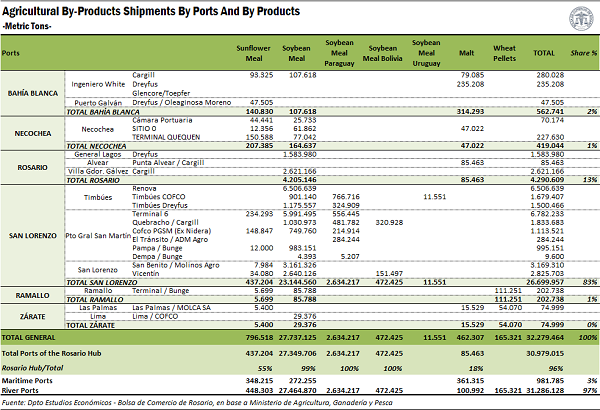

However, the performance of Rosario agribusiness export node during 2021 was uneven, depending on each by-product. The following table shows the evolution of shipments by type of product and port area.

It is evident from this table that this preponderance of the Up-River Paraná ports is almost entirely due to its total dominance in the shipments of soybean meal/pellets. Since this product represented in 2021 96% of all agricultural by-products shipped, the fact that almost all (99% to be precise) have been shipped at the terminals in the region explains the high participation of the ports of the area in total shipments of all by-products.

In fact, when we look at the shipments of other by-products, we see that the ports located between Timbúes and Arroyo Seco do not have such great supremacy over other regions. Taking the shipments of sunflower pellets, it is observed that, although more than half of them were shipped at the terminals of the region, a high share (44%) found their way out in the southern ports of Buenos Aires. In addition, the volume of this by-product shipped from those terminals grew by almost 90% compared to 2020, while from the ports of the area it increased by about 50%.

In the case of malt shipments, the Up-River Paraná terminals are even relegated to the second place, behind the seaports of southern Buenos Aires. In 2021, of the more than 460,000 t of this barley by-product that were shipped abroad, only 18% had as their way of departure the ports of the region, while 78% were shipped in Necochea and Bahia Blanca. Finally, it should be mentioned that all the wheat pellets shipped during the last year did so in other port areas: Ramallo and Zárate.

Thus, the total aggregate shows that, although shipments of meal and pellets from Rosario cluster grew in equal proportion to shipments of meal and pellets from all Argentinian ports year-on-year (in both cases it was 19%), shipments of agricultural by-products from the southern port terminals of Buenos Aires increased 45% year-on-year. However, shipments from the rest of the port terminals (Ramallo and Zárate) fell 2% compared to the previous year.

Turning attention to the port terminals that shipped the highest volume of by-products in 2021, it is highlighted that the three main ones are in the department of San Lorenzo: in the first place, Terminal 6, in Puerto General San Martin, which in 2021 sent 6.8 Mt from its docks; in the second place, Renova, in Timbúes, which shipped 6.5 Mt; and in the third place, San Benito, in San Lorenzo, which shipped 3.2 Mt. Thus, the three main port terminals keep their hegemony from 2020, although with a change: Terminal 6 displaced Renova as the main port of shipment of meal and pellets.

Disaggregating by products, it is noted that Terminal 6 was the one with the highest volume of sunflower pellets shipped in 2021, while Renova was the main point of dispatch of Argentinian soybean pellets. The largest volume of Paraguayan and Uruguayan soybean pellets was shipped in Timbúes/COFCO, while Bolivians had Quebracho as the main outlet abroad. Finally, and in line with the preponderance the ports of southern Buenos Aires in shipments of malt, most of this by-product was dispatched from the Dreyfus terminal in Bahía Blanca.

Destinations for the shipment of meals and pellets

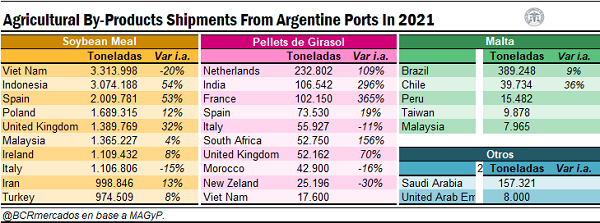

Finally, with regard to the destinations of meal and pellets, Asia again emerged as the main course for shipments of Argentinian by-products, receiving 47% of the total shipments, equivalent to 14.75 Mt (↑15% vs. 2020). In second place was Europe, which received 35% of all by-products shipped from Argentinian ports in 2021, totalling 11.17 Mt (↑25% YoY) while America positioned itself as the third main destination, with about 10% of total shipments (3.2 Mt in total, ↑85% compared to 2020). Africa ranked fourth and Oceania fifth with 2.1 and 1.1 Mt, respectively.

Disaggregating by subcontinental regions, most of the shipments of by-products were primarily destined to Southeast Asia (8.8 Mt), while West Asia was positioned as the second region with the highest volume of by-products received (4 Mt) and Southern Europe closed the podium with 3.8 Mt. In addition, the strong year-on-year increase exhibited by South America is also highlighted, which practically doubled the volume received between one year and the following.

Finally, analysing the main countries for each type of by-product, it can be noted that Vietnam was the main destination for shipments of soybean pellets. A total of 3.3 Mt of this by-product was shipped to Vietnamese coasts in 2021 and, while the volume fell 20% from the previous year, it is still sufficient to stand at the top of the podium for the 8th consecutive year. In the second place was again Indonesia, which received 3.1 Mt of this by-product in the last year, denoting 54% year-on-year growth. An interesting aspect is that this island country is the second largest recipient of soybean pellets for the 5th consecutive year. These two countries explain to a great extent the heavy weight of shipments heading towards Southeast Asia on total shipments.

As for the remaining products, the Netherlands has positioned itself as the main destination for sunflower pellets, as happened in 11 of the last 12 years, while Brazil was the largest recipient of malt shipments, as it has been doing since at least 2010.