Rosario hub remained second in the world agribusiness port nodes ranking in 2021

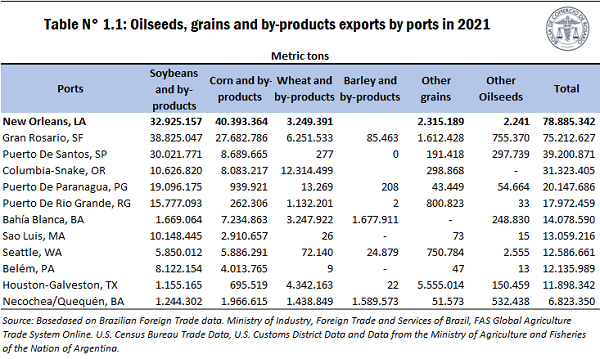

Rosario hub positioned itself as the second most important agribusiness export port node of the world in 2021. With a total shipped of 75.2 Mt of grains, oils, and by-products, the Up-River region maintained the second place in the ranking obtained in 2020, ranking only behind the US customs district of New Orleans, Louisiana, which dispatched a total of 78.9 Mt in all of 2021. The podium of the most significant agribusiness port nodes in 2021 is closed by the Brazilian port of Santos, São Paulo, with 39.2 Mt shipped in the year.

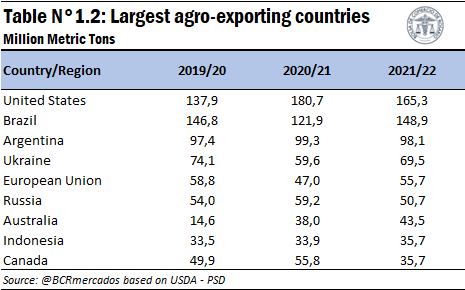

Argentina is third in the ranking of exporters of agricultural commodities at a global level, with a total export of 99.3 Mt in the 2020/21 crop season, which is about to end. The United States lead the first place with 180.7 Mt while the second place is for Brazil with 121.9 Mt. Only with the shipments that left the Gran Rosario in 2021 Argentina was placed in third place, surpassing the rest of the world in dispatched volume. Due to the latter, the following analysis focuses only on the ports of the United States, Brazil, and Argentina, without going into detail about the countries' ports with lower total exports of grains and by-products than the Rosario hub region, such as Ukraine, Russia or Canada.

Even though the United States and Brazil export a greater volume of grains, oilseeds, and by-products than our country, several characteristics make Rosario hub a fundamental market in terms of the export of agricultural commodities in the world. When we speak of the Rosario hub, we refer to the oil and port industrial complex that stretches along 70 km of coastline on the Paraná River, between the town of Timbúes to the north and Arroyo Seco to the south and from whose port terminals different types of grains, oils, and by-products are shipped, among others.

Breaking down by complex, an improvement in shipments from the soybean complex allowed Rosario hub to obtain the first place in the ranking of exports of products from this complex. Shipments of the oilseed and its by-products from the port terminals of the region reached 38.8 Mt in the last year and were enough to displace New Orleans as the main soybean pole in the world (32.9 Mt of these products were shipped from that US customs region).

Regarding the corn complex, considering that the United States, Argentina, and Ukraine were, in that order, the leading exporters of corn in 2020/21; and that the ports of the Up-River alone shipped a greater volume than everything exported by Ukraine, we are in a position to affirm that the ports of the region ranked as the second-largest corn export pole in the world, with 27 .7 Mt shipped and just below the 40.4 Mt reached by the New Orleans port area.

Concerning the wheat complex, although Rosario hub ranked second among the port regions under analysis with 6.3 Mt, it is worth mentioning that it is likely that some port areas of other countries such as Russia, Ukraine, or Australia may have surpassed it in importance. The same occurs with shipments of other cereals and other oilseeds.

In aggregate terms, despite not being able to recover the 1st place obtained in 2019, the Rosario hub closed the gap with the enclave located at the mouth of the Mississippi and widened the gap with the port of Santos: in 2020, the leading US port area had dispatched 78.4 Mt while Rosario hub had shipped 70.1 Mt, that is, an 8.3 Mt difference in favour of the former, while in the last year it was only 4.5 Mt. At the same time, in 2020, the largest Brazilian port had registered shipments of 43.1 Mt, while in 2021, it reached the mark mentioned above of 39.2 Mt, so the difference between Rosario hub and the port of São Paulo went from 27 Mt to 36 Mt.

This improvement in the performance of the region's ports is mainly due to the aforesaid considerable recovery in shipments of the soybean complex. Despite the lower production of the 2020/21 crop season, the rate of industrialization of beans remained high, which allowed a marked increase in shipments of products from the complex (they went from 33.7 Mt in 2020 to 38.8 Mt in 2021).

However, the inability to regain the title of the world's main agribusiness export pole is explained by two factors that were analysed in previous editions of the weekly report: the drop in the production of some crops in the central and northern regions of the country in the last crop season, on the one hand; and the complications generated by the low level of the Paraná river, on the other.

Next, we include technical notes and provide a brief analysis of the geography and the movements of goods in the main ports of the United States, Brazil, and Argentina.

1. Exports of grains, oils, and by-products from the United States

Export channels by water for grains, oilseeds, and by-products in the United States can be divided into two main routes. One is through the bulk ports of the Pacific, which usually have Southeast Asian countries, China, and Japan as their leading destination. The other is through the terminals located at the mouth of the Mississippi River in the Gulf of Mexico. According to the Agricultural Marketing Service (AMS), an agency that depends on the United States Department of Agriculture, the Mississippi basin is the main artery of the US grain trading system, competitively exporting corn, wheat, soybean, and by-products..

However, it should be noted that there are other important port regions in the North American country that ship grains and by-products. The ports located in the Great Lakes region and the ports on the Atlantic stand out among them. In addition, you should not ignore shipments via rail to Mexico, which are not on the list because they are exports by land.

Various factors affect the distribution of bulk shipments throughout the country, such as the distance from the production areas to the export centres and the multiple means of transport that connect the fields, stockpiles, and export terminals: a vast network of railroads, highways, and the enormous navigable extension of the Mississippi River that passes through much of the productive zone of the country.

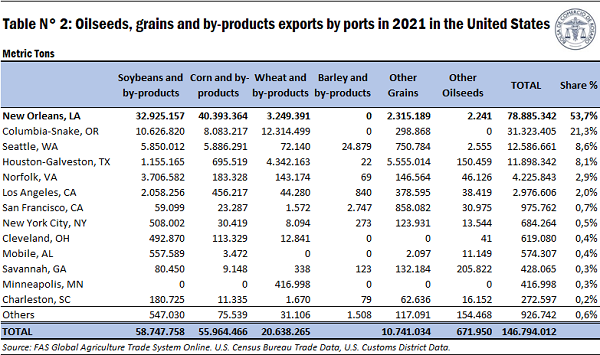

According to the AMS, the ports located along the Mississippi River from Baton Rouge to Myrtle Grove, LA, are called the New Orleans Customs District, while in this article, we will refer to the New Orleans Port Region. This is because the ports are close enough, sometimes even adjacent, to give the appearance of one large port area. The New Orleans Port Region brings together all modes of transportation (ocean vessel, barge, rail, and truck), allowing ocean-going ships to serve ports up to 367 km upriver from the Gulf of Mexico.

The export volumes of cereals, oilseeds, and by-products were obtained by processing the data from the API (web service) of the United States Department of Commerce, dependent on the US Census Bureau. The classification of customs areas is under the US Bureau of Foreign Trade Statistics supervision.

According to the data in Table N° 2, for 2020, the Port Region of New Orleans shipped 32.9 Mt of the soybean complex (56% of the total) and 40.4 Mt of the corn complex (72% of the total), among other complexes. The country's central export pole of agricultural commodities shipped 78.9 Mt of products, representing 53.7% of national shipments in 2021.

2. Exports of grains, oils, and by-products from Brazil

The export routes for grains and derivatives in Brazil, like what has been done for the United States, can be divided into two main nodes. One route passes through the ports located in the north of the country (such as Sao Luis – Itaqui, Bacarena – Belém, Santarém, Manaus, or Itaituba – these last three river ports being located on the Amazon River). Santarém and Manaus can operate Panamax vessels, which require a minimum draft of 39.5 feet deep. The other outlet for grains is in the Southeast-East region, on seaports that hold a large part of Brazil's foreign trade (Santos, Paranaguá, Rio Grande, San Francisco Do Sul, Itajaí, Vitoria, among others).

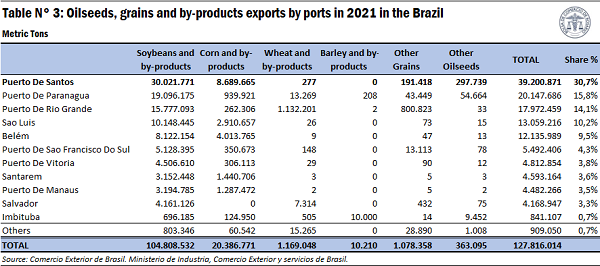

Brazil has at least 40 river and seaports for bulk agricultural cargo. The most important port in Brazil and Latin America is the port of Santos. It has several private port terminals in its vicinity and is the exit point for a large part of the country's export of cereals, oilseeds, and by-products (30.7% of the total gross exported by Brazil in 2021), so we will emphasize this port in particular.

From the data in Table Nº 3, we can see that a large part of the soybean complex and corn complex is exported through the ports located in the Southeast of the country (Santos, Paranaguá, Rio Grande, San Francisco Do Sul, Vitoria), representing 71% of the total products of the soybean complex and 52% of the corn complex.

The port of Santos is the most important in Latin America by commercial volume, that is, taking into account all goods loaded and unloaded. It has five container terminals, twelve general cargo terminals, twenty-four liquid bulk terminals, fourteen solid bulk terminals, two automotive shipping terminals, and one passenger terminal. It has an approximate share of 29% of the Brazilian trade balance, being its main exported products the soybean complex, sugar, orange juice, corn, and chemical wood pulp.

As is the case with the port area of New Orleans, the Port of Santos brings together all available modes of transport (barges that go down the Tieté-Paraná Waterway that transship in Pederneiras and railways, pipelines, and trucks). In 2021, 30 Mt from the soybean complex and 8.7 Mt from the corn complex were shipped through the port of Santos. The total bulk exported amounted to 39.2 Mt, equivalent to a 30.7% share of the total cargo of agribusiness commodities shipped by Brazil.

Currently, the data is disaggregated in the Brazilian foreign trade statistics system as the "place of shipment" that takes the name of the Federal Revenue Unit. The "place of shipment" is defined as the customs jurisdiction and the coordinates of each specific port.

3. Exports of grains, oils, and by-products from Argentina

As in Brazil and the United States, the logistics of grains and by-products in bulk in Argentina are organized in two main port areas. On the one hand, the southern region of the Province of Buenos Aires, which includes the ports of Necochea/Quequén and Bahía Blanca; on the other, the Gran Rosario zone, which consists of the port terminals located on the 70 km of Paraná River coast from Arroyo Seco to Timbúes (also called the Paraná Up-River Zone). In this export pole, port terminals operate different types of cargo where grains, oils, and by-products are shipped all over the world.

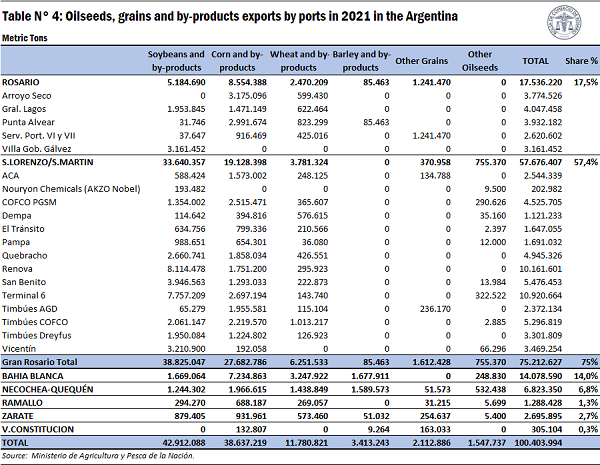

Close to 75% of the total agribusiness products dispatched from Argentine ports throughout 2021 left the Rosario hub in 2021, while the port of Bahía Blanca occupies the second place with 14%.

For a more exhaustive analysis of the subject, we recommend reading the articles on shipments of Oils and By-products from Argentinian ports published in Report Nº 2041; the article on shipments of Grains from Report N° 2040; and the article on Total Shipments published in Report Nº 2036.