With the arrival of March, a new corn crop season formally began. The 2021/22 crop was marked by a harsh condition of extreme dryness this summer, which conditions the supply projections. In this sense, the increase in the sown area manages to compensate only part of the falls in yields, so it is forecast that production will be cut by 8.3% compared to the 2020/21 campaign results, to 47.7 million tons.

Indeed, the climatic situation that the corn crops went through is part of what is considered a "Niña" year, which in much of the productive area of Argentina and southern Brazil is related to below-normal rainfall. Likewise, it should be taken into account that the productive overview of early crop corn is already practically sealed, and the forecast yields are lower than last year. In contrast, late corn crops still have a temporary window that enables the possibility of productivity improvements.

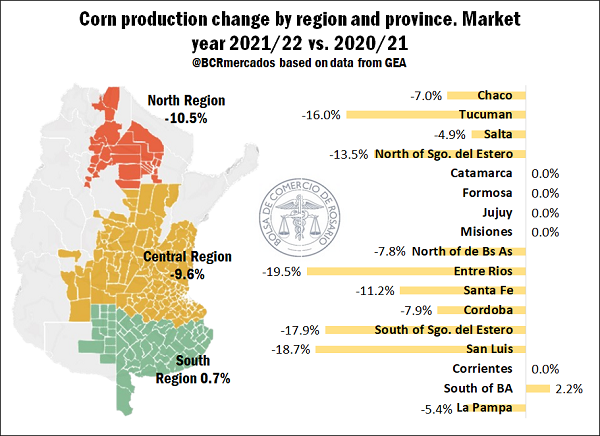

Going into how this new corn crop is shaping up, we have that the forecasts for the North and Central Regions predict decreases of 10.5% and 9.6%, respectively. This implies that 4.6 Mt would be harvested in the first of these areas and 36 Mt in the second. The Southern Region is presented as the only one that would increase the produced volume of corn in the 2021/22 crop season, surpassing the previous record by just 0.7%. Within this segment, the south of the province of Buenos Aires is the only region that would surpass last season, mainly due to an increase in the area sown and better humidity conditions than the rest of the country's sectors. As a counterface to this situation, reductions of close to 19.5% in the production of Entre Ríos are expected, with this province showing the greatest decreases between crops. Likewise, the province of Santa Fe would register a fall of 11.2%. In comparison, Córdoba would reduce the tonnage generated by 7.9%, highlighting the situation of these provinces for the critical role they play year after year in grain production.

In addition, it should be noted that, according to the data released by the Agribusiness Strategy Guide (GEA, for its Spanish acronym) by the Rosario Board of Trade (BCR, for its Spanish Acronym), corn yields in the core region would be the lowest in at least ten years due to the severe climatic conditions that affected the crops planted early. In this way, with the first surveys carried out until March 3, yields of 7.5 t/ha were forecast for the core region, 0.38 t/ha less than the previous minimum of 7.88 t/ha recorded for the 2017/18 crop season.

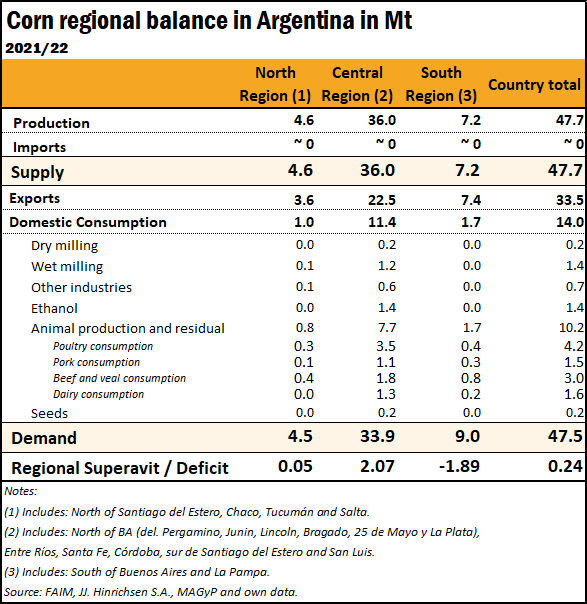

On the side of the destinations for our country's corn production, in absolute terms, the internal absorption falls close to 400,000 tons (-2.75%) compared to the 2020/21 season. It is estimated that this will be a consequence of lower consumption of corn in animal feed, while the supply of dry and wet milling/crushing would also fall slightly.

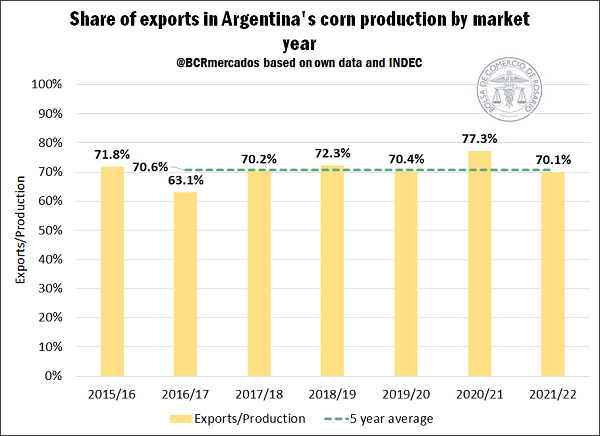

The main destination affected by the decrease in production will be exports, which will fall by 16.8% between crops to 33.5 Mt. This lower tonnage of exports generates a sharp decrease in the share of the external sector in the destinations of domestic grains. In this sense, the estimated volume of shipments abroad for the 2021/22 crop will represent 70.1% of production, while in the previous season, the tonnage of exports represented a share of 77.3%. At the same time, we should note that this figure represents the lowest share of exports since the 2016/17 crop, when it accounted for 63.1% of production. In addition, the average of the last five crop seasons shows a share of 70.6%, surpassing the forecast for the 2021/22 harvest by about 0.5 percentage points.

The three regions we analysed maintain their shares in exports relatively stable, with variations of less than one percentage point. In this sense, the Central Region would represent 67.4% of exports (22.5 Mt), while the Southern Region would contribute 22% (3.6%) of shipments abroad, and the Northern Region would contribute 10.6% (7.4 Mt) of the tonnage exported. These tonnages dedicated to export imply different participations within the productive matrices of each region. In this sense, export represents 102.8% of the production of the Southern Region, implying a transfer of production from the rest of the regions to the southernmost one to be able to supply the demand of that area. Likewise, it is estimated that 78% of the production of the Northern Region will be exported, while the rest of the goods will be used to supply the animal consumption market, wet milling, and the other industries of the corn complex. Finally, 62.7% of the production of the Central Region will be destined to shipments abroad, while 31.6% will be destined to domestic consumption, with animal consumption being the main item of this type of absorption, with about 7.7 Mt, followed by the production of ethanol with 1.4 Mt, and wet milling with 1.2 Mt.

Finally, the regional balance considers that the Central and Northern Regions will end the crop with regional surpluses of 2.1 Mt and 0.1 Mt, respectively. This tonnage will be destined in the first instance to supply the Southern Region's excess demand, while at the country level, the 2021/22 crop would end with a surplus of 240,000 tons, directly implying an increase in national grain stocks.