Barley is the fifth most produced crop globally (147 Mt in 2021/22) and the fifth most traded grain globally (34 Mt in 2021/22). In terms of production, Argentina has a relatively low share of 3%, although its importance is growing in terms of world exports, contributing 10% of the total.

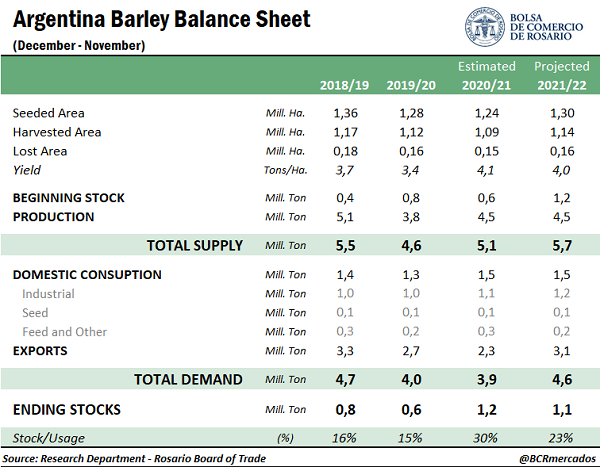

In the 2020/21 crop season, Argentinian barley had achieved its best performance since 2013/14, positioning itself as the second-best crop on record. The productive leap of 18% in the last crop season was accompanied by increased demand, essentially from domestic consumption. However, the supply growth was higher, with which the 2021/22 crop season had initial stocks of 1.2 Mt.

Apart from these goods in stock, last winter, Argentinian producers renewed their commitment to barley and covered 1.3 M ha with the cereal, 5% more than the area destined to barley in the previous crop. Three main reasons have driven the adoption of barley in Argentinian production plans. In the first place, there is the extraordinary moment of international prices that the cereal is going through with prices that at the time of planting 2021/22 were 30% higher than their average value in the planting months a year ago. Secondly, the sustained growth in domestic demand for malt production is worth mentioning. In trade year 2020/21, cereal crushing grew by 14%, and in 2021/22 it is forecast to rise by 4%. Thirdly, this crop's benefits to the soil structure, which translates into better yields, also play an essential role. According to data by Argentina’s National Institute of Agricultural Technology (INTA, for its acronym in Spanish) [1], soybean planted after barley yields an average of 0.3 t/h more than wheat and has better resistance to possible fungal problems.

Barley yields for 2021/22 are slightly lower than the previous crop, mainly due to the production problems in the southern region, but this is offset by the growth mentioned above in the planted area, which will allow a production of 4,5 Mt, slightly higher than that of the 2020/21 crop season. The stocks at the beginning of the crop season plus the harvest obtained consolidate a total supply of 5.7 Mt for the trade year, representing a maximum of goods available on record.

Regarding demand, approximately 25% of the production is expected to be absorbed by the domestic malt market (1.2 Mt), another 5% is destined to the production of animal feed and seeds (0.3 Mt), while the remaining 70% is exported as feed barley, malting barley or as malt (3.2 Mt). Therefore, a total 2021/22 demand of 4.7 Mt is forecast, which stands out as one of the largest on record. It should be noted that unlike other trade years with high levels of demand, the current crop season presents a higher share of domestic consumption compared to exports.

Barley crushing heading to all-history high this crop season

The 2020/21 trade year was an outright record for barley processing in Argentina. Hand in hand with a growing consumption of beer at a national level and high exports of malt, the previous crop was the one with the highest crushing on record in our country.

Less than three months after the crop’s start, barley comes back firmly in trade year 2021/22. Over 183,000 tons of barley were crushed between December and January, an absolute record for these two months, supporting the crop's optimistic forecasts. The current trade year aims to break the barley industrial processing record again, exceeding 1.15 Mt, according to the BCR's estimates.

As has been highlighted, the barley planted area and barley production have grown enormously in recent years. One of the vectors of this growth has been the demand for this cereal for animal feed and the irruption of Chinese demand.

Forecast of a high level of Argentinian barley exports

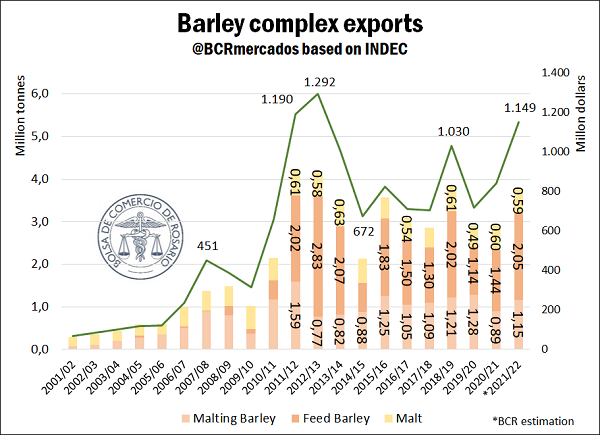

The various products that make up the Argentinian Barley Complex have been propping up a growing export trend in the last 20 years. It went from exporting just 300,000 tons at the beginning of the millennium to exporting over 4 Mt of barley and its by-products in just ten years.

As of today, the Barley Complex is on track to export near US$1.15 billion in the 2021/22 crop season, which began last December. In this way, it would consolidate a growth of almost 37% compared to the previous crop if the forecasts prepared by this Board of Trade are met. Although international barley prices have grown in recent months, in the current crop, FOB prices are forecast to rise by around 10% for the various products of the Barley Complex.

Consequently, the most substantial rises are explained by rises in the tons shipped to the various destinations. Malting barley and fodder barley are forecast to see their exports increase by 28.7% and 42.1%, respectively, while malt is forecast to decrease slightly by 2.8% in its exports measured in tons. In this way, the growth of nearly US$ 310 million forecast for Argentinian barley exports is explained in more than 63% by rises in the quantities exported.

The export destinations of the Barley Complex depend on the product under analysis. Argentinian fodder barley is massively exported to China to feed the Asian giant's cattle. For its part, malt is exported to two neighbouring countries: Chile and Brazil. Finally, malting barley is exported to various destinations, including Brazil, China, Colombia, among others.

China played a decisive role in the growth of foreign trade for Argentinian barley. It should be borne in mind that the Asian giant is the largest global importer of barley and accounts for 31% of the world's purchases. On the other hand, it is also crucial to consider the position of Australia, which is the largest international supplier of barley with a global market share of 26%. The interruption of trade between these two countries, which until the beginning of 2020 had been strategic partners in the cereal market, unleashed significant changes in incentives for other barley-producing countries, including Argentina.

In May 2020, the People's Republic of China imposed a tax duty of 80.5% on Australian barley, mainly as an anti-dumping measure. Despite the claims made by Australia through the World Trade Organization, the tax barrier remains, forcing Australia to relocate its barley exports and China to seek new suppliers. This situation led to a sharp rise in barley prices in alternative export markets such as the Black Sea, the European Union, Canada, and Argentina. Then, the booming Chinese demand was reflected in better prices that materialized a growth in barley production, for example, in Argentina. In fact, based on shipping data from NABSA, in calendar year 2021, shipments of Argentine barley to China were more than six times the volume shipped to this destination in 2020.

Barley prices in the world and in Argentina

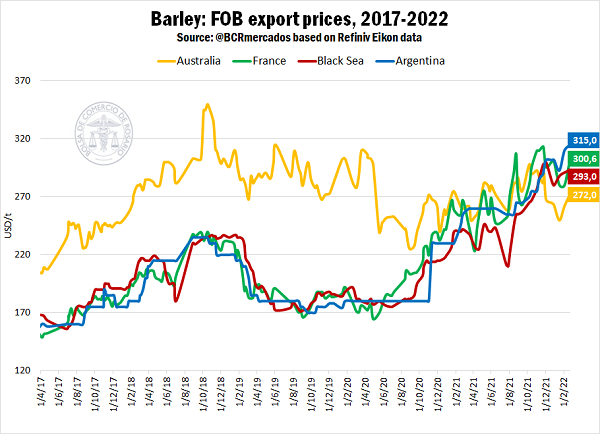

The extraordinary moment of barley prices at a global level responds, on the one hand, to the general solidity shown by the prices of feed grains and, on the other hand, to the lower harvests of important barley exporting countries in particular.

According to data from the United States Department of Agriculture (USDA), the 2021/22 global cereal harvest will reach 145.8 Mt, thus showing the first drop and the worst result since 2018/19. This decrease is fundamentally the result of lower harvests in important producers such as Russia, Canada, and the European Union. Demand is also estimated to be lower, although its year-on-year drop is proportionally smaller than that exhibited by supply. In this sense, it is worth highlighting the sustained presence of Chinese foreign demand, which would again exceed 10 Mt for the second consecutive year, thus absorbing 30% of world trade. As a consequence of variations in supply and demand, the 2021/22 stock/consumption ratio falls to 8%, the tightest ratio in 38 years.

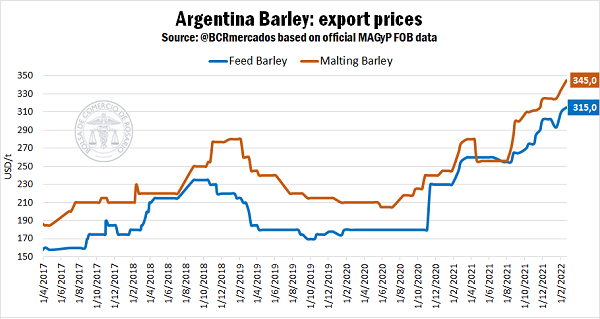

The world's largest wheat exporters are Australia, France, Russia, and Ukraine. In the last 12 months, the export price from France rose by 68%, that from the Black Sea ports by 53%, and that from Australia showed wide fluctuations and showed a point-to-point drop of 4%. The export price of barley from Argentina increased by 75% year-on-year, exhibiting the greatest improvement among the origins considered.

In the third week of February, a time of wide availability of the cereal in Argentina, the export price for the local feed variety is US$ 315/t and exceeds the values in alternative origins. While on the other hand, the FOB price of Argentinian malting barley is currently quoted at US$345/t, showing a growth of 64% during the last twelve months.

[1] National Seed Institute (INASE, for its Spanish acronym) and Simplified Agricultural Information System (SISA, for its Spanish acronym). (2021). Barley 2020-2021. Argentinian Ministry of Agriculture, Livestock and Fisheries Retrieved from: https://www.argentina.gob.ar/sites/default/files/if_sisa_cebada_20_21.pdf