Outlook of Bolivia Soybean Complex and current agenda

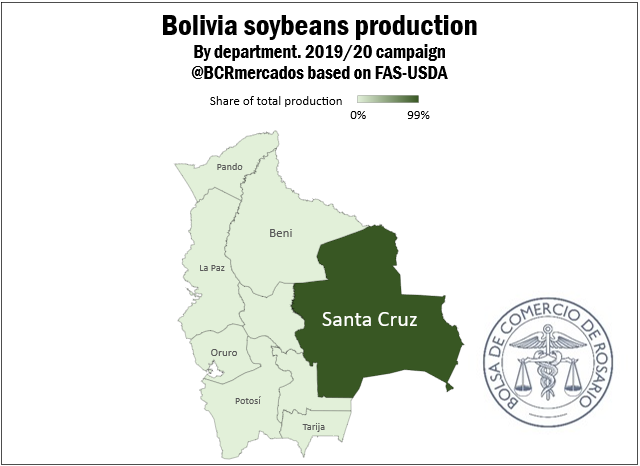

If the soybean complex in Bolivia is analysed considering production, the geographical location of crops is almost exclusively in the Eastern region of the Santa Cruz jurisdiction, with a share of the planted area close to 99% with regards to the total. In the department of Santa Cruz, the Bolivian soybean production is mainly concentrated on the provinces of Ñuflo de Chavez, Chiquitos, Guarayos, Obispo Santistevan, and Sara.

In that sense, although the planting of this crop extends to the provinces of the North in Beni and La Paz; in the centre of Cochabamba and to the South in Chuquisaca and Tarija, they represent a very low share of total production.

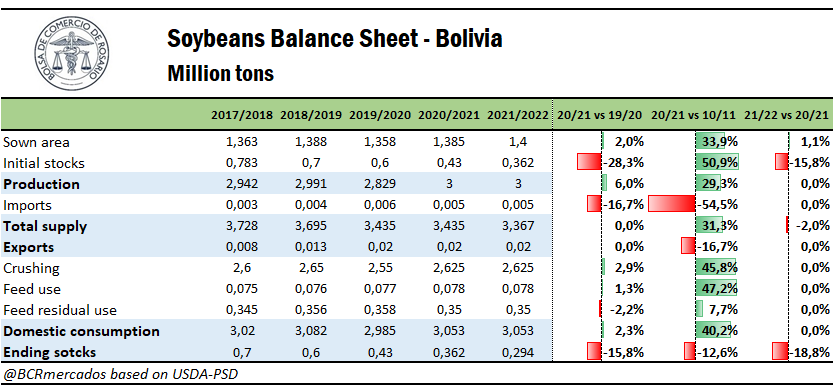

As for productive indicators, during the last decade between crop season 2010/11 and 2019/20, the United States Department of Agriculture (USDA) forecast a production increase of 21.9 %, with a relative higher increase of the planted area of 31.3 %. This way, crop season 2019/20 production is 2.8 Mt, with a planted area of 1.35 M ha.

For crop 2020/21, the USDA forecasts a soybean production in Bolivia of 3 Mt, that is, close to the historical record reached during crop 2015/16 with 3.2 Mt. On the other hand, planted area forecasts for crop season 2021/2022 are established on a historical record of 1.4 M ha and a production that would reach 3.1 Mt.

As for the production destination, almost 90% of the cropped grain is used for crushing, while soybean exports are marginal. At the same time, if we reference to crop season 2019/20, out of the total soybean meal (2 Mt) and oil (0.473 Mt) produced in Bolivia, 85% of meal and 80% of oil had export as the ultimate destination.

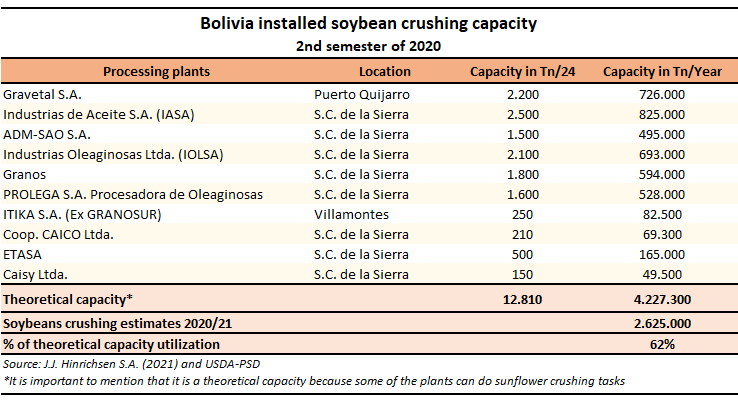

Based on what was mentioned before, it is worth analysing the current industrial structure of the Bolivian soybean complex. According to J.J. Hinrichsen, at present there are 10 soybean processing plants in Bolivia, with a crushing capacity of 12,810 t/24 hs and 4.2 Mt on annual basis. As for soybean crushing forecast for crop 2020/2021, the USDA estimates 2.6 Mt, which indicates a 62% installed capacity utilization. It is important to highlight that this is a “potential theoretical capacity”, since some of these plants perform alternative tasks of sunflower crushing, mainly, therefore using its potential for processing other crops.

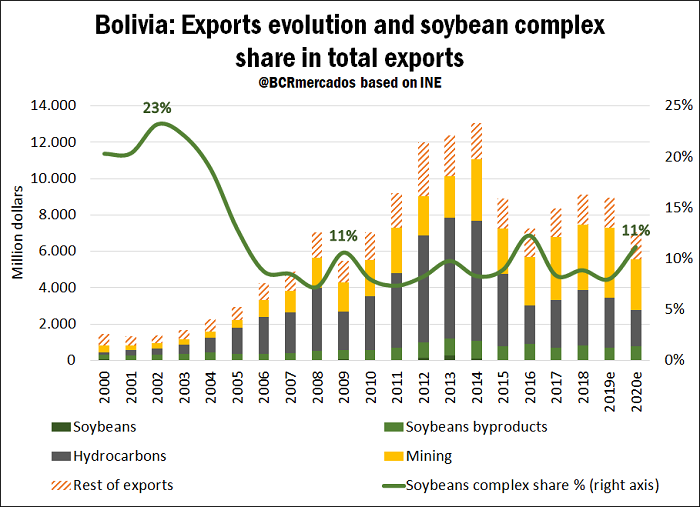

Regarding foreign trade, in 2020 soybean complex exports reached US$ 784 million in Bolivia, which represent a 10% growth regarding the values of 2019. Just as we remarked before, this export complex is mainly based on the export of by-products, reaching in 2020 a share of 11% of the total exports of the country.

This way, when analysing the Bolivian export basket, other sectors predominate, such as hydrocarbons and minerals which, in total, represented in 2020 almost 70% of the exported value.

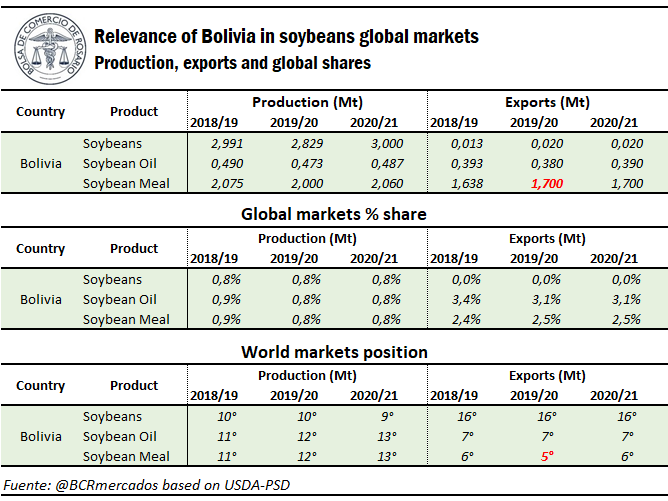

Last, in the following chart we can observe data regarding the importance of the Bolivian soybean complex in the world market. As for the soybean production and its by-products, it has a low share regarding the total, although it ranks among the main 10 soybean producers in the world, which indicates an important concentration of the crop among few countries.

On exports, an almost null share is kept in the case of soybean, while on soybean by-products is also low, but a bit higher. In that sense, its position improves if compared to production data, especially in the case of by-products, reaching the 7th place among the biggest exporters of soybean oil and the 5th place in the case of soybean meal, using USDA data for crop season 2019/2020.

Soybean agenda in Bolivia

According to the Bolivian Association of Oilseed and Wheat Producers (ANAPO, for its Spanish acronym), the main topics to consider on short and middle-term basis are:

- Genetically modified organisms (GMO): Norms allowing the approval of new events of GMO in soybean, corn, wheat, cotton and sugar cane were abolished. The abolished norm would establish abbreviated procedures that allowed the recognition of studies and approvals from other countries. Left without effect, they might affect the introduction of these technologies in Bolivia.

- Since this abolition, the government announced the passing of a new biotechnology law. This law concerns the sector since it could make the approval of new GMO events even more difficult.

- The abolition of norms regarding clearance of exports and the implementation of an export quota policy to guarantee domestic market supply.

- Regulated prices for the domestic market: A price regulation policy for the domestic market has been resumed, with the application of price bands and supply quotas for the sale of soybean meal and oil. This situation affects the price received by the soybean producer and conditions the export permissions. To give a notion, the solvent extracted soybean meal price for the domestic market was set at U$S 323/tn, which is a subsidized price that distorts the negotiation prices with the soybean producer. In Argentina, the FOB price is around U$S 387/tn.

- New state plant of renewable diesel: The government is planning to build with public funds a Renewable Diesel Plant that might demand 450,000 tons of vegetable oil (equivalent to the current exportable supply). It is feared that low purchase prices are set, which would damage producers. The same happens with the regulated prices for domestic market of soybean meal.

- The government is trying to reduce the outflow of foreign currency for the purchase of fuel. It is planned to establish a cut rate of 5% to favour domestic consumption of diesel. 70% of the domestic demand comes from abroad, which implies for Bolivia imports for a value from U$S 800 to 1,000 million per year.