Ocean freight increases could result on a cost overrun of US $ 2,500 million for Argentinian agribusiness exports

Since the start of the spread of COVID-19, prices of ocean freight have been subject to strong demand shocks, which provided great volatility. During the first months of 2020, the values of freight fell strongly, reflecting an initial drop in the demand of goods and the collapse of fuel price. The situation a year and a half ago contrasts significantly with the current scenario of international trade, with freight quotes reaching maximum levels in 11 years. The significant increase of freight for dry bulk transport is mainly due to the reactivation of building of infrastructure in several regions, which has driven a great demand of iron ore. Also, the strong rise of agribusiness commodity imports by China has added pressure to the bulk cargo freight.

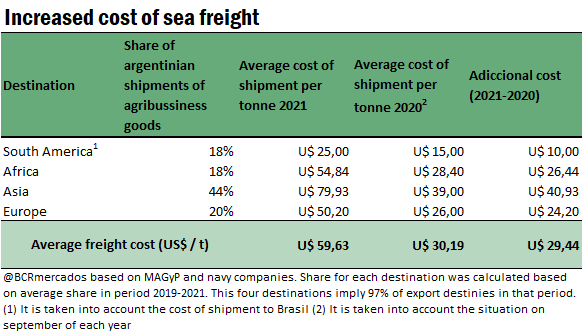

If we compare the current situation to the one a year ago, we can see that shippings to Asia, destination of more than 40% of the national agribusiness products, have increased their cost in over US$ 40 per shipped ton between September 2021 and the same date a year ago. Shipping cargo to middle Brazil, to quote another case, via ocean vessel costs about US$ 10 more per ton year-on-year.

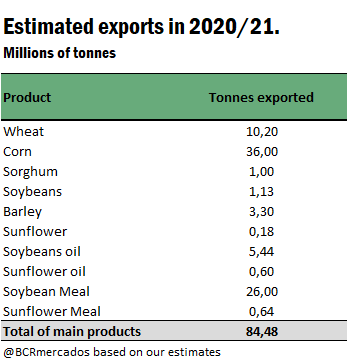

It is forecast that Argentina will export about 84.5 million tons of agribusiness products (grains, oils and meals) during crop season 2020/21, considering the most important products of the chains of the main 6 crops of the country (soybean, wheat, corn, sunflower, sorghum and barley).

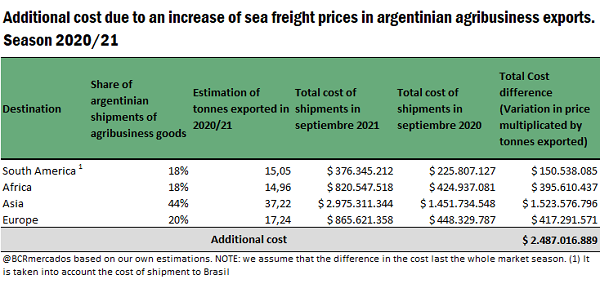

Thus, taking into account the average distribution of shippings during the last crop seasons, we can estimate the overrun generated by the increase in cost of ocean freight during the last year. Based on all that has been exported and is forecast to be exported during crop season 2020/21, assuming this price differential remains stable all along the crop season, a cost overrun near US$ 2,500 million is forecast.

It is necessary to clarify that export destinations are not calculated per product, but applying an average of the number of vessels that depart carrying agribusiness products from our country to each of those destinations, and that the calculation only computes the difference in the total cost of transport that would imply to export the totality of our products at the prices of September of each year.

This cost overrun is assumed by both parts, both importers and exporters, depending on the relative burden each part mainly faces of the supply-demand price elasticity. However, these costs are largely absorbed by production, because the oscillations of insurance and freight prices generally affect more the “up-river” than the “down-river” of the chain of production and international trade.