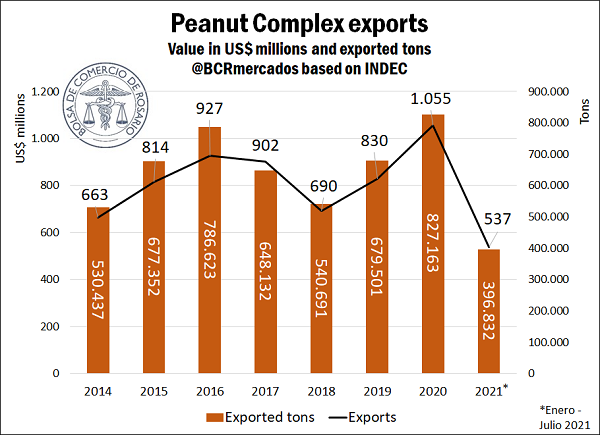

It is always a source of joy that a local company exceeds the value of 1.000 million dollars. Breaking this unbelievable value causes these companies to be called unicorns. In 2020, the Peanut complex exceeded 1,000 million dollars in exports, consolidating the process of sustained growth that has been observed during the latest marketing years.

Peanut stands out as an intra-Pampa regional economy. Just as Santa Fe’s dairy and Buenos Aires bee-keeping industry, it is developing strongly as an intensive crop within the Central Region of Argentina. Peanut is mainly produced in the province of Córdoba. This province concentrates 89% of the 965 agribusinesses that produce peanuts (INDEC, 2021), apart from 23 of the 25 companies that make up the Peanut Agribusiness Sector (SAM, for its Spanish acronym), as called by the Argentine Peanut Chamber (CAM, 2021). Of these 25 companies, 4 are large, 9 are mid-size and the remaining are small. Large companies account for 50% of the exports, while mid-size and small companies account for 39% and 11%, respectively.

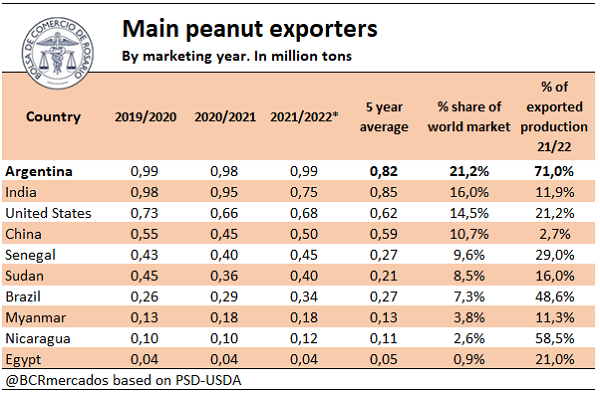

The export levels of Argentine peanuts would not be possible without the good levels of production and the relatively low domestic consumption in Argentina. Although for decades Argentina has alternated positions among the first three places in the ranking of global peanut suppliers, for the fourth consecutive year, it ranks as the first global peanut exporter. Argentina exhibits a resounding exportable balance for peanuts, exporting over 70% of its production, a market share that no other exporter has. This way, it can hold over a fifth of world trade of this oilseed.

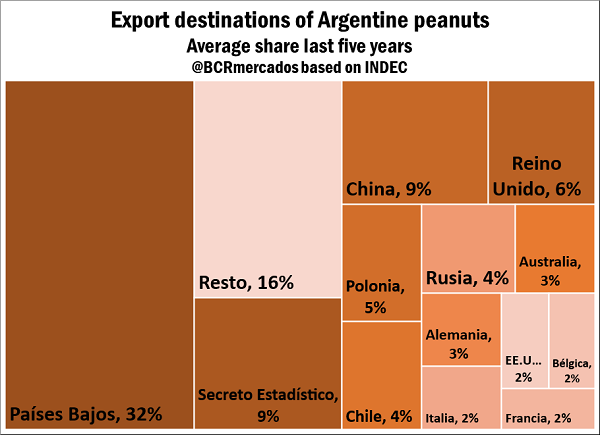

Although there are more than 106 destinations for Argentine peanuts, almost a third have the Netherlands as their destination, probably because the Dutch port of Rotterdam is the gateway to Europe. In 2018, peanuts without any transformation represented 60% of the exported tonnage. In 2021, they have barely represented 9%, with a resounding rise in the export of shelled peanuts, which account for almost 82% of peanut exports so far this year. The remaining exports of oil and meal represent 7% and 2% of exports, respectively,

No exports without production

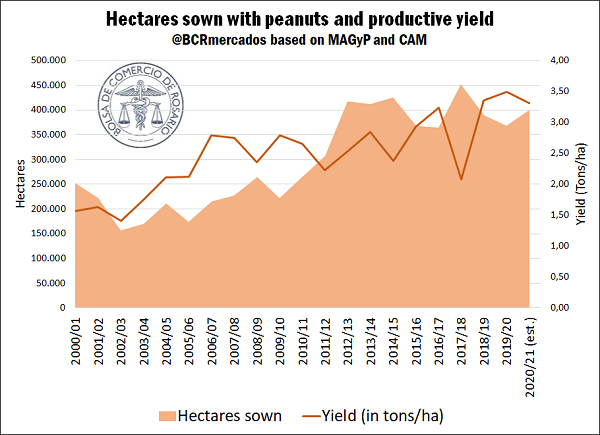

In the last two decades, peanut cultivation has been growing steadily both in planted area as in yield. In addition to this increase of the planted area, a sustained incorporation of new technologies and regional specialization have allowed a sharp rise in the productive yield, boosting total production.

In this way, in the decade that began in 1990, peanut production per crop was around 334,000 tons, with a yield close to 1.6 t/ha. Moving forward in time, by the decade of 2000, production averaged 450,000 tons in each marketing year, with a yield close to 2.1 t/ha. Finally, the decade that began in 2010 continues to consolidate the growth of peanuts in Argentina, with an average production of over 1,038,000 tons per crop season, and a yield over 2.8 t/ha.

During the 2019/20 crop season, peanuts yield was 3.5 t/ha, while soybean and corn showed yields of 3.05 and 8.24 t/ha, respectively. Taking international price averages for 2020 and 2021, one hectare of peanut reaches an estimated gross production value of US$ 4.518, while those of soybean and corn are US$ 1.311 and US$ 1.524, respectively. However, it is important to emphasize that peanut planted area is much smaller than the other two crops mentioned, partially due to the territorial specificity of this oilseed. Likewise, the need for crop rotation, more imperative in peanuts, in addition to the higher production costs for this oilseed, should not be overlooked in this analysis.

Crop season 2021/22, starting in June next year, shows forecasts between 1.2 y 1.4 Mt, in line with the best production values registered. Consequently, exports for almost 1 Mt are expected, which could again break foreign trade records.

Prospects and issues for the future

Among the political guidelines to be developed, a recent document by the Ministry of Productive Development of Argentina gives an account of some issues (Carciofi, Guevara Lynch, Cappelletti, Maspi, y López, 2021). Firstly, it highlights the need to increase even more primary production in order to boost peanut processing. Furthermore, it is emphasized that the main export products of the peanut complex are shelled peanut and unrefined oil, and there is still room to add even more value to rising exports. Finally, much of the industry waste can be used as input for other activities.

The Argentine Peanut Chamber has repeatedly insisted on lowering export duties on the top export chain in the world. Within shelled peanut we can find blanched peanut (without peel) and confectionery peanut (ready for human consumption), which together account for 90% of the exports, with tax rates of 7% and 4.5%, respectively.

Also, on September 8th and 9th, the World Peanut Meeting will take place, a meeting organized by the Argentine Peanut Chamber with the support of associations related to the industry around the world. The global perspectives for this thriving Argentine export chain will be discussed there.

Bibliography

CAM. (August 17th, 2021). Argentine Peanut Chamber website. Obtained from http://www.camaradelmani.org.ar/

Carciofi, I., Guevara Lynch, J. P., Cappelletti, L., Maspi, N., & López, S. (2021). Economías regionales: red de actores, procesos de producción y espacios para agregar valor. Algunos lineamientos de política para el impulso de las exportaciones en cadenas productivas ligadas a la agroindustria. Buenos Aires: Documentos de Trabajo del CCE N° 10 - Consejo para el Cambio Estructural - Ministerio de Desarrollo Productivo de la Nación.

INDEC. (2021). Censo Nacional Agropecuario. Resultados definitivos. Buenos Aires: INDEC.