Methodology of the Manufacturing Agribusiness Production Index by Rosario Board of Trade (IPAA-BCR)

Rosario Board of Trade constructed a manufacturing agribusiness production index for Argentina with the aim of periodically measuring the joint evolution of the production of a series of key items for the Argentinian economy, such as milling of cereals, crushing of oilseeds, production of meat, dairy and biofuels. The methodology used is detailed below.

The Agribusiness Sector is defined as the set of industrial activities framed under the agricultural-livestock category and the activities related to the primary link that allow to obtain the raw materials necessary for their processing. Agriculture, livestock, bee-keeping, aquaculture, fishing, forestry and logging make up the primary sector of the economy, which includes the productive activities of obtaining from natural resources the commodities for consumption or industry. If we group them, it can be said that agribusiness is the economic activity that encompasses obtaining, industrializing and trading agricultural, forestry and biological products. It is in charge of the fundamental task of generating value by first producing goods to later transform them through subsequent activities. Due to its relative importance, this activity is strategic for the economic and social development of the Argentine Republic and has a high growth potential. The ensemble of companies that work daily in agribusiness are fundamental pillars for securing a higher level of activity, added value, exports and employment, with their consequent positive impact on income distribution and social equity. The agribusiness sector is the main generator of foreign currency in our country, leading the trade balance. It is also an important generator of jobs, and has a significant share in the added value of the economy.

In order to obtain the level of performance of the agribusiness sector in Argentina, Rosario Board of Trade created an index that surveys the evolution of certain activities that compose this sector in Argentina. Therefore, the BCR-IPA is an index made up of several selected productive activities within the agrifood sector, whose goal is to measure the evolution of the sector over time. It is published monthly and is based on methodological aspects developed for other activity indices currently carried out by the National Institute of Statistics and Census (INDEC, for its acronym in Spanish).

1. Involved activities

Every month, the BCR-IPA will measure the evolution of the livestock sector (items: cattle, pigs and poultry) and the agricultural sector (items: soybean, corn, sunflower, wheat, barley and biofuels). Both the industrial agricultural sector and the industrial livestock sector will have their respective indices, and the mentioned API index will be calculated from these. The information about the activities in the areas involved is mainly obtained from the Argentinian Ministry of Agriculture, Livestock and Fisheries.

2. Calculation of the index

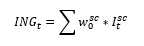

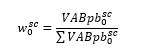

The BCR-IPA general index calculated each month is defined as:

and

where

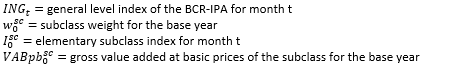

The variables selected for the survey of the BCR-IPA will be production in physical units. A physical volume index is calculated for each month per subclass, whose formula is given by:

where

At the level of activity, the base value added levels for year 2004 are used to generate the weights for each activity. As for the weight of the biofuel sector in 2004, when such sector did not exist, it was decided to estimate its added value using the hedonistic pricing method. In a nutshell, here we simply assumed the same cost structure as today and biodiesel prices proportional to soybean and corn oil prices back in 2004. The weight of each activity in the index is shown in the table above.

3. Results and de-seasonalization

The series adjustment is carried out with the R package based on the X-13-ARIMA-SEATS software, which is a seasonal adjustment software produced, distributed, and maintained by the United States Census Bureau. At present, there are two seasonal adjustment modules in the software. One uses the X-11 seasonal adjustment method. The second seasonal adjustment module uses the seasonal adjustment procedure based on the ARIMA model of the SEATS seasonal adjustment software developed by Víctor Gómez and Agustín Maravall at Banco de España.

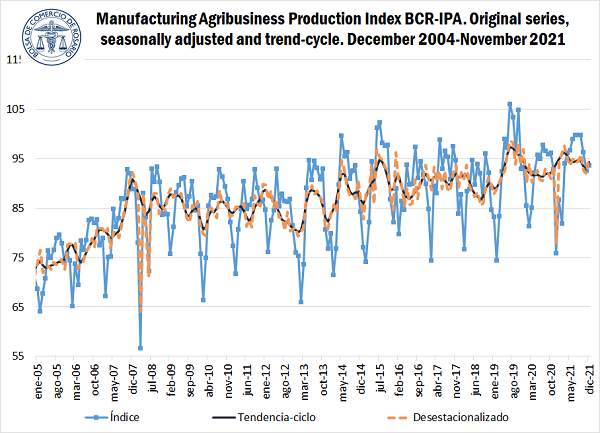

When the result of the seasonally adjusted series is observed, it is possible to notice a long-term growth of the sector that has plateaued until today. Since 2005, the sector had a considerable growth that continued with great variability until 2008. From this year till 2010, the index shows a considerable drop that coincides with the international crisis that was happening at that time. From 2011, the index recovers strongly with the rise in commodity prices, only to fall again in 2012. During that year, restrictions on the trading and export of agricultural products gained strength and the index falls sharply, reaching new lows. From that year on, the biofuel sector began to gain momentum, generating a new growth factor in the agribusiness sector together with new investments that increased the oilseed crushing capacity, firmly increasing the industrialization of grains in our country. After the abrupt drop reached in 2018 due to the toughest drought suffered by Argentina in 50 years, a new productive maximum is reached in 2019 in the seasonally adjusted series. The year 2020, marked by the Covid-19 quarantine, caused a new drop in the sector’s activity. After a marked recovery of the economy and agribusiness activities at the beginning of 2021, the index has been declining month after month, until reaching the minimums of 2020 again. The drop in the index is mainly due to lower soybean crushing and lower cattle slaughter. The situation should start to set off alarms, since both sectors involve a huge amount of foreign currency and jobs in the country. The lower soybean crushing is due to a fall in the rate of industrialization, lower than the high performance achieved at the beginning of 2021. On the other hand, after the closure of beef exports, the sector continues to show a significant drop in comparison to last year.

When looking at the long-term series, it can be seen that the growth rate from 2015 to the present in the agribusiness sector has been very low. In part, it is due to the high export duties and tax burden that the sector has, which prevents it from reaching its true potential. This true potential has already been seen in other countries with similar structures, such as Uruguay and Brazil. The long-term evolution can be seen in the red line, where we can observe a stagnation in the growth of the sector that was accentuated as the years went by. Undoubtedly, if authorities really want the country to grow and improve the different macroeconomic variables, they should try to eliminate the handicaps and tax pressure so that this key sector of the economy can progress and generate genuine work and foreign currency through an activity which nowadays is present throughout our country.