The low water level of the Paraná River pushes down FOB prices of Argentinian corn, soybean and its by-products

Although more than five months have passed since the official beginning of the new corn crop season and four since the beginning of soybean’s, FOB prices offered, that is, FOB bid prices in the Up-River Paraná ports are the lowest among the main exporting countries.

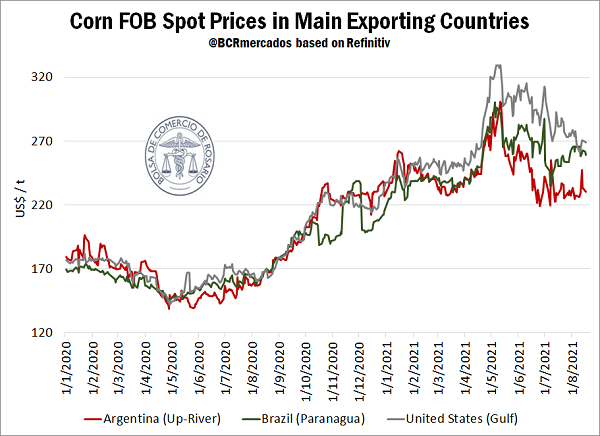

In the case of corn, FOB price for nearby shipping in Argentina (Up-River), Brazil (Paranagua) and the United States (Gulf) have shifted with a relative synchronicity since the beginning of last year until May of the current year. However, from that moment on, a higher divergence among the various origins can be observed. In the United States, prices remain higher than those of Argentina and Brazil, and currently reach US$ 269/t, which makes sense if we consider that the American harvest of corn starts in September, so at this moment of the year supplies start to be scarce, while the re-entry into the market of the new crop season grains is expected.

Brazil and Argentina, on the other hand, start to harvest corn in February and continue to do so until August, so that the entry of goods into the market pushed prices in those origins in comparison to prices in the United States. However, the price in Argentina has been even below the values of Brazil. If we analyse the reasons for this phenomenon, we find one cause: the historical draught that affected the South of Brazil. This had two consequences: on the one hand, second crop corn in the neighbouring country was severely affected by the lack of water, and production is to fall by 15% in the current crop season, thus reducing the availability of grains for export and raising the prices. On the other hand, the Paraná River is registering the lowest water level in over 60 years, which generates logistic costs that impact the values offered for corn in Rosario city cluster of ports. At present, FOB price Up-River is US$ 230/t, while in Paranagua is US$ 259/t, that is to say, a US$ 29 difference. Although this difference was reduced during the last few weeks, towards the end of June it reached US$ 48/t, the highest difference in history in favour of Brazilian corn.

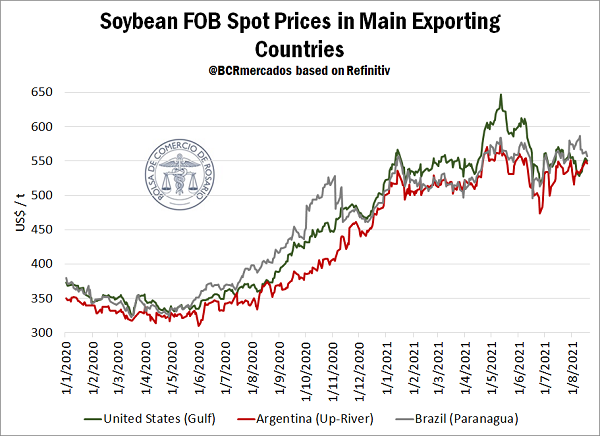

As for FOB price of soybean, the values offered for nearby shipment in the Up-River Paraná Ports reached US$ 546.7/t by August 18th. Even though they are below the prices offered in the Gulf of Mexico ports in the United States and in Paranagua in Brazil (564 and 555.5 dollars per ton, respectively), the gap is considerably lower than the one registered for corn.

This is due, in part, to the 10% fall of the Argentinian oilseed production in the current crop season with regards to 2019/20, reducing the availability of grains in the local market, while in Brazil the opposite happened, by harvesting a historical record of 137 Mt. On the other side, the share of Rosario city hub terminals in shipments of soybean is relatively lower than other products. In this way, although the low water level of the Paraná River is also causing logistic problems in the shipment of beans, the difference is of a lesser magnitude.

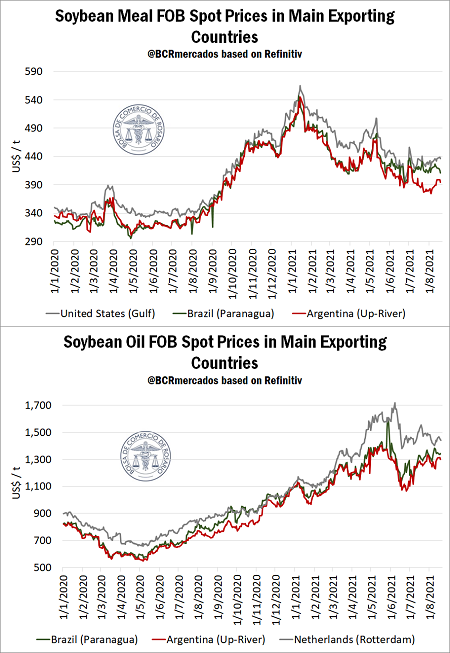

Soybean meal and oil, however, present a higher difference to that of soybean among the first origins. The FOB price of soybean meal for nearby shipment in the Up-River Paraná ports is US$ 394.5 by August 18th, 42 dollars below the price in the Gulf and 17 dollars below the price in Paranagua. Besides, regarding the last one, the gap was considerably reduced, but at the beginning of August (on August 4th, to be more precise) it reached US$ 41/t, the highest difference since September 2014. On the other hand, in the following chart it can be appreciated that the prices in the United States have been kept on top, while the ones in Argentina and Brazil have been very close to one another until beginnings of May, precisely the month during which the low water level of the Paraná River started to be more pronounced.

Also, a fact that is worth mentioning here is that, although the exports of Argentinian soybean meal grew by 18% during the first 4 months of the crop season (April-July) with regards to the same period of the previous crop, it is convenient to compare to earlier years, since in 2020 the outbreak of the pandemics generated certain complications not only in the flow of goods, but also in the industrialization of the bean, particularly during the first months of the crop season. In fact, compared to 2019, 2017 and 2016, it can be observed that between April and July this year they were slightly below (4%, 2% and 1%, respectively). However, when we observe the exports of Brazilian soybean meal during the same period, we notice that the exports of our neighbouring country between April and July of the current year are 12%, 25% and 6% above the ones of 2019, 2017 and 2016, which indicates a higher global appetite for this by-product.

In this way, we can assume that the lower water level of the Paraná River has not only resulted in lower export prices for products, but also in a lower exported volume of this by-product that could have potentially been exported under normal conditions.

Last, FOB prices of the oil for nearby shipping in the Up-River Paraná Ports are S$ 1,300/t by the 18th of the present month, while the prices in Paranagua reach US$ 1,345 /t and in Rotterdam, US$ 1,442. We need to make clear that these three origins are considered because they are the main ports of the three main exporters of this by-product (Argentina, Brazil and the European Union considered as a block). Just as happened with corn and soybean meal, in the last few days, the gap was considerably reduced, but a week ago it reached 146 dollars per ton, while at the end of June it reached US$ 270/t, the highest difference on record.

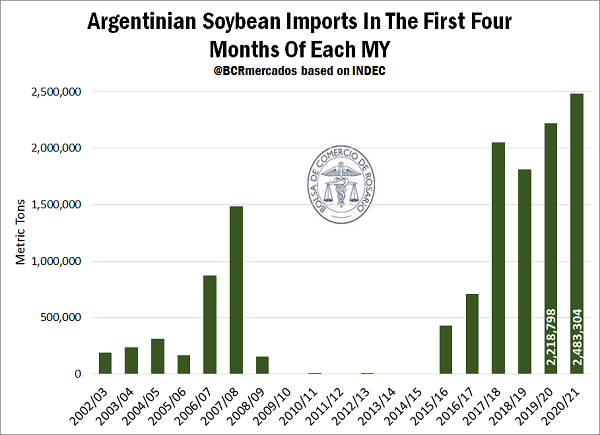

Temporary imports of soybean at record levels

On the other side of Argentinian foreign trade, an interesting factor to analyse is what is happening with temporary imports of soybean. During the first 4 months of the crop season, 2.5 Mt of soybean were imported, the highest volume in history for the same period. Out of that total, 2.3 come from Paraguay. In general, the imported goods from that origin are moved on barges that sail down the river from the ports of Asunción to Rosario city hub of terminals, and therefore the low water level of the river also raises a question for the upcoming months in this sense, considering that for this crop season, Argentina is forecast to make temporary imports of soybean for 5 Mt.