Low level of Paraná River to cost near US$ 315 million over 6-month period to Argentinian agribusiness export complex and farmers

Executive Summary

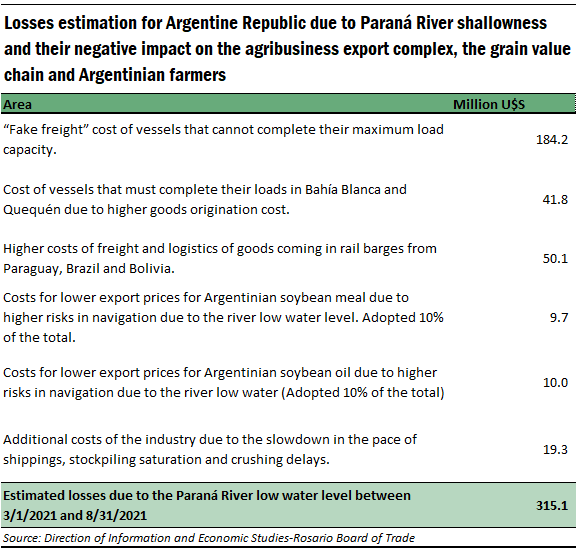

According to our estimations, in the semester from March 1st and August 31st 2021, the extraordinary shallowness of the Paraná River, which is the main exit route of goods of the country’s agribusiness complex, would generate losses of around US$ 315 million to the Argentinian grain value chain.

These higher costs result from adding up the following areas:

- Increase in costs related to the need to adjust the cargo volume on certain type of vessels in Rosario city hub of ports due to the lower water level, which implies that a group of ships must depart to their (definite) destinations with a lower tonnage and have to face the so-called “fake freight” cost.

- Higher costs that result from the need of certain vessels of completing their cargo in other Argentinian ports, different from Rosario city hub of ports. It implies the need to increase the volume shipped in ports such as Bahía Blanca or Quequén, where the origination price of the goods ends up being higher than in Rosario due to logistic problems and higher costs of land transportation. In this estimation, there have not been included the higher costs of those vessels that need to complete their cargo on the Brazilian port hubs (Santos-Paranaguá, for example).

- Higher transportation and logistics costs related to lower tonnage that can be loaded on rail barges coming down the rivers Paraná and Paraguay to Rosario city cluster from Paraguay, Bolivia and local ports. We refer to goods of foreign origin that are transhipped on Rosario city hub of ports, to soybean temporarily imported by our country and to Argentinian grains arriving from domestic ports of Chaco and Entre Ríos.

- The losses suffered by the local agribusiness due to lower export prices collected by our country both for soybean meal and oil due to logistic and transportation problems because of the shallowness of the Paraná River. There is a price penalty to these Argentinian products that translate into a downward pressure on Argentina FOB premiums compared to other origins, such as Brazil. In this report, we have used a lower percentage of these incremental costs so as not to duplicate the loss estimation, but to be able to reflect the risk and additional uncertainty implied to a ship when entering the Paraná River with the current low water level, and being forced to face unexpected events that might delay the trip and cause additional unplanned costs. The percentage applied was 10% of the price difference between Argentina and Brazil.

- Additional costs in the industrial activity of the oilseed complex in Rosario city hub of ports due to the slowdown in the pace of shippings, which generates various inconveniences, stockpiling saturation and crushing delays.

We believe that we have been cautious enough with the calculations in order to not overvalue the losses of the event.

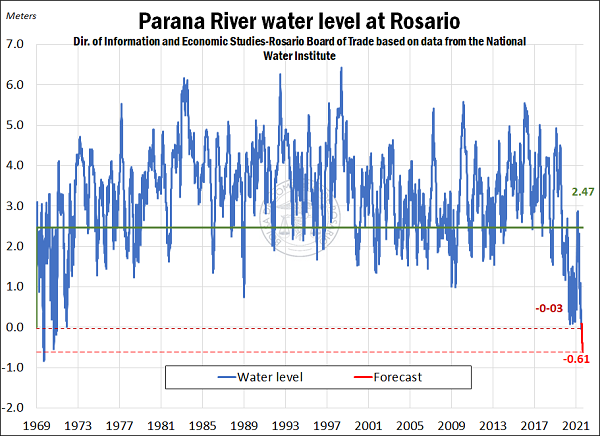

As for climatic issues, our specialist, Dr José Luis Aiello (Doctor in Atmospheric Sciences and scientific advisor of the Board), together with our Agribusiness Strategy Guide (GEA, for its Spanish acronym) and Rosario Board of Trade (BCR, for its Spanish Acronym) specialists, look with great concern at the extremely dry phenomenon in the regions that pour into the Paraná-Paraguay and Tiete-Paraná waterway. The outlook for the oncoming months is that the Paraná River might reach its lowest level in decades on its river-sea stretch.

Doctor Aiello indicates that the mentioned regions are going through the so-called “Dry Season”, that is to say, with low precipitations that would only reverse from the end of September on, which is the basis for the forecast quoted. During the dry season, atmospheric dynamic systems do not have a clear correlation with the Equatorial Pacific, which is on the final stage of a NIÑA, and could change to NEUTRAL from September on. In short, the forecast is far from auspicious on the Paraná-Paraguay and Tiete- Paraná regions, with negative impacts for Rosario city hub of ports.

Complete Article

Situation of the Paraná River and strategic importance

Historically, Rosario has been the epicentre of bulk carrier port locations due to its privileged geographical position. On the one side, the closeness to one of the most productive regions of the world for cereal and oilseed cultivation, and on the other side, the topographic benefits presented by the cliffy bank of the Paraná River on these latitudes for bulk loading of ships. In addition to these natural characteristics, a series of investments in dredging, logistics, human resources, and productive infrastructure made since the decade of 1990 finished potentiating Rosario city hub of ports as a world-class industrial-export cluster for agribusiness products and by-products. During 2019, it was positioned as the most important agricultural export port hub of the world, exceeding in shipped tons the main ports of other big players in the world market of agribusiness products and by-products, such as the United States and Brazil.

During 2020, from the port terminals that ship grains and its by-products located on the Up-River (Rosario city hub of ports), 70% of the grain, 96% of the vegetable oils and 96% of meals exported by the country were shipped, for an approximate value of US$ 20,000 million, which equals 37% of Argentina's yearly exports.

What happens on the Paraná River is key for the logistics to flow efficiently. The current situation poses a complicated outlook. After a January with over-the-normal rain on the Brazilian region of the Paraná sub-basin, which, therefore, allowed to recover part of the water volume lost during the previous year, between the months of February and May this year, the rains on that region of Brazil presented a notable deficit in relation to standards. The current situation is characterized by an extraordinary drought, with scarce and insufficient rain to generate surplus towards rivers, therefore the Paraná River shallowness worsens week after week.

Our specialist, Dr José Luis Aiello (Doctor in Atmospheric Sciences and scientific advisor of the Board), together with our Agribusiness Strategy Guide (GEA, for its Spanish acronym) and Rosario Board of Trade (BCR, for its Spanish Acronym) specialists look with great concern at the extremely dry phenomenon in the regions that pour into the Paraná-Paraguay and Tiete-Paraná waterway. The outlook for the oncoming months is that the Paraná River might reach its lowest level in decades on its river-sea stretch.

Doctor Aiello indicates that the mentioned regions are going through the so-called “Dry Season” with low precipitations that would only reverse from the end of September on, which is the basis for the forecast quoted. During the dry season, atmospheric dynamic systems do not have a clear correlation with the Equatorial Pacific, which is on the final stage of a NIÑA, and could change to NEUTRAL from September on. In short, the forecast is far from auspicious on the Paraná-Paraguay and Tiete-Paraná regions.

As a matter of fact, during the month of June, the water level measured by the hydrometer located in Rosario had a strong descent, reaching a relative minimum of -0.03 m on Saturday 26 at 12.00 h, the lowest figure since December 1970, and the lowest figure recorded for the month of June in history. Although the record partially improved last week, reaching 0.18 m on July 7 at 12.00 h, it is still much lower than the minimum of 2.47 m that should be registered on the banks of Rosario city in order for Hidrovía S.A. to have the obligation to guarantee the draft depth of 34 feet.

Looking into the future months, the situation does not present a promising horizon since, being in full dry season on the regions where the Paraná tributaries origin, the rains are not seasonally abundant. In fact, according to forecasts by the National Water Institute, the river’s volume will decrease and the water level in Rosario by beginnings of September will reach -0.61 m which, if confirmed, might be the lowest record since 1969.

Losses due to higher costs and lower sale prices of agribusiness products due to the low water level of Paraná River

The situation of extreme shallowness of the Paraná River, the main exit cargo route of domestic agricultural production, forces the industrial-export sector to adapt its work, assuming incremental costs related to the export, industrialization, operation, and associated work logistics, as compared to a normal operation situation. These costs have an impact not only on the industrial complex, but all along the value chain and farmers.

Among the costs that stand out, we could note:

- Costs related to the need to adjust the cargo volume in Rosario city hub of ports, which forces certain vessels to sail down with a lower tonnage, and others to increase the volume loaded in ports where the price of goods is higher (Bahía Blanca-Quequén)

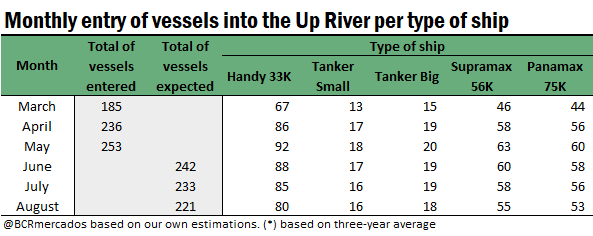

It is expected that in the months between 3/1/2021 y 8/31/2021, a total of 1,247 vessels enter the Up River Paraná Ports to load goods of various types. 674 vessels have already entered to load oil, grain or by-products during the first three months of the period under consideration. The remaining months were forecast based on the historical average of the last years. However, we do not discard that the situation generates a higher entry of ships as more vessels are needed to ship the same tonnage of goods.

The distribution per type of vessel applied to the study is an estimation based on sample data collected by the Rosario Board of Trade on a typical year. The vessels and their sample distribution is the following:

- Vessels like Handy size and Handy max represent 36.28% of the total of vessels entering the Up River. They have a load capacity of 35,000 to 40,000 t.

- Tanker boats enter the river to load oils or biodiesel and represent 15.04% of the total. This is split in Tankers Big 7.08% and Tankers small 7.96%.

- Supramaxes represent 24.78% of the total and can load between 50,000 and 60,000 t.

- Last, Panamaxes and postpanamaxes represent on a typical year 23.89% of the total of vessels that enter Rosario city hub of ports. They have a load capacity of 60,000 to 65,000 t.

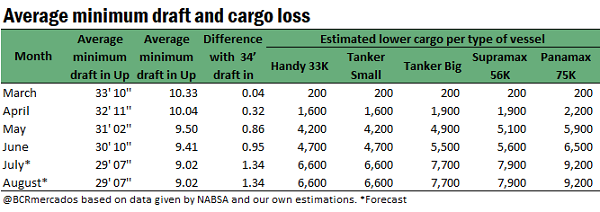

The “fake freight cost” is caused by the impossibility of fully loading the vessels of lower capacity, or loading them to an average capacity with the usual 34 feet draft of the waterway. This forces the ships to sail overseas with a lower cargo hold. Certain vessels will not proceed to completing their loads on ports located further South or in Brazil, since their remaining cargo capacity does not economically justify mooring at another port. On a Handysize or Handymax, each draft feet the Paraná River loses represents a loss of said load capacity of 1,500 to 1,800 tons.

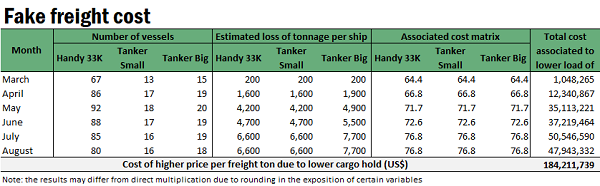

We calculated average sailing drafts for the months under analysis in order to estimate the theoretical load lost by this vessels due to the low water level. To that effect, we used the passages of lower draft from San Lorenzo to the sea and averaged them, assuming the current situation will not improve in the next two months, just as forecast by specialists like Dr. José Luis Aiello.

We then proceeded to calculate the additional freight cost of using a lower cargo hold in smaller vessels, which will not complete their cargo in other ports. To that effect, we theoretically calculated the cost of sending a Handymax with a dry load to our export destinations with 40,000 tons, which is the cargo that would be shipped under normal river conditions. Therefore, we obtained a price (freight) per cargo ton that we can compare to the price (freight) per cargo ton that we would obtain for loading that same ship with a lower tonnage. This, logically, will have a higher value.

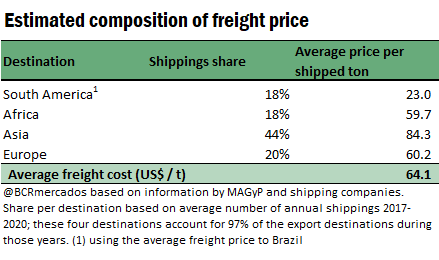

To execute this calculation, we proceeded to determine an average freight price weighted by each continent’s share in the destination of shipments sailing from the Up-River Paraná Ports. The obtained value is U$S 64.1 per ton, as can be seen in the corresponding chart.

Therefore, with this reference price, we can estimate that Handymax loaded with 40,000 bulk tons has a total freight cost of US$ 2,564,000, approximately. It is clear that this price is not a real price to any destination in particular, but that it comes from an average estimation of our usual shipping destinations. This total freight cost is much higher than our loss estimation of April last year, due to the increase in international freight costs and the higher value of the barrel of oil.

Therefore, if instead of loading a ship with 40,000 tons we load it with, for example, 35,000 t, we will have a higher cost of freight per ton. In this example, the cost would rise up to US$ 73.25/ton, an additional cost of US$ 9.2/ton, due to the low water level of the Paraná River. Calculated in a similar fashion for each type of vessel, for each of the 6 months under analysis, with its respective average losses according to the existing draft, we obtained a total of higher costs of U$S 184 million for the so-called “fake freight”. This is one of the main factors for lower prices currently paid to Argentinian exporters for local soybean oil and meal. We would like to reiterate that this record is affected by the high international values of freight at present.

¿It is necessary to clarify that, if a lower tonnage load is agreed upon in advance, it is highly probable that the total gross cost of freight will be cheaper, since a lower tonnage will imply less fuel expenses of the vessel to destination, among other costs that could be reduced. We assumed the price of the fully-loaded vessel for the sake of ease of calculus, although this does not undermine the calculation veracity, in the authors’ opinion.

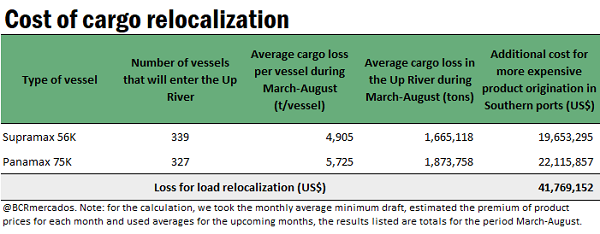

On the other hand, the higher-capacity vessels often complete their cargo hold with goods at ports located on the South, on the shore of the Atlantic Ocean: Quequén/Necochea or Bahía Blanca. Although this is a usual load, due to the fact that large scale vessels cannot be fully loaded on the Up-River Paraná Ports because of their designed draft, the low water level forces to increase this additional load, with its associated costs.

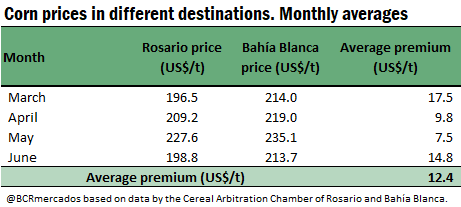

The goods on the South of Buenos Aires province (FAS goods, that is to say, the price of goods on port) usually operate with a premium over the price of goods in Rosario, especially because of geographical availability of the goods and the cost of ground freight. This premium had an upward trend in the current year, as the load on the Up-River Paraná Ports (Rosario city hub of ports) was more and more complex due to the lower water level and the Southern ports started to need more grain to complete the vessels, a phenomenon similar to what occurred in 2020 for the same reason.

We will use for this analysis the corn premium over Rosario prices, in the months during the cereal crop season. If we take into account the prices of the Cereal Arbitration Chamber of Rosario and Bahía Blanca, we obtain the results listed in the chart below.

Thus, all goods that cannot be loaded in Rosario on larger vessels (Panamax, Supramax, Post-Panamax) and must complete their cargo in the ports on the South of Buenos Aires province imply a loss for the loader, since they must face higher costs for buying the goods. It is necessary to make clear that we are not considering other costs that the relocation of goods origination might imply for companies, such as the cost of renting for companies that do not have facilities on both port regions, the difference in load efficiency in different ports, the costs of rearranging in-house functions, among others.

By applying the higher cost of goods to the theoretical load tonnage lost due to the existence of a navigation draft below the usual or below the draft designed for the waterway, we obtain the result listed in the chart titled “Cost of cargo relocalization”. A total of U$S 41.7 million of losses for higher expenditures in goods origination.

It is important to state that there have not been included the higher costs of those vessels that need to complete their cargo on the Brazilian port hubs (Santos-Paranaguá, for example). It is especially frequent in loads of soybean meal on those port hubs.

- Higher transportation and logistics costs related to lower tonnage that can be loaded on rail barges coming down the rivers Paraná and Paraguay to Rosario city cluster from Paraguay, Bolivia, and local ports. We refer to goods of foreign origin that are transhipped on Rosario city hub of ports, to soybean temporarily imported by our country and to Argentinian grains arriving from ports of Chaco and Entre Ríos.

Goods shipped down the waterway towards the plants and ports located on the banks of Santa Fe are of vital importance, not only for the local industry, but also for exports of countries upriver. The soybean that enters year after year from Paraguay and Bolivia -mainly Paraguay- has an important role for the oilseed complex in Rosario city cluster because, mixed with Argentinian soybean, it helps to raise the level of protein of soybean meal in order to comply with the requirements of international demand. Besides, down the waterway arrive grain mainly from Paraguay and Bolivia, destined to be exported on larger-scale vessels from our terminals.

The river shallowness forces to use a larger number of rail barges to transport the same tonnage of goods, also rising the time needed for them to arrive. On many cases, there are transportation operations that are in fact cancelled due to the low water level.

The cost of transportation under normal conditions is 0.02 U$S/tn/Km. We assume that under normal conditions, a convoy sails down the river with 30 barges, with an average cargo of 15,000 tons per barge. If the distance from Rosario city hub of ports to Asunción del Paraguay (Puerto Villeta area) is of 1000 km, on average, Rosario-Asunción del Paraguay freight cost might be around 20 U$S/t per ton of grain and by-products.

If we now assume that for each feet of sailing-draft lost up river, the load capacity per barge drops about 100 tons, we can estimate (keeping the number of barges per convoy) that the cost per ton of goods sailing down the river from Asunción increases by US$ 7.2 /tons, reaching US$ 27.2 /t. That is to say, the cost of transporting the same amount of goods is 36% more expensive. In a similar way, we can perform calculations for each origin of goods processed and/or shipped from our ports.

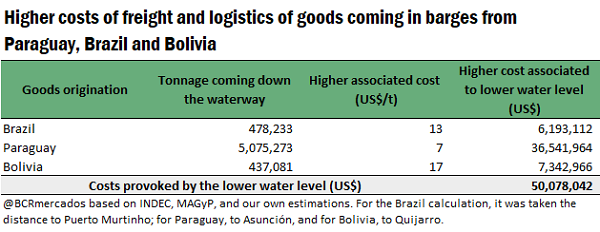

Considering the data available until the month of May, and the average of the last three crop seasons in order to estimate the rest of the semester under consideration, we forecast that 478,000 tons of Brazilian goods will sail down the waterway to be processed/shipped, about 5.1 Mt goods from Paraguay and 437 thousand goods from Bolivia. This rises from considering not only what enters our country as temporary imports, but also what enters to be shipped directly under its flag of origin.

Thus, assuming this rise in the price of goods transported down the waterway, we can calculate the associated cost of the river shallowness for the goods on each of the origins. This results in a total of U$S 50 million, approximately.

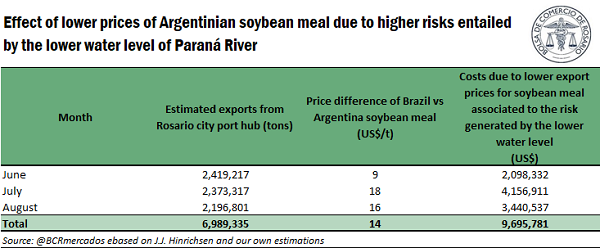

- Costs due to lower export prices for Argentinian soybean oil and meal associated to the risk generated by the lower water level of the Paraná River. There is a price penalty on these Argentinian products that translate into a downward pressure on Argentina FOB premiums compared to other origins, such as Brazil.

This analysis reflects the losses suffered by the local agribusiness complex due to lower export prices collected by our country both for soybean meal and oil of local production due to logistic and transportation risks as a result of the shallowness of the Paraná River and other factors. There is a price penalty on these Argentinian products that translate into a downward pressure on Argentina FOB premiums compared to other origins, such as Brazil. In this report, we have used a lower percentage of these incremental costs (only 10%) so as not to duplicate the loss estimation, but to be able to reflect the risk and additional uncertainty implied to a ship when entering the Paraná River with the current low water level and being forced to face unexpected events that might delay the trip and cause additional unplanned costs. This is the point being quantified on the present analysis.

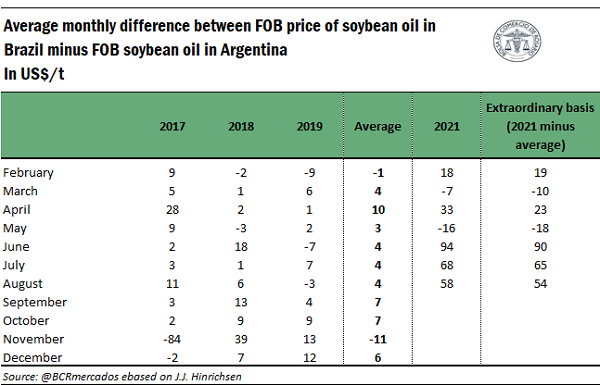

In the following chart, we can observe the average monthly FOB price difference for soybean oil between Brazil and Argentina in the years 2017, 2018 and 2019 (2020 was ignored, since there also were severely low water levels on the Paraná River, which is considered an atypical situation). As can be appreciated, for the months of June to August each year, the FOB prices of oil in Argentina are usually very close to those of Brazil.

At present, the FOB prices in our neighbouring country are considerably above the ones offered to Argentina. This is caused by three factors.

- On the one hand, the strong industrialization of soybean that took place during the last months in Argentina, after the strikes that affected industrial plants and port terminals towards the end of 2020 and in the beginnings of 2021, which rose the local offer of oil.

- On the other hand, it is due to the costs generated by not being able to fully load the vessels in Rosario city hub of ports and being forced to ship them with a lower cargo and incurring in the above-mentioned fake freight cost or completing them in other destinations, such as Brazil. As can be appreciated, the difference of FOB prices of Brazil and Argentina is accentuated in the months of June, July and August, which are the months were a worsening of the Paraná River situation is forecast.

- But there is a third factor, which responds to the risk and uncertainty that causes the lower water level. The shallowness of the Paraná River makes navigation more difficult, increasing the probability of inconveniences along the way and possible delays in the trip or in the port operations. We should remember that the cost for each day of delay for a vessel is of US$ 45,000. Besides, there is an additional risk that navigation conditions worsen when they arrive in the Up-River Paraná Ports and a higher load cut than the originally calculated is needed.

This last factor generates an overreaction in the prices of oil and meal, which are raised above what is needed to cover the costs of the fake freight or the costs generated by the need to complete the cargo in other ports. In the present work, we consider that this risk represents a 10% of the price difference between Argentina and Brazil.

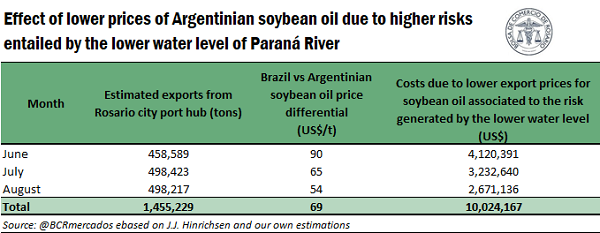

In this way, given the tons of soybean oil forecast to be exported during June, July and August, bearing in mind the price penalty on the Argentinian soybean oil, and considering that the risk and uncertainty that come along with the lower water level explains 10% of the price difference, we can conclude that the cost caused by the shallowness of the river in this area is of US$ 10,024,167.

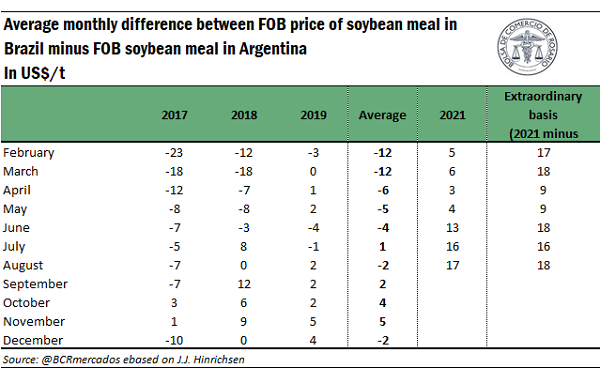

Extending the same analysis for the oilseed pellets/meal, it can be appreciated that, usually, Brazil FOB price operates under Argentina’s price. However, between the months of March through August of the current year, the difference has been above Argentina’s, situation which is enhanced during the months of June, July and August. In a similar way to how we proceeded with oil, we avoided to include all this difference in the costs of the river lower water level since, on the one hand, there are other factors that influence the prices and, on the other hand, the costs could have already been included in the cost of the fake freight. Therefore, we consider that 10% of that price difference responds to the risks and uncertainties mentioned before.

Bearing in mind the tons exported and the tons forecast to be exported of soybean meal from the Up-River Paraná Ports during each month of the period under analysis, applying the additional price penalty of oilseed pellets/meal (current difference minus average difference) and considering that the costs associated to the risk generated by the low water level represent 10% of that difference, the losses due to lower prices received for those by-products would rise to US$ 9,695,781.

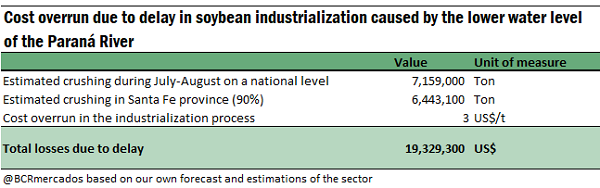

- Additional costs in the industrial activity of the oilseed complex in Rosario city hub of ports due to the slowdown in the pace of shippings, which generates operational inconveniences, stockpiling saturation and crushing delays.

In addition, a cost associated to the low water level refers to the cost overrun faced by the oilseed processing industry in Rosario city hub of ports, due to the slowdown in the pace of grain and by-product shippings, which generates pressure over grain and by-product stockpiling and injures the normal operation of the industry.

Soymeal stocks at industrial plants by June 1st reached 880,000, which shows a remarkable growth in regard to stocks a month earlier (481,000 t by May 1st). This data is still below last years’ average, however, it is rapidly growing and some difficulties in companies of the sector are already being noticed. Problems for shipping, together with some complications related to the trade and external collocation of soybean meal are starting to generate problems in stocking and the pace of crushing.

In order to calculate this overrun cost, we took the tonnage forecast to be industrialized in the Up-River Paraná Ports factories between July and August this year, and we estimated a cost overrun of US$ 3/t per ton over the usual cost of crushing. In order to not overvalue the losses, we only considered 2 months (July and August) of the 6 months of the study. The losses on this concept are close to U$S 19,3 million.

On the other hand, it should be noted that the problems in the barge activity transporting the temporary import goods that are to be mixed with domestic origin soybean in order to increase the protein content of meal to be exported adds an additional cost factor for the local oilseed industry. It is not only the higher freight cost of bringing those goods (factor that has already been analysed in the present study). The possibility of incurring in foreign trade penalties in case of selling meal under our commercial standards also causes an impact. These possible incremental costs have not been computed in the present work.

Conclusion

According to our forecasts, in the semester spanning from March 1st through August 31st, 2021, the extraordinary shallowness of the Paraná River, main exit route for the products of the Argentinian agribusiness complex is to generate losses to the industrial complex, the grain value chain and all the Argentinian farmers near US$ 315 million.