Local prices of corn and soybean strengthen at good levels on first semester of the year

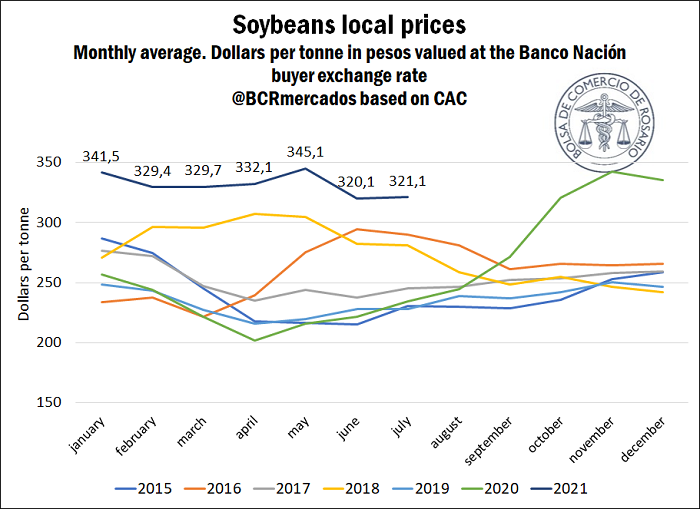

The upward rally of commodities that started on April 2020 alongside worldwide propagation of coronavirus continues to show its effects on the agribusiness commodity markets. Although domestic and international prices have shown a fluctuating behaviour during the last few weeks, there is no doubt they are quite above the levels observed on previous years. During 2021 to date, the monthly averages of Argentinian soybean have always been between 25% and 40% above the median of the last 6 years.

After the prices peak on May, soybeans had its local price around US$ 320/t, comfortably above the values observed during the last few years on the same date. To find such a high average price in June, we need to go back to year 2013, when the ton of soybean was near US$ 326/t. However, prices are still far from the maximums of the end of 2012, when they surpassed US$ 400/t.

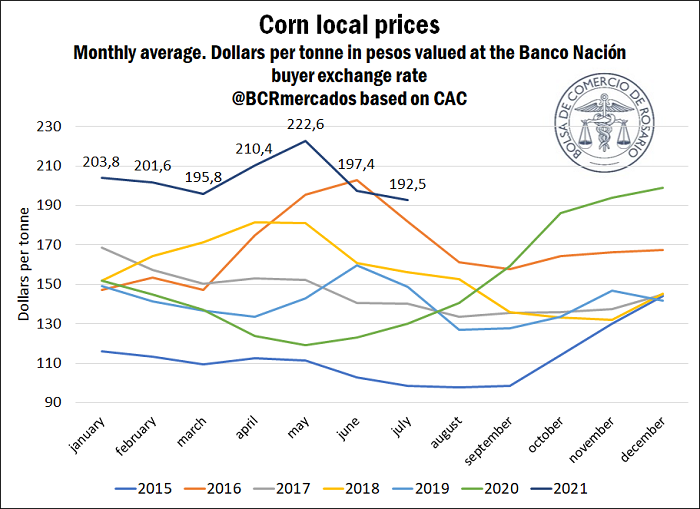

In the case of corn, during 2021, the average monthly quotes in Argentina have always been between 30% and 48% above the median of the last 6 years. In fact, during the first half of May, the cereal reached US$ 244.95/t, the highest dollar price registered, breaking the record established in May 2016, with some days exceeding US$ 240/t.

However, since May prices of corn showed a downward trend and broke the barrier of US$ 200/t by mid-June. During the last week they have recovered some ground and they currently are above US$ 190/t. Despite the drop that took place since May, the values in June and July to date are not significantly different from the ones observed during the record year, 2016.

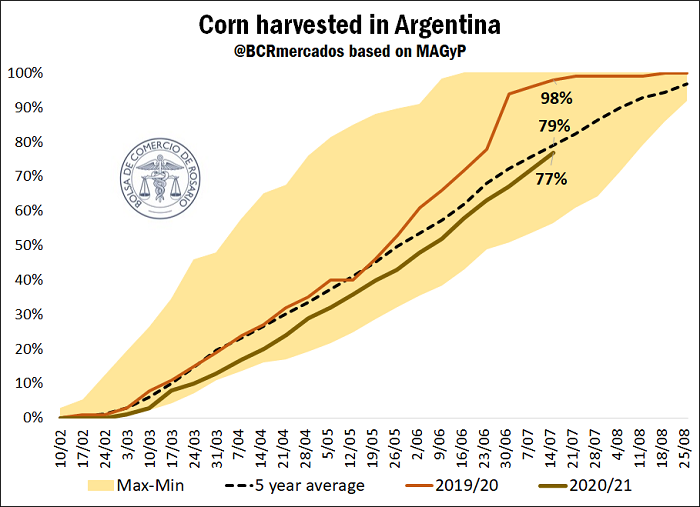

On the productive level, the soybean harvest has virtually finalized a few weeks ago, while the corn harvest progresses with delays on late parcels. The advance of crop season 2020/21 increased its pace during the last few weeks for yellow bean corn and is currently close to the average progress for the same date on the last few crop seasons. However, with 77% of the area already harvested, it is still far from the 98% advance displayed by corn during last crop.

The provinces of Buenos Aires and Santa Fe, which concentrate 26% and 12% of the total corn area respectively, already have 90% of their area harvested and underpin the average. Despite this, the main corn province, Córdoba, has harvested 72% of its parcels, concentrating more than 30% of the hectares planted with corn. The high levels of grain moisture on the Mediterranean province delay progress.

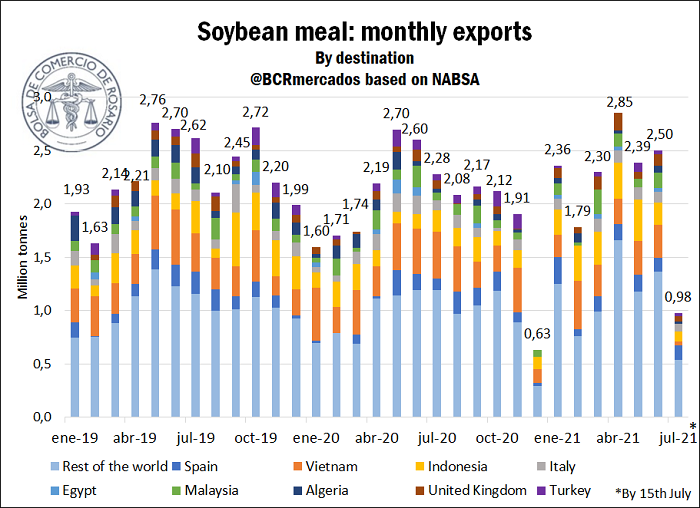

Soybean meal shippings recover

The first semester of the year show soybean meal shippings for about 14.18 Mt. This volume represents a 13% increase regarding the same period on 2020, year that showed a 6% decrease regarding the first six months of 2019. Therefore, the first six months of 2021 have already exceeded the tonnage shipped on the same periods in 2019 as in 2020.

The soybean meal market is one of the most diversified of Argentinian foreign trade. Only this year, it has exports shipped to over 61 countries. But the most interesting of this by-product of the soybean complex is that its foreign trade is much more distributed than other agribusiness products.

This way, Vietnam emerges as the main destination for Argentinian soybean meal, accounting for almost 17% of the total exported in 2020. Indonesia follows, with a 9% of the total, and from there on, shares only exceed 5% for destinations as diverse as Spain, Malaysia, Turkey and Algeria. Another group of countries just as heterogeneous from one another, such as the United Kingdom, Iran, Philippines, Egypt, etc., account for 3% of the soybean meal exports each.

This distribution of destinations for soybean meal differs, for example, from the buyers of soybean and soybean oil. These last two have majority shares of its exports concentrated in China and India, respectively. China bought 80% of the Argentinian soybean exported during 2020, while India absorbed 55% of the soybean oil during the same period.