Increase in sales of wheat 2021/22 and corn 2020/21 accompanies the evolution of soybean crush

Wheat: higher prices encourage selling

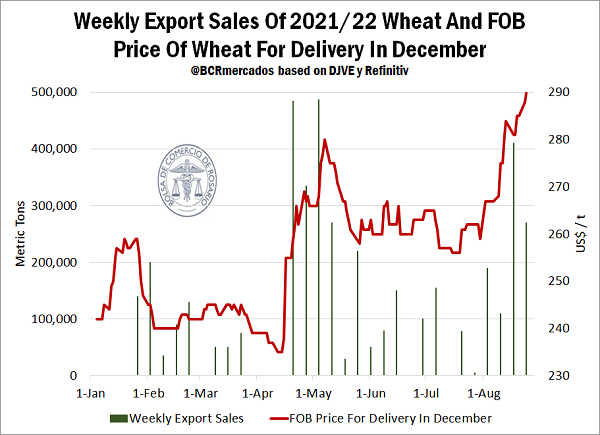

Wheat 2021/22 started the year making headlines due to its accelerated rate of foreign sales. By late January, a considerable volume of export sales started to be recorded, which rapidly set itself up as a record crop season in that sense. Also, this trend deepened between late April and early May: between April 20th and May 28th there were export sales of wheat for 1.8 Mt. Later, the pace slowed down significantly: during June and July, external sales of new crop wheat were registered for 620 thousand tons. However, an increasing dynamism can be noticed during the last few weeks and, since the beginnings of August to date, there were export sales recorded for 1 Mt.

In order to explain this behaviour, it is interesting to analyse how FOB prices for shipping between December 2021 and February 2022 evolved. As can be appreciated in the chart above, these started the year off by reaching a relative maximum in late January, and then receded in the following months until reaching a relative minimum by mid-April. Then, they were strongly recomposed between the end of April and mid-May, which matches precisely the highest volume of sales ever registered. By the end of May, there was a drop in prices, which later remained relatively stable between June and July, while since the beginnings of August they showed another upward surge, which matches precisely the second “wave” of new crop wheat export sales. In this way, it is evident that the behaviour of prices has worked as an incentive for the materialization of new crop wheat trades.

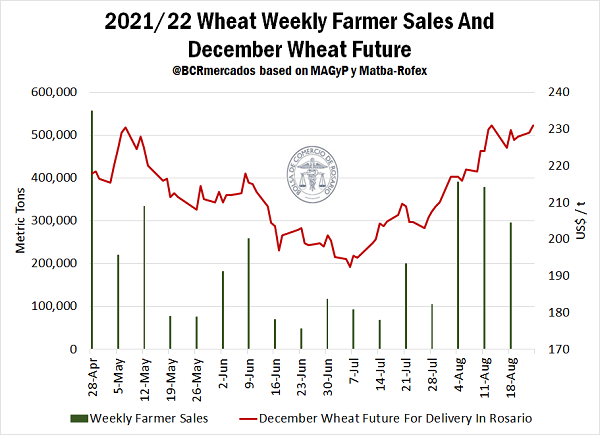

But this phenomenon is not only seen on the external front. If we follow the tons of wheat traded domestically per week. Taking the Matba-Rofex wheat future price for delivery in December in Rosario as a reference for prices at harvest, it can be noticed a virtually identical behaviour to that of exports.

The highest volumes of wheat traded in the week occurred in two moments: the first, between late April and mid-May, with 1.1 Mt traded in three weeks; and the second, since the beginnings of August to the 18th (last data available), with another 1.1 Mt during the same time frame. These were precisely the moments when wheat price at harvest reached relative maximums. Thus, just as with the external front, it can also be interpreted that the evolution of prices has acted as an incentive for producers when trading the new crop.

Regarding wheat of the current crop season 2020/21, having already sold abroad the totality of the exportable balance, the focus is on what is happening with the milling of the cereal. During July, 542,000 t of the cereal were industrialized, 4.6% more than the month of June and the highest monthly volume since the start of the crop. However, in the year-on-year comparison, wheat milling fell 6.3% regarding the same month of 2020.

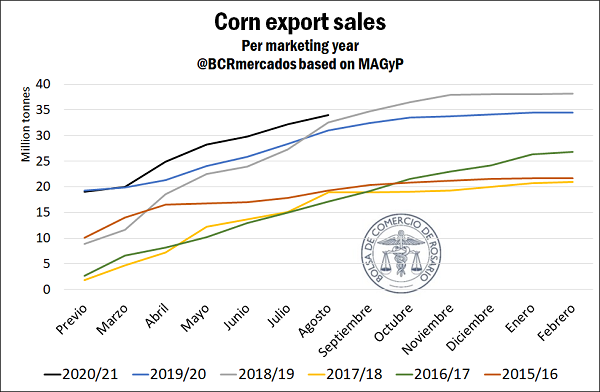

Corn: towards external sales record

Corn crop season 2020/21, which started almost 6 months ago, broke the barrier of 34 Mt this week. Thus, by this time of the year, this crop season consolidates as the one with the highest level of Export Sworn Statements (DJVE, for its Spanish acronym) on record.

It remains 4 Mt for the current crop season to exceed the total declared during business year 2018/19, the one with the highest declared export sales in history, with over 38.1 Mt by the end of its crop season. This favourable export context would not be possible without a good productive outlook. In this sense, corn crop season 2020/21 showed a growth of the planted area of around 5%, which is also pushed by a rise in the domestic consumption of the yellow bean.

However, the low water level of the Paraná river takes a toll on shipments on the Up River ports. From August 25th to September 25th, shipments are expected for 2.5 Mt of corn, about 51% of which will be loaded in the export hub of Rosario. The situation showed a different outlook for that same period in 2020, when 1.5 Mt were shipped, but 67% of the corn was forecast to be shipped on the Up River Paraná ports.

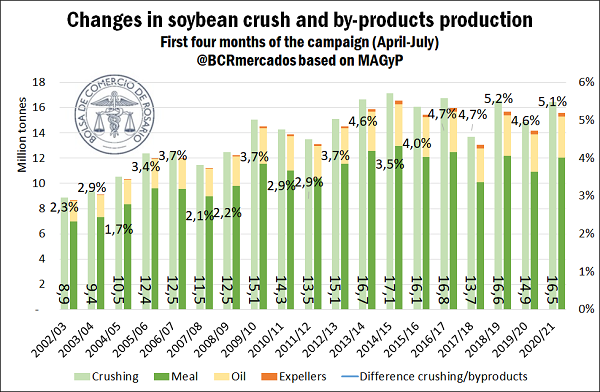

Soybean: crush fell in July, but the accumulated value keeps above last year’s

In July, 3.8 Mt of soybean were crushed, below the 4 Mt of June, but above the 3.5 Mt of the same month last year. Crop season 2020/21 is exceeding month after month the previous business year regarding bean processing, given the improvement of the levels of international demand.

However, the difference between processed tons and produced tons of by-products (oil, meal and expellers) keeps growing, as can be seen in the chart below. Although this difference also includes the hull, which is a product that can be sold, the rise of this ratio can also be explained through other factors, among which we can highlight the loss of soybean protein. This loss of protein implies a higher drying requirement, which subtracts moisture and, as a consequence, limits the harnessing of soybean by producing a lower tonnage of by-products.