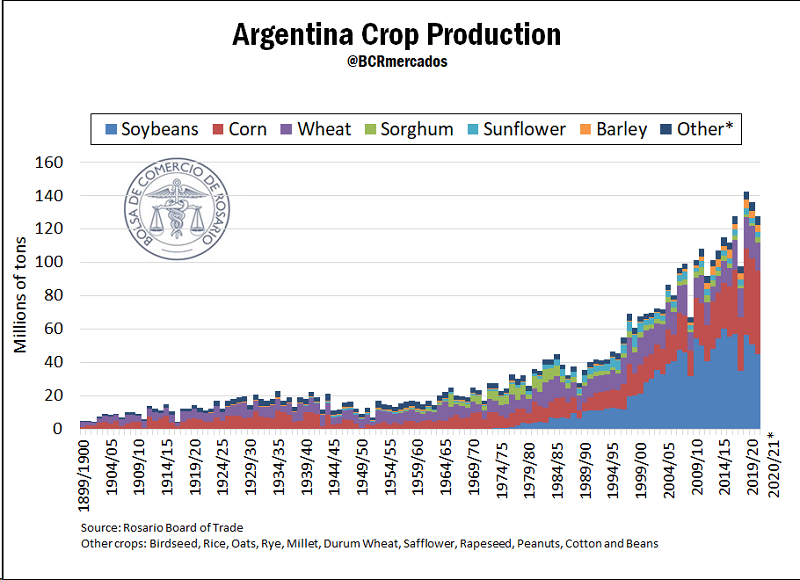

Although falling for the second consecutive year, the production of crop season 20/21 in Argentina is forecast tp be the biggest third in the history of the country. The total production of the crop season reached 127.5 Mt, with corn as the main grain produced in Argentina, with 50 Mt harvested, and soybean as the second biggest production, at 45 Mt. Production data are taken from the Agribusiness Strategy Guide (GEA, for its Spanish acronym)/Rosario Board of Trade (BCR, for its Spanish Acronym) and the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym). The drop in the total production of crop season 20/21 was due to strong yield falls of the main grains, since the planted area is estimated to have grown and reached a historical record of 38.7 M ha. The biggest increase of the planted area was on sorghum, which, according to MAGyP data, reached 950 thousand hectares, increasing by 430 thousand hectares compared to last crop season, mainly due to better planting margins forecast at the soiling stage, and better relative prices due to the emergence of China’s demand on external markets. The biggest drop of the planted area could be seen on wheat, which fell 300 thousand hectares compared to the previous crop season, due to climatic problems that caused the inability to fulfil the planting forecasts by mid-2020. As for yields, the main drop was on soybean, which caused the oilseed production in Argentina to fall by more than 5 million tons (Mt).

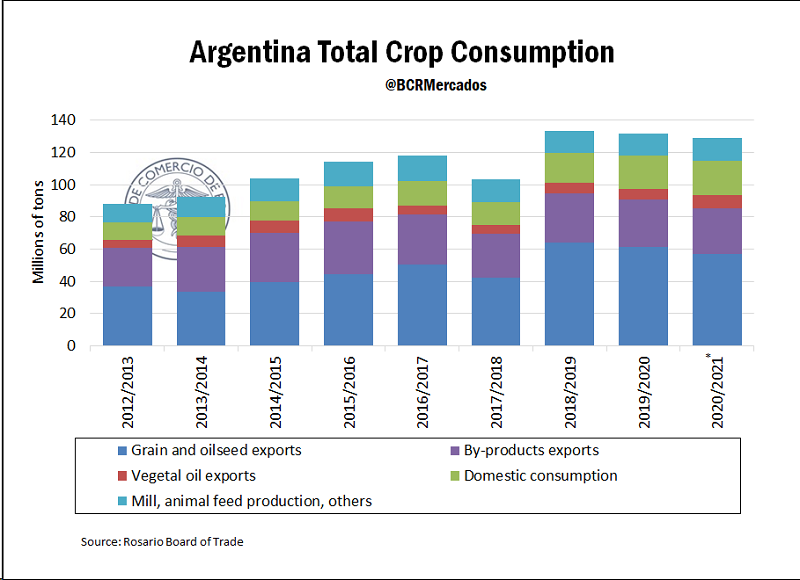

For season 20/21, it is forecast to be exported a total of 93.4 Mt of grain and by-products, which equals 73.25% of Argentina’s grain production. Of that export total, 56.9 Mt are forecast to be grain, cereals and oilseeds, while 36.6 Mt of industrial by-products of cereal and oilseed processing are forecast to be exported. This implies that 39% of Argentina’s grain export has some degree of industrial processing. This value keeps falling since the peaks recorded on 2013, mainly due to the higher export of corn and wheat made after the recovery of that area in both grains since the mentioned year.

Also, it is forecast that 39.9 Mt of grain and by-products go to domestic consumption. Of this total, 21.1 Mt of grain are forecast to being consumed on field, without going through the trading circuit. This “on field” consumption includes estimations of seed production, grain for animal consumption, animal feed and oilseed expeller industries’ consumption. The rest of domestic consumption, 18.8 Mt, are forecast to be of “industrial origin”. The industrial origin consumption refers to the production of processed grain which do not end up being exported. Within this group there is industrial origin domestic consumption from “oil industry”, 4.2 Mt (soybean meal and oil from large industries per extraction method, biodiesel, glycerin, lectin and other byproducts), and 14.7 Mt of crushing, animal feed and others, among which there is production of malt, wheat flour, dry and wet crushing as well as the production of ethanol from corn.