External winds push the export values of Argentinian coarse grains

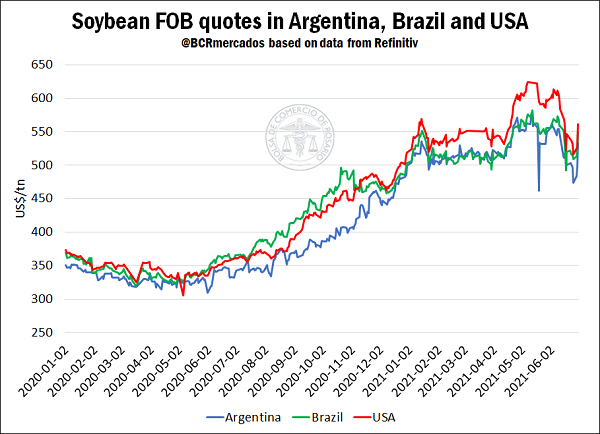

During last week, particularly, since the presentation of the Quarterly Report of the United States Department of Agriculture (USDA) on Wednesday, Argentina experienced an increase in FOB quotes of soybean and corn. Starting with soybean, quote recovery in our country was the largest between June 25 and 30 compared to Brazil and USA. During that time, the FOB value of the national oilseed increased by US$ 59/t, while Brazil had an upturn of US$ 40/t and the USA, of US$ 45/t. However, the US$ 532 reached by Argentina-produced ton remain below the values paid for the tons produced by the mentioned competitors. In that sense, the FOB value of each ton of soybean at the port of Paranaguá was of US$ 549/t, while in the gulf of México had a value of US$ 561/t.

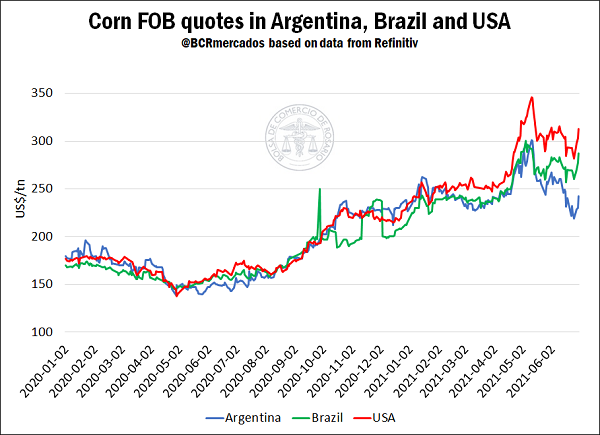

Regarding corn, FOB quotes of the three mentioned countries rose, on average, US$ 27/t between Friday 25 and Wednesday 30, with Argentina having the lowest upturn, with an increase of US$ 23/t, while Brazil increased US$ 27/t and USA reached US$ 31/t of upturn. At the same time, it must be stressed that Argentinian export corn quotes were at US$ 242/t, while the value in the neighbouring country reaches US$ 287/t, and the North American country lists its corn at US$ 312/t. This difference of approximately US$ 70/t can be based on the pressure of late corn harvest in our country.

As for the domestic market, during last week’s negotiations on the Rosario market, the oilseed as well as yellow corn showed upward trends, partially alongside the international increases of agribusiness commodities. In that sense, the ton of corn went from $17,650/t (US$ 185/t) on June 25 to $18,400/t (US$ 92.5/t) on July 1, implying a percentage increase of 4.2%. On its part, soybean went from $29,100/t (US$ 305/t) to $30,680/t (US$ 321/t) during the same period, which implies a 5.4% increase.

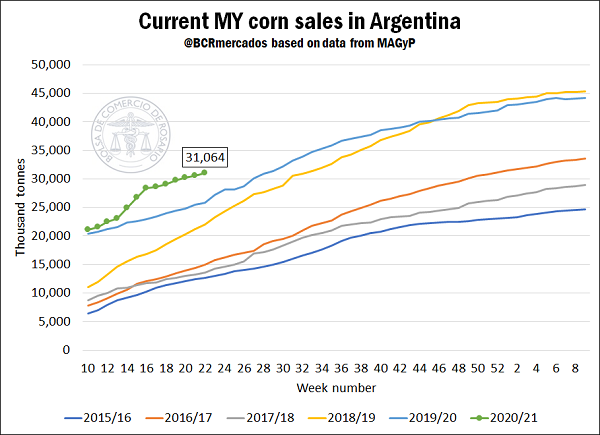

Commercially speaking, since the values along the crop season exceeded last years averages, and the produced volumes had been growing, local corn kept an accelerated pace of commercialization compared to previous years. At present, according to data from the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), there have been traded around 31 Mt. This record exceeds last crop’s record by this moment of the year, when business had been made for 25.8 Mt. Bearing in mind that the production forecast for this season (2020/21) is 50 Mt according to the Agribusiness Strategy Guide (GEA, for its Spanish acronym), which is below last crop season by 1.5 Mt, it can be assumed that there is an anticipated commercialization of corn regarding production. That is to say, a larger portion of what will be obtained during the crop season has been traded, compared to the dynamic presented in previous years. More specifically, in the present crop, there has already been traded 62% of the harvest and 54.6% of total supply (considering cereal in stock), while by the same moment of the year during crop season 2019/20 there had been traded 50% of the production and 44% of the country’s total supply.

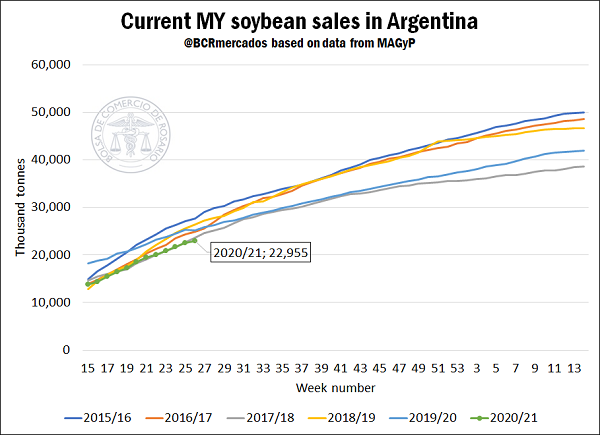

Regarding soybean, the trade dynamics is tightly related to what has happened during the last few years. In that sense, the trade volume of crop season 2020/21 is 23 Mt, implying 51% of the oilseed harvest has already been committed, since the productive results forecast by GEA are 45 Mt. As for previous crop seasons, cycle 2019/20 at the end of June also presented a trade volume that represented 51% of the harvest. In addition, in the last five years’ average, by this time of the year the same percentage of national production was already traded.