Evaluating the impact of agrobusiness on Argentinian economy

Executive Summary

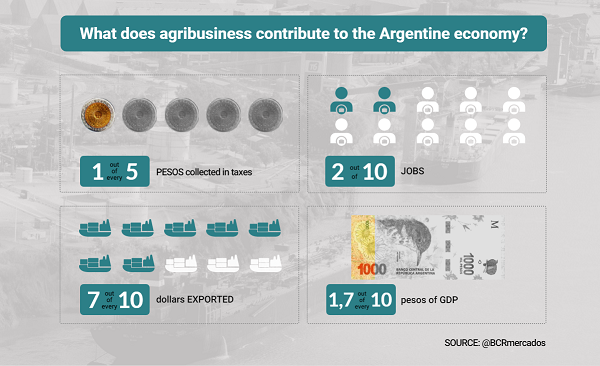

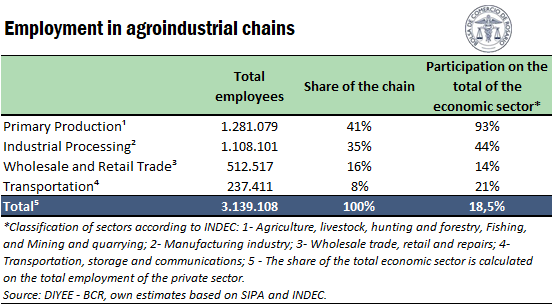

Agribusiness and agrifood chains contributed 1 out of every 5 pesos collected as tax by the National State in 2020. Also, 18.5% of private employment in Argentina is linked to agribusiness chains. Thus, almost 1 out of every 5 jobs are directly or indirectly created by the primary sector and their related industries.

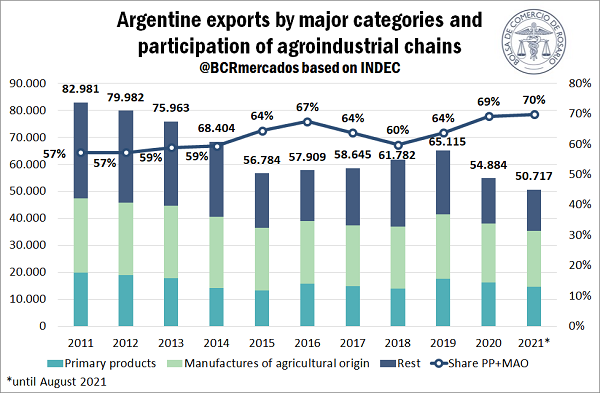

As it traditionally does, one of the most important contributions of the agribusiness chain to Argentinian economy is the genuine generation of dollars through exports. These contribute to supporting the external balance of the country and to stabilizing the value of the dollar. Agribusiness generated 70% of the country’s dollar income in 2020 on the concept of exports, besides showing one of the lowest imported contents in export sales.

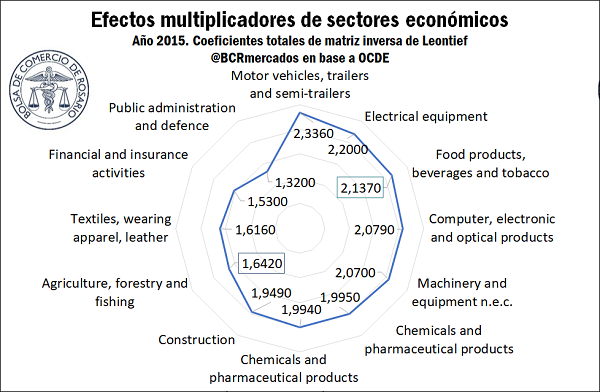

As for the contribution to recovering the economic activity after the dramatic 2020, agribusiness-related industries have important multiplying effects on the economy in their various links. It is estimated that for each $1 that the demand of final goods rises in the agricultural, forestry and fishery sector, the economic activity grows by $1.64; while for each $1 of increase in the demand of food and beverage products, the economic activity increases $2.14, according to the input-output matrix developed for Argentina by the OECD.

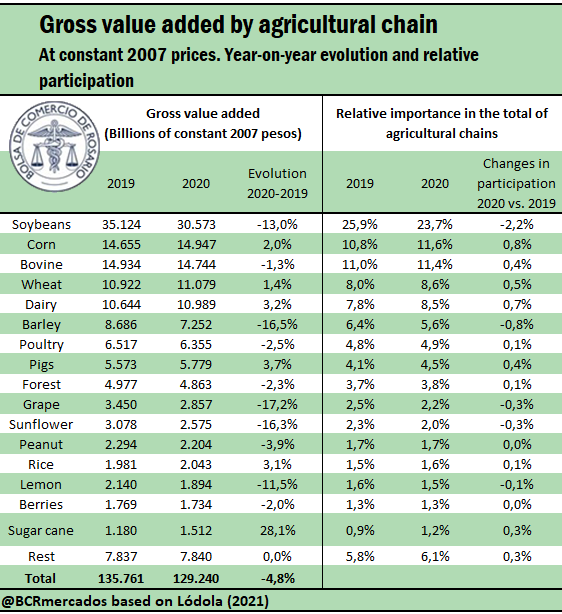

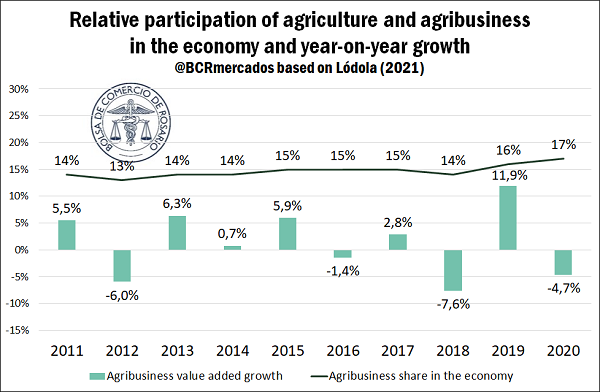

Finally, despite the 5% fall in the Gross Value Added of the agricultural chain in 2020, the agribusiness’ share in Argentina’s GDP grew to 17%, a maximum in over 20 years. Although chains like wheat, corn, pork production, among others, showed an increase in the value added, these do not get to compensate the fall of the soybean complex, given its majority share in the total of the sector. Despite this, production and trading of agribusiness products was always defined as an essential activity, and it was kept operative even during those moments when other activities of the country’s productive industries were affected by the measures taken to limit the advance of the pandemic.

Introduction

The primary sector and the agribusiness and agrifood chains in Argentina stand as a fundamental sector in the Argentinian economy. With a tradition that dates back to pre-Columbian times, this wide universe includes agricultural, livestock, forestry, fishing, fruit and vegetable activities, among other regional economies. In addition, agribusiness includes the commercialization and industrialization of its products to supply the needs of a growing world population. Agriculture stands as the means of life for a large part of the Argentinian population, being a creator of work with a federal vision.

The care of the soil, the search for new and better ways of producing and the adoption of technology characterize the activity of these hundreds of thousands of inhabitants who, throughout the country, allow the generation of the necessary goods to cover food and pharmaceutical needs, among others, of millions of people around the world. This article seeks to quantify what is the contribution that agribusiness makes to the Argentinian economy in taxes, employment, income of dollars, economic activity and added value, among others.

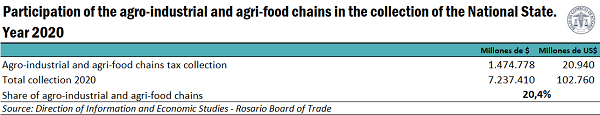

I. Farming and the agribusiness and agrifood chains contributed 1 out of every 5 pesos collected by the National State in 2020 for a total of US$ 20,940 million.

In 2020, farming and the agrifood and agribusiness chains in our country/1 generated a tax income for the National State of $ 1,474,788 million, according to our own estimates. This equals to US$ 20,940 million, taking the average official exchange rate for said year. Considering that the annual collection reported by the Federal Administration of Public Revenues totalled $ 7.2 trillion in 2020, farming and the agribusiness chains represented 20.4% of the total, that is, 1 out of every 5 pesos entered into the coffers of the National State.

In this way, the sector remains in its key role to sustain public finances, maintaining the same share of the total income estimated for year 2019 (Weekly Report N° 1973 – September 25, 2020). It should be clarified that this calculation does not include the taxes collected by the provincial or municipal jurisdictions, but only includes the collection of the National State.

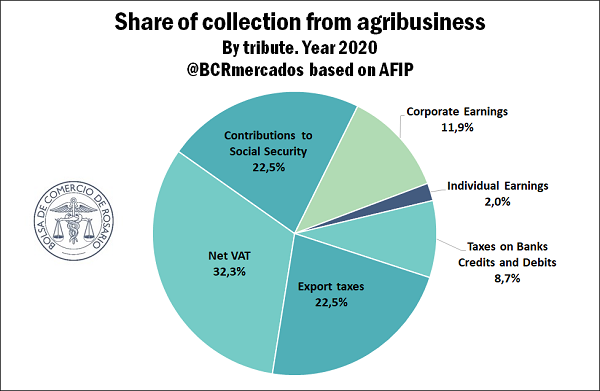

The tax with the highest incidence within the sector’s taxation is, as in 2019, VAT, which represents 32.3% of the total contributed by the sector. That is, $ 476,297 million. It is followed by Social Security Contributions and Payments, which account for $ 332,226 million, equivalent to 22.5% of total collection. The third place on the podium is closed by Export Duties, accounting for 22.5% of the total collected, about $ 331,506 million.

A notable aspect is the fall in Export Duties, both in absolute terms, as well as taken as a share of the total collected with respect to year 2019. At that time, Export Duties represented 31% of the total contributed by the sector ($ 358,070 million), considerably above the 22.5% estimated for 2020 ($ 331.506 million). This is due to the way the “withholdings” are settled. Regardless of when the different products are actually exported, the Export Duties are paid 5 days after the export sale is declared. In 2019 it happened that, given the political uncertainty caused by the electoral year, a high volume of Export Sworn Statements (DJVE, for its Spanish acronym) for new crop goods was registered in advance, which “inflated” the revenue per Export Duties for that year. But it also had another effect, that of reducing the volume of Export Sales for 2020 (given that a large part of the goods had already been sold in advance) and, consequently, reducing the collection of export duties.

Despite this fall in the collection per Export Duties or Export taxes, the share of the farming sector and the agribusiness and agrifood chains in the collection of the National State remains at the same level as in 2019. This is explained by the increase in the share of the Gross Value Added (GVA) of the sector over the national GVA that took place in 2020.

The emergence of the pandemic and the circulation restrictive measures imposed to stop it led to a sharp decline in economic activity. However, as they were considered essential, activities related to farming, food processing and trade did not experience a collapse of the magnitude that the rest of the activities did. According to data by the National Institute of Statistics and Census (INDEC, for its acronym in Spanish), the national GVA in current pesos grew by 15.7% between 2019 and 2020. However, the GVA of the sector (primary production, food production and trade, transportation, related services, and production of agricultural machinery) in current pesos grew by 37% in the same period. This better relative performance led to an increase in the weight of the sector’s GVA over the national GVA, which went from 19.5% in 2019 to 23.1% in 2020.

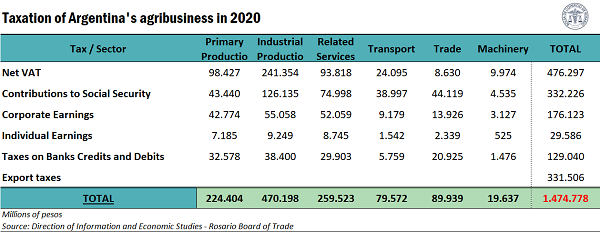

Finally, the following table shows the main results obtained in our estimates in a summary table, which allows us to distinguish the impact of each link, for each type of tax.

II. 18.5% of private employment in Argentina is linked to agribusiness chains. Thus, almost 1 out of every 5 jobs are directly or indirectly created by the primary sector and their related industries.

The total estimated employment generated by the agribusiness and agrifood chains in the 1st quarter of 2021 was 3,139,108 jobs, which means 18.5% of the private employment in the country. Of this total, 1,281,079 people (41%) are employed in the primary sector, 1,108,101 are employed in the secondary sector (35%), 512,517 (16%) in the wholesale and/or retail trade of food products and 237,411 (8%) people are employed in cargo transportation.

Furthermore, another interesting aspect to analyse is what proportion of employment they represent within each of the sectors of economic activity reported by the INDEC. In primary production, 93% of those employed correspond to the agribusiness and agrifood chains. In the manufacturing sector, 44% of employment is related to agribusiness complexes, while 14% of employment in the wholesale and retail trade is attributable to agribusiness chains. Last, 21% of employment in the transportation sector is directly or indirectly associated to agribusiness chains.

III. Genuine dollars: agribusiness generated 70% of the country’s dollar income in 2020, the highest share in over 30 years.

For decades, agriculture has been at the top of the Argentinian foreign accounts, reaping the fruits of sustained investments in technology and productive developments. In this framework, the various agricultural complexes have strong foreign competitiveness, which makes them highly resilient production chains to the diverse storms that emerge in the globalized world.

In recent years, the share of agribusiness complexes in exports has grown steadily, hand in hand with progressive growth in primary production and manufactures of agricultural origin, while exports of manufactures of industrial origin have fallen. In 2020, the joint participation of primary products and manufactures of agricultural origin (MAO) reached a maximum that had not been seen since 1988. In addition to the three main chains of Soybean, Corn and Wheat, the complexes Meat and bovine leather, Sunflower, Barley and Dairy products show an outstanding export performance in recent months.

The high international competitiveness and sustained foreign insertion allows Argentina to be the first world exporter of soybean meal and oil, the second global exporter of sorghum, the third exporter of corn, soybeans and sunflower oil, among other podiums in which our country stands out in the world.

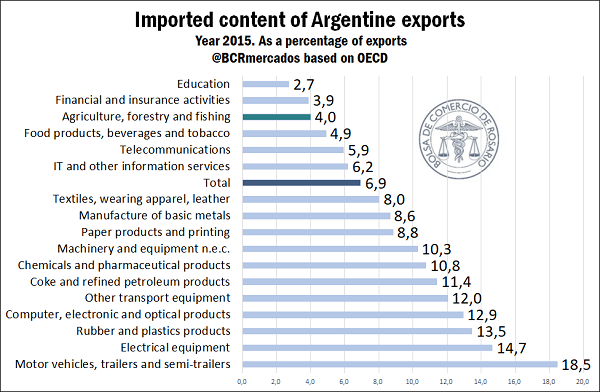

The agricultural sector, partially grouped in the Agriculture, Forestry and Fisheries account of the national accounts, is of fundamental importance as it contributes with foreign currency for the sustainability of Argentina’s foreign accounts. In this sense, in addition to its very important export share, the imported content of this sector’s exports is barely around 4%. This figure is remarkably lower than the general average of the economy, almost 7%. Furthermore, it is even further away from the import shares of some manufacturing branches with high linkages with the exterior. Many agricultural manufacturing complexes can also be found grouped under the Food, beverages and tobacco sector, which also has a percentage of imported content lower than 5%.

This high level of net exports from Argentinian agrifood chains gives oxygen to the balance of payments. The very small share of imports is only lower in some service sectors, such as financial services, education, hotels, and real estate.

IV. Agribusinesses and their multipliers on the economy

The agricultural sector also plays a fundamental role in stimulating economic activity. It is estimated that for each $1 that the demand of final goods rises in the agricultural, forestry and fishery sector, the economic activity grows by $1.64, according to the input-output matrix developed for Argentina by the OECD. This is due to the multiple linkages and multiplier effects that the sector generates in the rest of the economy. As a reference, this value is above the effects generated by the public administration and most of the service sectors.

The multiplier effects are even higher in the Food and Beverages sector. It is estimated that for every $ 1 increase in the demand for this type of goods, economic activity grows by $ 2.14, thus exhibiting greater dynamism to drive economic growth than sectors such as textiles, construction, pharmaceuticals and electronic products, among others.

V. Despite the 5% fall in the Gross Value Added of the agricultural chain in 2020, the agribusiness’ share in Argentina’s GDP grew to 17%, a maximum in over 20 years.

The dramatic year 2020, when the world had to face a pandemic of dimensions not seen in 100 years, was a severe blow to global economic activity. The oil crash took biofuels with it, and many investment projects were relegated to waiting for a more encouraging outlook.

The agribusiness sector was not alien to the global context, and the Gross Value Added (GVA) of the agricultural chain suffered a 5% setback, as shown in the attached graph. However, as it is an essential activity, this drop is significantly lower than that one suffered by other activities, resulting in an increase of the share of agriculture in the Argentinian Gross Domestic Product.

Regarding the agricultural GVA in 2020, the soybean chain (the most important of the agricultural chains) explains a large part of this decline. Lower planting intentions, water deficit, less production, and the complicated situation of the biodiesel industry in the midst of a pandemic contribute to explaining this result.

In any case, according to the eloquent work of Lódola and Picón (2021), the share of agribusiness chains in the national economy climbed to 17% of GDP in 2020, the highest level on record, which begins in 2002. Looking ahead, with good prospects for recovery, 2021 promises to be a year of economic growth and exports on the rise for the country’s agrifood chains.

/1 Methodological note: among the agrifood and agribusiness chains, there have been considered oilseed, cereal, meal and oil chains, besides the rest of by-products of their industrialization; cattle, pork, poultry, dairy, cotton, fishing, forestry, tobacco, fruit, and vegetable sectors, and agribusiness productions related to regional economies. Also, six links that form the Agribusiness Chains were analysed: the primary sector, the secondary sector (agricultural manufactures), the commercial sector, transport sector, the agricultural machinery sector, and activity-related services.

Taxes considered were the ones of the highest revenue incidence for the National Government: Value-Added Tax, Export Duties, Corporate and Personal Income Taxes, and Taxes on Bank Debits and Credits.