The entry of wheat trucks speeds up while the harvest progresses at a good pace

Wheat threshing advances steadily in the North of the country and is already on the verge of becoming general in the core area. The wheat harvested in these regions is the one that, due to its geographical proximity to the port terminals of Rosario export node, finds there its main exit route abroad.

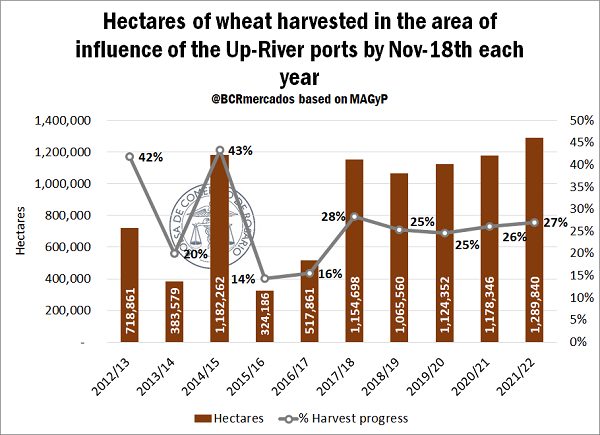

The progress of the harvesting efforts in the area of influence of the Up-River ports already reaches 27% of the total area to collect, according to information from the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), somewhat above what was registered by the same time last year and the average of the last five years. However, in addition, as the area allocated to this cereal grew by 6% compared to the 2020/21 crop and reached a maximum in 20 years, the total hectares harvested to date amounts to 1,289,840, a record for this time of year.

In addition to this fast progress of cereal threshing, the prospects for yields are, in general, more promising than what happened a year ago. Although some areas of the Northern region of the country suffered a certain lack of rain in recent months, in general the weather favoured wheat production, providing a good amount of water at critical times for the crop and giving an important boost to yields and production.

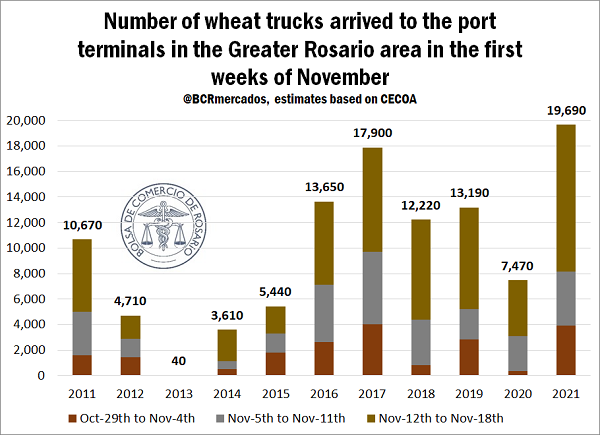

This way, the good progress of the harvest and the higher production are reflected in the entry of wheat trucks to the port terminals of the region. In the last three weeks (that is to say, from the end of October to date) approximately 19,690 units have entered the Up-River ports, more than doubling the number of trucks entered during the same period last year (7,468) and a record for the same period in previous years (the record was held by the 2017/18 crop, with 17,904 trucks). Also, out of that total, approximately 11,520 did so in the last seven days, which accounts for an acceleration in the arrival of wheat to the region's terminals.

In any case, it should be mentioned that, unlike what happens with other crops such as soybean, where the bulk of the production is destined to the agribusiness pole of Rosario for processing and exporting, a large part of the wheat is consumed domestically in each region, with local mills being the main source of demand of the grain.

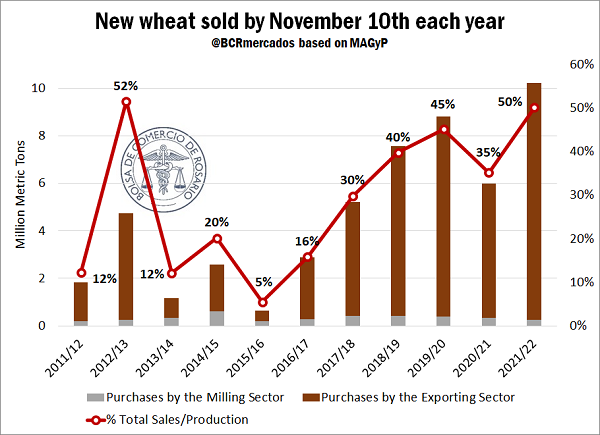

Another aspect to remark about new crop wheat is the level of domestic trade of the cereal. To date, 10.2 Mt of grain have already been sold, the highest volume in history for this time of the year. If we differentiate the purchases of the export sector and the milling sector, however, a very uneven picture can be observed. The first one has already acquired 9.98 Mt, an all-time record, while the second has only bought 245,000 t, the lowest volume for this time of the year since the 2015/16 crop.

It could be assumed that one of the reasons for this high volume of grain already sold when there are still a few days to go before the official start of the harvest is the aforementioned higher production expected for the current year (in fact, it is forecast that, for the first time in history, Argentina will produce more than 20 Mt). Nevertheless, taking the grain already traded as a share of the total produced in the crop, it is evident that wheat already sold reaches 50% of the total, widely exceeding the 35% of the previous crop by this time of year and the average of the last five crops (33%). As a matter of fact, it is the second highest share in history, only surpassed by what happened in the 2012/13 crop (52%).

In this way, in order to find the main cause for this high volume of grain traded to date, we must turn our attention to the behaviour of prices in recent times. As commented in the previous edition of the Weekly Report, wheat prices are at their highest for crop transition since 2013, while prices in Chicago reached a record since 2012 during last week. This has been attractive to farmers, who have chosen to sell a considerable volume trying to seize the good local prices.

During the last few days, in the meantime, local prices showed a slight decline. The price of the Cereal Arbitration Chamber of Rosario (CAC, for its Spanish acronym) on Thursday was US$ 235/t, falling almost 10 dollars compared to the values a week ago. In addition, in the Physical Grain Market of the Rosario, the open purchase bids for the cereal also exhibited a similar behaviour. For delivery in the first month of the crop, the prices offered on Thursday receded by 8 dollars compared to the values of a week ago, reaching US$ 238/t, while those for delivery in January also yielded US$ 8/t to US$ 240/t. The values offered for delivery in February and March fell 5 dollars per ton to US$ 247 and US$ 250 per ton, respectively. Last, the open purchase bid for delivery in mid-year (June/July) fell by 9 dollars per ton to US$ 248/t.

Finally, another aspect that stands out in the local market is that the number of active buyers remained similar to that of the previous week, with the focus mainly on the months of February and March.