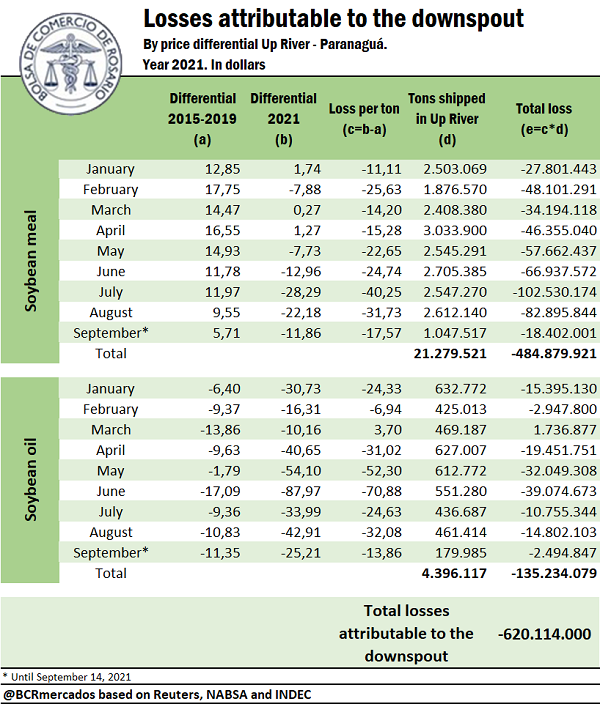

Due to the low water level of the river, Argentina has already lost US$ 620 million in exports of soybean meal and oil in 2021

The low water level of the Paraná river has been affecting Argentinian exports with particular strength. The lower depth in the stretch Timbúes-Ocean limits the loading capacity of the vessels that sail the waters of the Paraná river, apart from forcing to redirect the load to other ports.

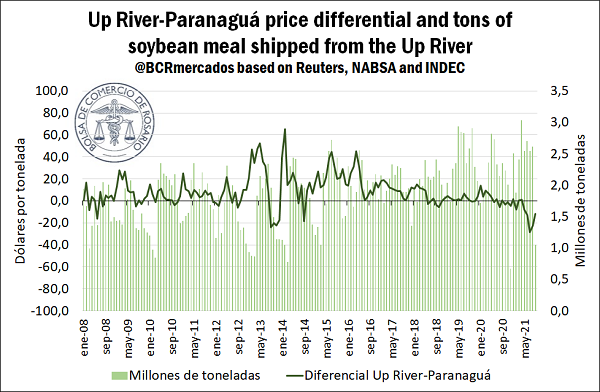

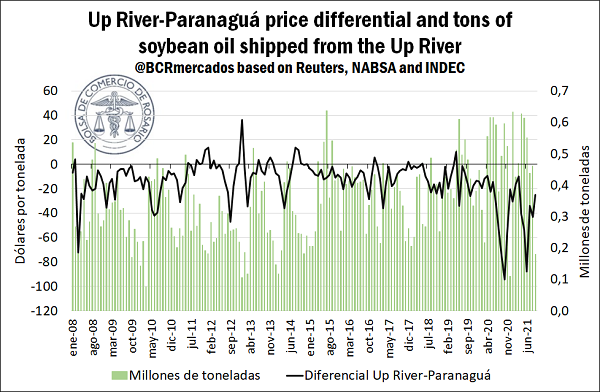

In this sense, the higher logistic costs of shipping products from the ports on the banks of the river impact the export prices with Rosario origin, increasing the differential with Brazilian goods. In this sense, the gap between FOB Paranaguá and FOB Up River/Rosario for soybean meal is currently at its worst FOB price differential since 2013. In order to find an even worse differential for soybean meal, we should go back to the period 2003-2005. The situation is even more disadvantaged for Argentinian soybean oil, since such a large price differential has not been seen since year 2008.

With more than 25 million tons of by soybean complex by-products already shipped this year to date, we forecast a loss above US$ 620 million for these shipments from the Up River Paraná Ports. At the end of this article can be found the methodology of estimation

Given these conditions, the exports of soybean meal and oil are currently being shipped with prices that limit the entry of dollars to Argentina. This is due to the lower competitiveness of Argentinian goods and the severe difficulties of port logistics, regarding the scarce water volume of the Paraná-Paraguay waterway in the banks of Rosario.

In the present study, losses are accounted for from the beginning of year 2021 until the present. However, the low water level of the river has been observed since September 2019, in view of the drop of the water level below the 2.47-meter minimum needed on the banks of Rosario in order for the finalized bidding contract to force Hidrovía S.A. to guarantee the 34-feet draft. Only February 2021 was found with a draft average above this reference minimum in the last two years. At present, with the depth of the Paraná river in negative levels in the hydrometer at Rosario port, and the prospect of an ongoing decreasing trend, no scenario forecasts a recovery of the water level until at least December this year, according to the National Water Institute (INA, for its Spanish acronym).

As for soybean meal, the losses are of special concern since it is a differential that has generally been on positive ground through the years, that is to say, Up River Paraná ports FOB prices above the ones from Paranaguá. The negative differential has a higher impact with the rise in exports of this fundamental soybean by-product. After the 17.8 Mt minimum during period January-August 2020, the exports have recovered and they already exceed 20.2 Mt in the same period.

Regarding soybean oil, the losses due to the low water level have been even more critical. Although the price differential between the Up River Paraná Ports and Paranaguá have generally been in favour of the Brazilian port, the price divergence has accentuated strongly during the last few months. Notwithstanding this, the progressive global economic recovery has driven the demand of soybean oil with special emphasis, which took shippings from 3.7 to 4.2 Mt, considering the first eight months of the year.

More differences for concern

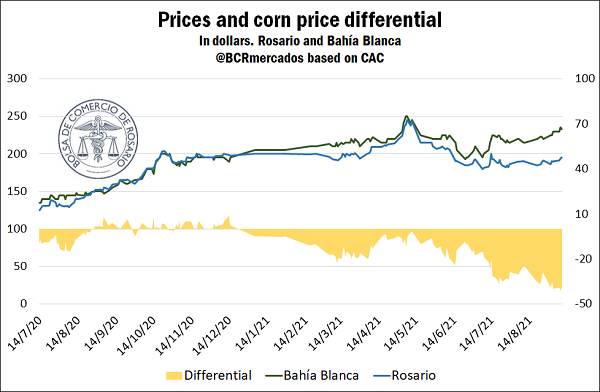

The low water level has not only vigorously affected the export prices, but has also been felt on the domestic prices of grains. The case of corn is eloquent: in the midst of the coarse harvest, the low level of the Paraná river has limited the possibility of loading the yellow bean at the Up River Paraná Ports.

Consequently, the load of corn at Bahía Blanca has broken historical records. This has caused a rise in prices in the South of Buenos Aires, while there has been observed a relative stability of the prices in Rosario. In September, an average price of US$ 230/t of corn has been paid in Bahía Blanca, while in Rosario the price fluctuates around US$ 192/t, which sets a differential of about US$ 38/t. The outlook was completely different in September last year, when the corn shipped from Bahía Blanca averaged US$ 156/t and from Rosario, US$ 158/t, a difference of $2/t in favour of the Up River ports.

Methodological Annex

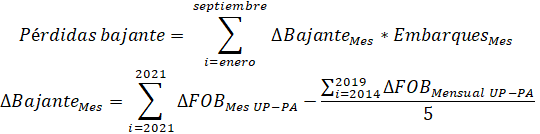

Both for soybean meal and oil, we took FOB prices at the Up River Paraná Ports and the port of Paranaguá, Brazil, extracted from Reuters. We calculated their daily differentials and estimated monthly averages for both products.

We considered the monthly average differentials corresponding to year 2021 and subtracted the average differential corresponding to each month of the period 2014-1019. The year 2020 was not considered, in view of the low level of the Paraná river during that year. Out of the subtraction of differentials comes the loss attributable to the low water level. This monthly loss is multiplied by the shippings made along the 8 months and a half of 2021. From the addition of those losses, we obtain the total loss attributable to the low water level of the river for soybean meal and oil.

A rise in the FOB differentials between the Up River Paraná Ports and Paranaguá may be frequently due to various circumstantial factors, such as logistic or transport inconveniences, or union conflicts that hamper the operations at some ports. In the period considered for this study, none of those factors was observed. Therefore, the losses are presumed to be caused in their totality to the low water level of the Paraná River.