Drought in South America and tighter soybean balance in 2021/22

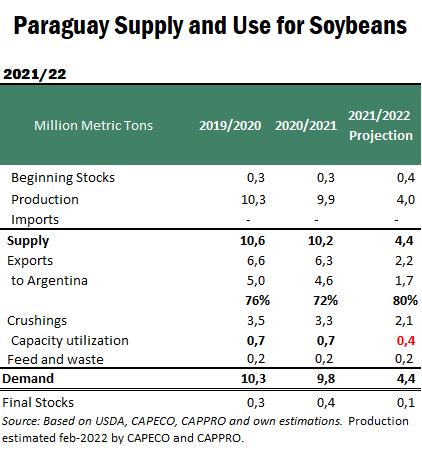

The lower production of Paraguay and the South of Brazil could complicate the temporary importation of soybean to Argentina in 2022. According to February data from the Paraguayan Chamber of Oilseed and Cereal Processors (CAPPRO, for its Spanish acronym) and the Paraguayan Chamber of Cereal and Oilseed Exporters and Traders (CAPECO, for its Spanish acronym), Paraguay's soybean production was estimated at 4 million tons (Mt), equivalent to a 60% drop in production 20/21.

In general terms, Paraguay does not import soybean for processing since it does not have a temporary import regime like Argentina. CAPPRO has requested that a flexible tax and customs regime be implemented only for government-supervised soybean imports, similar to the temporary admission regime implemented in Argentina. The problem with this strategy is that Argentina and southern Brazil have been under the same drought conditions, so it will be challenging to get the raw material in the region. In the immediate term, Paraguay exported 400 thousand tons in January and February 2022; 35% of the average for the years (2017 to 2020, 2021 is not considered since there was a delay in that year's soybean harvest). On the soybean processing side in Paraguay, in January and February, the neighbouring country processed a total of 409 thousand tons of soybean. This value is slightly below the estimated average of 460 thousand tons processed between the years 2017 to 2020 (2021 is not considered since there was a delay in that year's soybean harvest. From this, we can conclude that part of the soybean production would end up being processed in Paraguay while the other part would be exported. According to CAPPRO, the industry's capacity utilization is forecast to fall in the rest of the months due to the lower availability of soybean stocks as we move away from the harvest season.

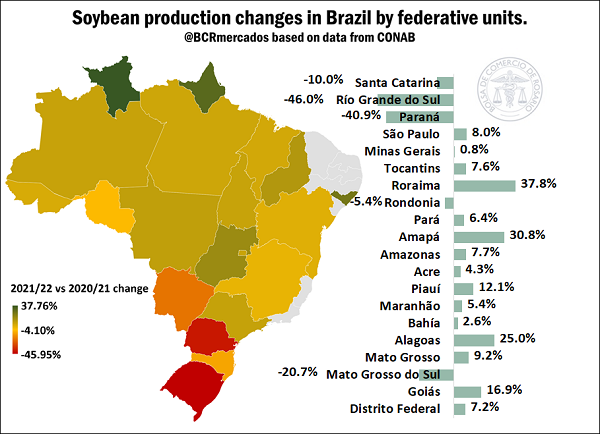

On the other hand, according to available data, imports of Paraguayan soybean from Brazil have risen in recent years to the point where the primary buyers of Paraguayan soybean are Brazil and Argentina. For this reason, Paraguay's crushing is expected to approach 2 Mt, and soybean exports amount to 2.17 Mt, of which 1.75 Mt would go to Argentina. According to Brazilian food supply and statistics agency CONAB data, a soybean harvest of 122.8 Mt is forecast, 11% below the 20/21 crop season from the Brazilian side, a soybean harvest of 122.8 Mt is forecast, 11% below the 20/21 crop season from the Brazilian side. The drop in production in Brazil is mainly due to the decrease in yields in the southern states of Paraná and Rio Grande do Sul. Together, both states had a 41% year-on-year drop in soybean production, equivalent to a decline of 17.7 Mt. A little further north, the state of Mato Grosso do Sul had a production loss of 20.7%. For these reasons, it is not expected that Paraguay will be able to import soybean from the neighbouring country. In turn, a strong impact is anticipated on temporary imports of soybean from Argentina that come from Paraguay and Brazil on barges through the Paraná.

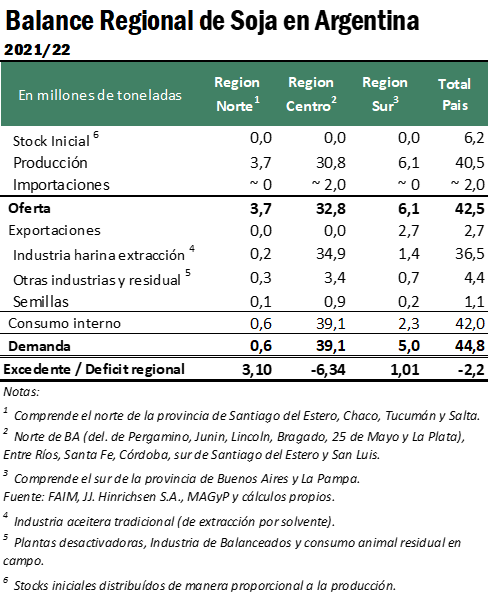

In this way, considering a production of 4 Mt for Paraguay and a production for Brazil of 122.7 Mt, we expect soybean imports from Argentina for a total of 2 Mt. Based on a soybean production in Argentina of 40.5 Mt, estimated by the Agribusiness Strategy Guide (GEA, for its Spanish acronym) and Rosario Board of Trade (BCR, for its Spanish Acronym) for March 2022, we estimate crushing of 36.5 Mt, soybean exports of 2.7 Mt, and use for animal feed of 5.5 Mt. Soybean stocks in Argentina would fall from 6.2 to 3.9 Mt. On the regional level, we expect soybean shipments from the ports of Greater Rosario to be very low, and a large part of unprocessed bean exports to leave from the ports south of Buenos Aires. Soybean consumption for animal feed is expected to fall to 4.4 Mt and to 1.1 Mt as seed for the next crop season. In this way, it is expected that the country's northern region will have a surplus supply that goes down by trucks and train (equivalent to 103 thousand trucks) to the ports of Rosario for subsequent crushing. The central region will have a deficit of 6.3 million tons that will be covered with the natural surplus of the northern region and a surplus of the southern region. The final stocks of the central region would fall by 2.2 million tons. The southern region, which has a lower annual soybean crushing, would have exports of 2.7 Mt (the country's total) and a crushing of 1.4 Mt. With this, it would have a soybean surplus of 1 Mt that would be transported by truck and train (equivalent to 33,000 trucks) to the Rosario hub to be incorporated into the crushing of the oil plants.

Impact of oil prices on soybean

From the result of soybean crushing and subsequent solvent extraction, soybean yields an average of 19.5% oil, 71.2% soybean meal, and 6.5% soybean hull pellets. If we multiply these by-products by their market price, we can affirm that the value of soybean is made up of 45% of the value of oil, 52% of the value of meal, and 11.15% of the value of soy pellets. For this reason, it can be said that when the price of the rest of the oils increases or decreases, this will directly impact the price of soybean.

The oil market is under intense pressure due to the war between Russia and Ukraine. The production problem falls mainly on Ukraine, the leading producer and exporter of sunflower oil in the world, where a large part of the area where this oilseed is grown has fallen into war-related problems. In the current 21/22 crop season, Ukraine produced 17.5 million tons of sunflower.

This armed conflict could generate a severe impediment in planting the 22/23 sunflower. Ukrainian farmers could have logistical problems or limited access to the necessary inputs for planting, such as fuel, pesticides, and fertilizers. According to the consulting firm Ukragroconsult, the sunflower area could fall by 48% this year and the corn area by 29%. According to the APK consulting firm, the area would fall by 35% compared to 2021, reaching the lowest value in 13 years, between 4.2 and 4.4 million hectares. The production forecast is 10 million tons. The area planted with rapeseed would also have problems since 50% of it is located in Oblasts (provinces) that have suffered military activity, so a large part of this production could be lost.

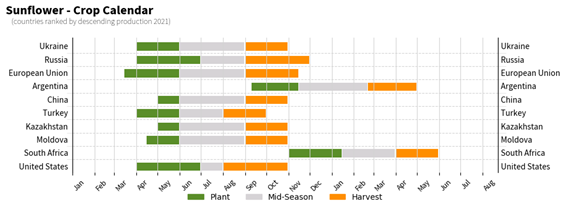

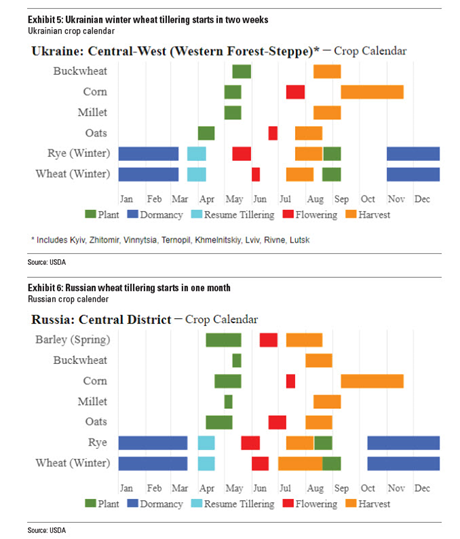

As you can see in the following graph, in Ukraine, sunflowers are sown between April and May, and the harvest usually begins in September. Tensions and military action in agricultural areas pose risks to supply and demand for the next crop cycle. With trade routes blocked, import and export facilities closed, and farmers planting late, sunflowers' average yield per hectare will take a heavy blow this harvest season. Ukraine's oil production capacity far exceeds the production of sunflower seeds in the region. According to USDA data, the total production capacity of Ukraine's oilseed presses in 2020 was about 23 million tons, of which 15 million tons were sunflower seeds. Currently, with the suspension of trade and the absence of sunflower seeds, most of the sunflower oil production plants are entirely closed. Along with the closure of the main shipping ports, the leading importers of sunflower oil are now concerned about acquiring their supplies.

The ongoing Ukrainian crisis threatens the supply chain of grains and edible oils in countries heavily dependent on grain and other food exports from Ukraine and Russia. After a few days of conflict, the commodity market faltered, and the price of FOB Black Sea Ukraine sunflower oil soared by $470.50 from $1,480 per metric ton, finally settling at around $1,950.50 per metric ton. This is the highest level reached by FOB Black Sea sunflower oil since 2018. This situation could support the price of oilseed globally since the Russian-Ukrainian conflict could have consequences beyond the limitation to export through the Black Sea ports in recent weeks.

Annex: crop sowing schedule in Russia and Ukraine: