Corn is, without a doubt, one of the crops with the greatest history in our land. The cereal was domesticated by native peoples of present-day Mexico around 10,000 years ago. At first, it was intended for medicinal uses, and over time, the different American civilizations began to prepare food and drinks with it. During the Hispanic colonial period, in the Virreinato del Río de la Plata, corn became more important as a complementary food to meat. While in Argentina, corn began to be cultivated for commercial purposes as early as the late nineteenth century.

In more recent times, corn – along with wheat – became the largest crop in Argentina. However, in the 1987/88 trade year, the soybean harvest exceeded the yields obtained individually by both corn and wheat for the first time. Moreover, in the 2001/02 crop season, the oilseed harvested exceeded the combined corn and wheat harvests for the first time, overshadowing the dominance of cereals.

For 32 seasons, ranging from 1987/88 to 2018/19, corn remained in second place in volume, always behind soybean. But currently, for the third consecutive crop, corn regained the productive throne in Argentina, consolidating itself as the largest harvest made by the country.

In turn, the corn chain plays a decisive role in the Argentine economy. Its importance is reflected in a series of economic indicators such as value addition, tax contribution, investment, employment, and foreign exchange generation, some of which are analysed in this article.

Production and Planted Area

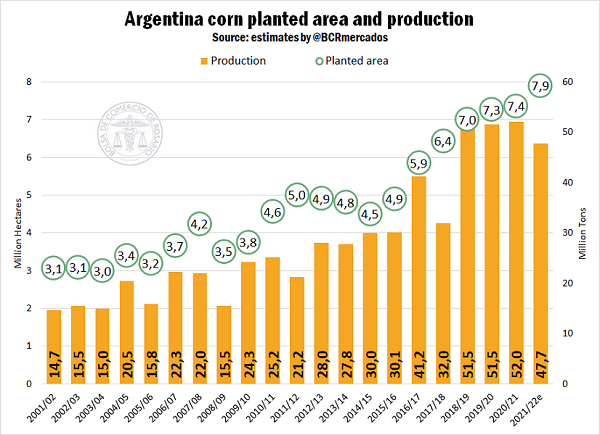

Last spring, Argentinian farmers covered 7.9 M ha with corn, the cereal's largest cultivated area on record. Unfortunately, in 2021/22, a new drought curtailed the potential of this great productive bet, limiting the yields of early corn initially. Despite adverse weather conditions, a 2021/22 harvest of 47.7 Mt is forecast, which, if materialized, would be the fourth-best in history. This estimate entails an 8% fall compared to the 2020/21 result, equivalent to 4.3 Mt less.

As can be seen in the graph, in the last 20 years, corn has more than doubled its area in Argentina. In 2021/22, of 7.9 M has been covered with corn, Córdoba sowed 34%, Buenos Aires 26%, Santa Fe 13%, Entre Ríos 6% and La Pampa 4%.

Foreign Trade

The international market, which buys corn for food production, is the primary source of demand for Argentinian cereal. While the local food and energy industries consume 30% of what is harvested in the country, the remaining 70% is traded as grain in foreign markets. The clear export profile of the chain has its raison d'être in an extraordinary local productive capacity that is combined with a relatively lower domestic demand from the meat and biofuel industries.

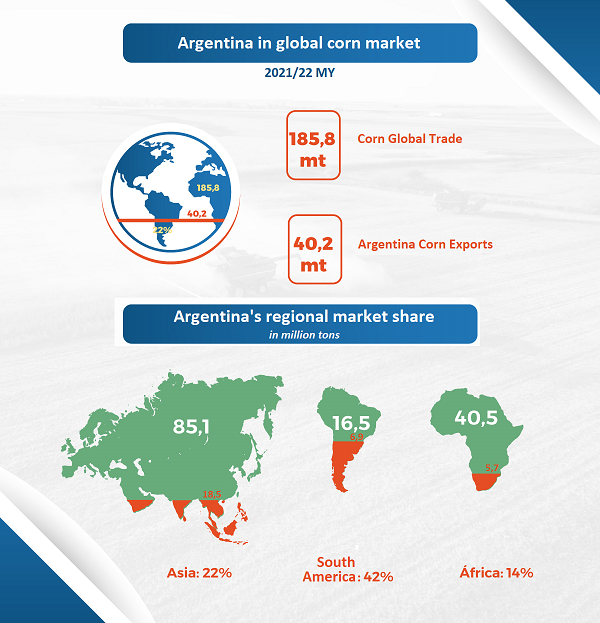

In the 2020/21 crop season, Argentina surpassed in exports to Brazil and was consecrated as the second bidder worldwide, behind the United States. With exports of more than 40 Mt, Argentina supplied 22% of the world corn trade (185.8 Mt). In the 2021/22 trade year, significant growth in global corn trade is expected to amount to 203.7 Mt, while local exports are forecast at 33.5 Mt, below what was exported in the previous season. Consequently, Argentina will lose market share this crop season, with a supply of only 16% of international external demand. It is also expected that the country will once again position itself as the third global supplier of corn, surpassed by the United States and Brazil.

The main markets for Argentinian corn will continue to be Asia, South America, and Africa. In 2020/21, Argentina supplied 22% of Asian external demand with 18.5 Mt, 42% of South American demand with 6.9 Mt, and 14% of African demand with 5.7 Mt.

Exported Value

Since 2015, when export quotas for cereal were eliminated, and despite the permanent disincentive of Export Duties that levy external sales, cereal exports have not stopped growing. In 2021, the value of the corn chain's exports amounted to US$ 9,257 million, representing 12% of Argentinian exports, according to data published by the National Institute of Statistics and Census (INDEC, for its acronym in Spanish). In a decade, the chain doubled its share of the total value exported by Argentina, going from 6% in 2012 to 12% during the last year.

Own export forecasts suggest Argentinian shipments worth around US$ 85 billion by 2022. Meanwhile, the value exported by the corn chain in the calendar year 2022 is forecast at US$ 9,445 million. It is worth clarifying that both figures are early estimates that are made, in addition, in a context of vast uncertainty in the world markets strongly affected by the Russian-Ukrainian war conflict. Given this uncertainty that impacts trade flows and FOB prices, the value exported by the corn complex is forecast to represent 13% of the value exported by Argentina in 2022.