Black Thursday in Chicago: soybean falls US$ 45/t in a day

This week, the US Federal Reserve (Fed) finalized its monthly meeting, where it defines, among other variables, the benchmark interest rates. Highlighting the good pace of US economic recovery and acknowledging the rise of North American inflation, which in May peaked to 5% year-on-year on wholesale level, the maximum monetary authority expressed in a release that interest rates are expected to be kept at a low level until 2023.

The newsbreak of a contraction in the monetary policy before expected caused the immediate appreciation of the US dollar in the world, and the major investment funds reacted terminating its positions in commodities in search for higher financial revenues and protection against inflation. This way, yesterday there were important losses for all agricultural commodities in the world reference markets, but also in metals. Although oil dropped, it was much more moderate.

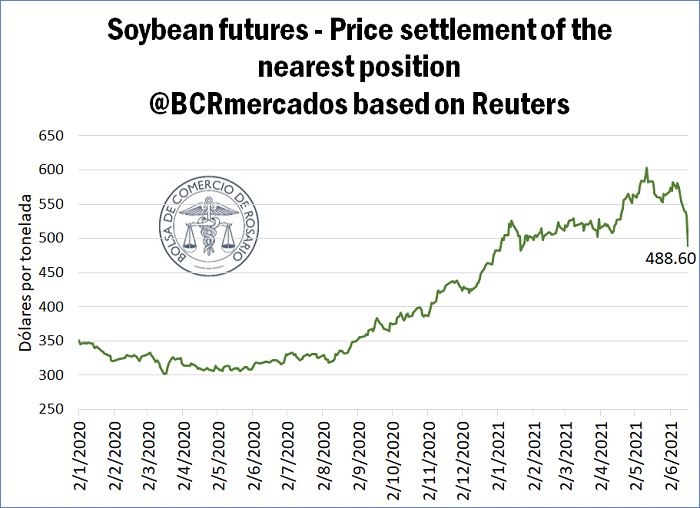

Soybean nearest position lost 19% of its value since the relative maximum of US$ 603/t reached on May 12, but the drop of June 17 only was 9%, to close on US$ 488.6/t. With these shifts, both the price of soybean and its byproducts, as well as corn, went back to the values registered at the end of 2020, losing in a month all the profits of 2021. In the case of yellow bean, the loss adds up to 4% during the week, but it rises to 13% if we compare current prices with May maximums of almost US$ 290/t this year.

At the same time, FOB export prices for Argentinian soybean and corn complex also showed an important shrinkage during June so far, with soybean oil ranking high by losing 21% of its official FOB value, reaching on Thursday US$ 1.060/t. Simultaneously, soybean meal dropped 6% during the same period reaching US$ 395/t, and soybean fell 12% to US$ 485/t, losing only on Thursday US$ 36/t. Given the soybean complex represents almost 30% of all the exports of goods and services annually made by Argentina, the stunning fall of international quotes undermines the external result. The official FOB value of corn, which leaded the second biggest export complex during 2020, dropped by 10% during June to date, reaching US$ 231/t, thus giving up all the ground gained during 2021.

In the light of these movements, although there were soybean exports during the first days of the week, corn exports were virtually paralyzed. Despite this, if we take into account aggregated Export Sworn Statements (DJVE) during the 2020/21 crop season so far, corn still shows a remarkable growth with operations already closed for over 29 Mt, 15% above figures registered by the same time last year. The aggregated Soy Complex (soybean plus meal and oil), on its part, shows a 14% drop in its exported amounts, totaling 17 Mt. Nonetheless, within the complex, soybean meal and pellets show a rise of 7%, in contrast with soybean and oil drops of 54% and 15% year-on-year, respectively.

The blow to the international value of soybean oil and corn, specifically, is related to the uncertainty surrounding Biden 's Administration policy relative to biofuels, considering these products as crucial inputs to produce biodiesel and bioethanol, respectively. In this sense, there is speculation that the US Environmental Protection Agency (EPA) could limit the mandatory biofuel mixture required from oil companies after environmental and biofuel promotion goals of the new government found a strong resistance by oil sectors, generating doubts regarding real possibilities of advancing at a faster pace in that sense. Although there are still no official documents in that regard, declarations have already been made by Producers Associations as well as by public officials, generating a wide range of rumors that boosts the market's volatility.