Barley Outlook 2021/22: barley booming in Argentina due to China's demand

Key Data

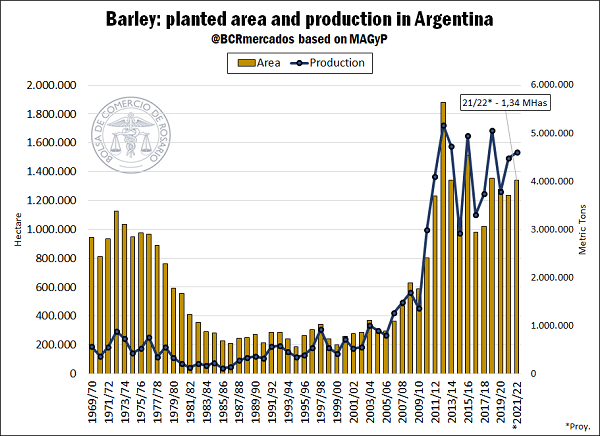

- During crop season 2021/22 there will be planted 1.34 million hectares of barley, according to data by the Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), a rise of 8% compared to last crop.

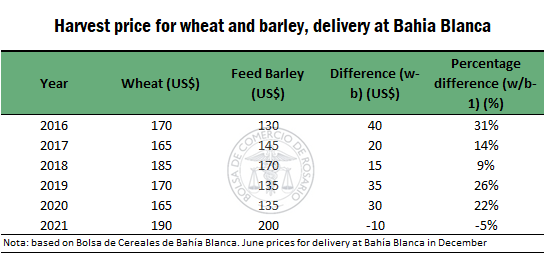

- On the main wholesale markets, forage barley is being paid at harvest on a par or with premium over export wheat, which is quite peculiar.

- A great export leap is expected: exports are forecast to grow by 20% during the crop, reaching 3.5 million tons.

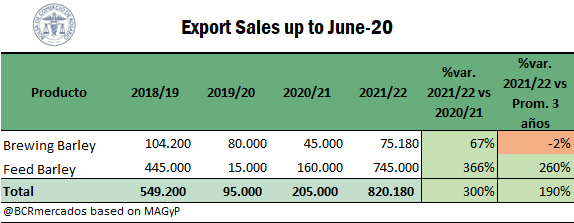

- Forage barley Export Sworn Statement (DJVE, for its Spanish acronym) for 2021/22 are the highest in history for this date. There have been declared 745,000 t, 370% above last crop.

- Export price spread of malting barley over forage barley in 2021 is the lowest in the last 30 years.

- China is forecast to import on 2021/22 10 Mt of barley, which is an absolut record. The commercial dispute with its main supplier, Australia, implies a historical opportunity for our country to supply that market.

A new fine grain crop has started to be planted in our country, with agronomic and commercial conditions that augur good results. On the one hand, the good soil moisture profile of the vast majority of regions where winter cereals prevail allows moving forward with planting at a good pace and, on the other hand, good harvest prices make it possible to close results in advance.

With this outlook, barley is forecast to gain protagonism during this crop. Very good external commercial opportunities for Argentinian barley underpin purchase conditions on the domestic market, which inclined a larger number of producers to plant this crop, in spite of the good prices that are also presented for selling wheat at harvest.

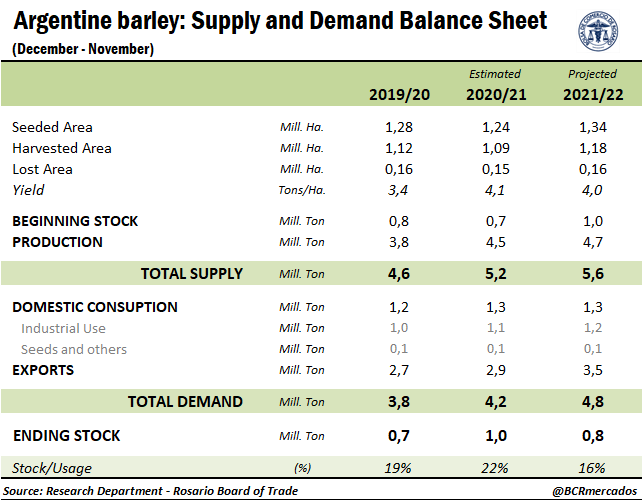

The first planting estimations mention that 1.34 million hectares of barley could be planted, which would represent an increase of 8% in reference to last crop, considering forecasts by the Ministry of Agriculture, Livestock and Fisheries. Taking into account trend yields, we could assume a crop of around 4.7 million tons, both of forage barley and malting quality barley. Other sources indicate an even higher figure, such as the United States Department of Agriculture, which forecasts a national production of 4.8 million tons for the new crop season.

The local market is showing a clear incentive to increase the area planted with barley, paying premiums above the price of wheat on the main wholesale markets, which is not standard. Taking into account forecast prices of the Bahía Blanca Grain Exchange of June 15, the price of forage Barley to be delivered at that destination during December was being traded at US$ 200/t, US$ 10/t above bin-run wheat. If we refer to the same date of 2020, the price of barley at harvest was being traded with a discount of US$ 30/t under the price of wheat, at US$ 135/t.

Regarding the supply and demand balance sheet for our country for the new crop season, a bigger production and a bigger opening stock are forecast. Yet, the important increase of exports expected (+20%) plus a higher demand for the brewing industry will cause a fall of closing stocks for crop season 2021/22 and a lower ratio stock-consumption compared to the previous crop. Exports are forecast to reach 3.5 million tons and, in case they are reached, it would be the largest volume exported since crop 2012/13.

To date, Argentina has committed the highest volume of forage barley by this time of the year in history. At present, the export sector has declared exports for 745,000 tons of forage barley to be delivered from December on, 370% above the amounts committed by the same time last year (160,000 t).

At the same time, 70,180 tons of malting barley have been traded externally. Although, on historical terms, the demand of cereal of this quality is not negligible, numbers are not comparable to the intensity of forage cereal demand, which is even lower than the average of the last three crops. In total, Argentina concentrates export commitments for the crop currently being planted for 815,180 tons of cereal, 50% above 2018/19, which holds the previous record of early exports.

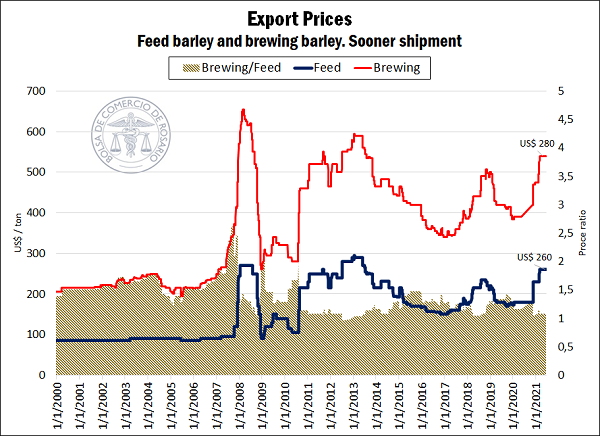

This higher relative intensity regarding the demand of the cereal for forage, compared to malting barley, can also be appreciated by analyzing the export prices from national ports. Although, logically enough, higher quality barley operates with a premium over forage barley, this relation has decreased considerably lately.

Taking into account official FOB prices for nearby shippings (spot position) for barley of both qualities, we can see that the price premium (FOB malting barley/FOB forage barley) has showed a downward trend lately, reaching to date 1,08 (that is to say, malting barley sells only 8% above forage barley). If we take annual averages of this ratio, we can see that in 2021 this relation is the lowest since at least 1993, which makes evident the relative higher prices of forage barley due to the international context.