Argentinian Agribusiness Chains contributed $1 of every $4 collected in taxes by the National State in 2021

Rosario Board of Trade, in order to show the relevance of farming and agribusiness in the national economy, beginning with January 2022 edition of the BCR Economic Situation Report, will present an estimate of the monthly tax contribution made by the Agribusiness Chains of our country, and how in this way they help sustain public finances.

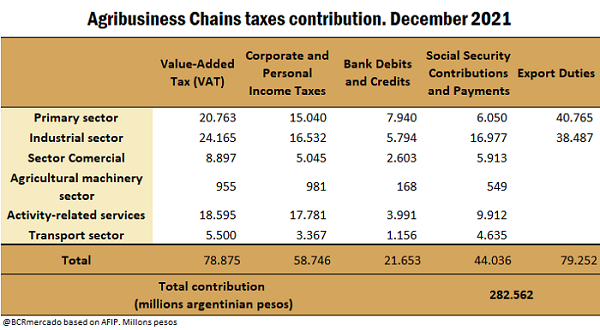

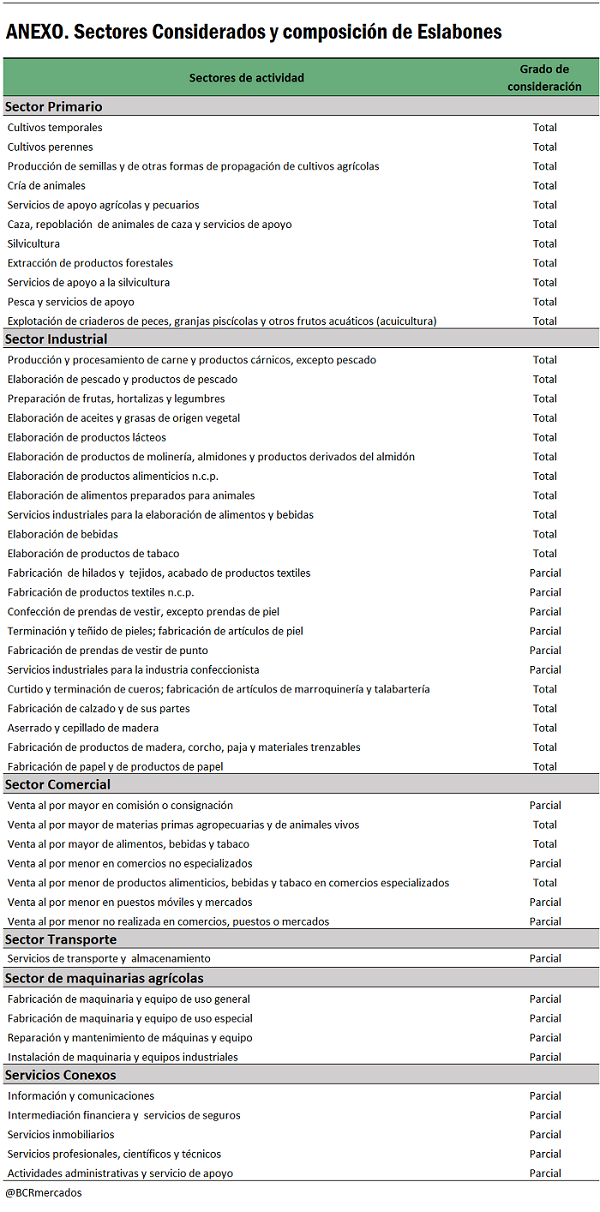

In order to create this index, six links that form the Agribusiness Chains are analysed: the primary sector, the industrial sector (agricultural manufactures), the trading sector, the transport sector, the agricultural machinery sector, and activity-related services. Also, the taxes considered were the ones with the highest incidence on revenue: Value-Added Tax (VAT), Export Duties (DEX, for its Spanish acronym), Corporate and Personal Income Taxes, Social Security Contributions and Payments, and Taxes on Bank Debits and Credits.

Clearly, by taking only part of the list of taxes levied on productive, commercial and consumption activity, the total impact of agribusiness on public finances is being undervalued. The generation of value by the direct and indirect effects through the consumption and investments of the sector (demand spilled over to other sectors) is not comprised in this study, so it can be considered another undervaluation factor.

For more information about the composition of this index, we recommend referring to the Methodological Annex.

According to our estimates, in December of the year that has just ended, the Agribusiness Chains contributed taxes for a total near $ 282,562 million, or about US$ 2,773 million at the average official exchange rate for the month. This implied a 22% increase from the month of November.

The tax that had the greatest incidence on the total collected was the Export Duties, for which $79,252 million pesos were paid. A detail of the calculation per chain is included further down. Next, and very close in volume, is what is taxed as VAT, which is estimated at some $78,875 million, approximately 22% of the total collected by the State in said tax and 28% of the total paid by the chains for the taxes considered. Following in importance is the payment of Income Tax, with an estimated contribution of $58,746 million, 21% of the total paid by the Chains in our calculation.

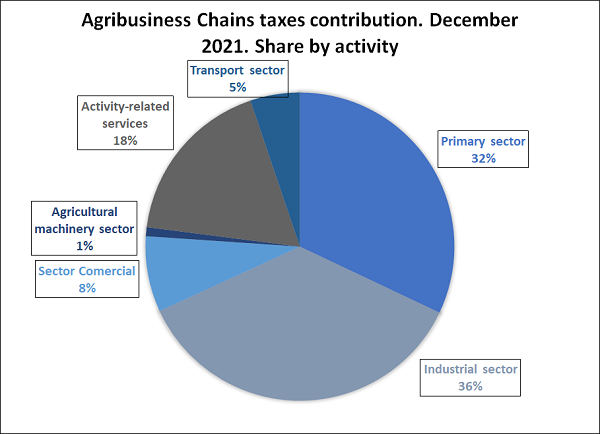

In terms of share by activity link, the one that was taxed the most in the reference month was the Industrial Sector (manufactures of agricultural origin), with 36% of the total, closely followed by the Primary Sector with 32% of the total. We need to clarify that the entire balance paid in Export Duties is assigned to these two sectors. This may not be entirely fair, since the product that ends up being exported is the result of the labour of the entire chain (for example, a grain cannot be exported if it is not moved from the farm to the port) and not only from the original sector of the product in question.

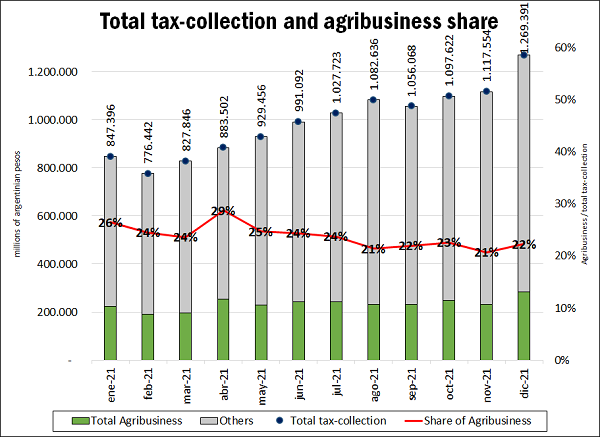

In total, only considering these five taxes, the tax collection balance of the National State assignable to the activity carried out within the Agribusiness Chains of the country represented in December about 22% of the total resources available for that month, which were a total of $ 1,269,391 million according to the Federal Administration of Public Revenues (AFIP, for its Spanish acronym).

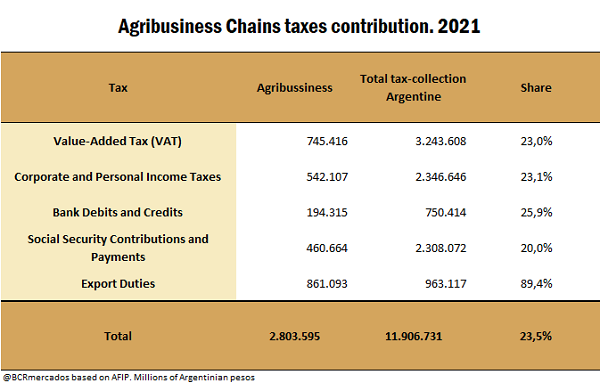

As a consequence, we are also in a position to estimate the tax contribution of the Agribusiness Chains in the year 2021 in its entirety. It is imperative to point out that this is an a priori estimate, and that it can be revised later, given that its calculation utilizes trend estimates of variables that determine the weights applicable to each tax.

In 2021, according to our figures, the Agribusiness Chains made a tax contribution close to $ 2.8 billion pesos to the coffers of the National State, out of the $ 11.9 billion that the public office collected that year, according to information from AFIP. Therefore, in relative terms, agribusiness contributed 23.5% of total tax resources, that is, about $ 1 of every $ 4 collected in taxes by the National State.

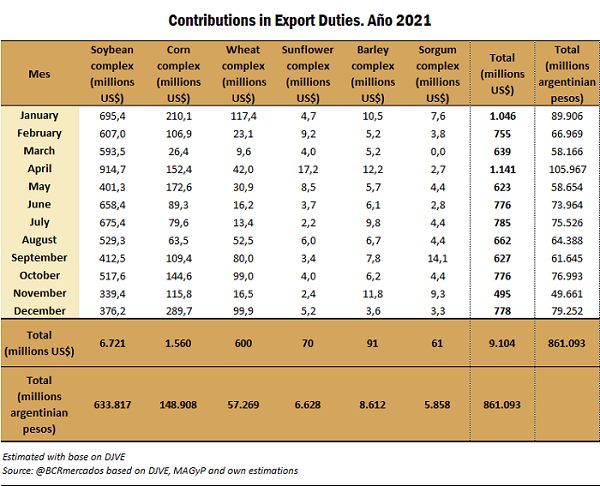

Export Duties were the ones with the greatest impact on the tax structure of the Agribusiness Chains in 2021, generating a balance of $ 861,093 million, 31% of the total paid by the chains in the links and taxes considered. The second in importance regarding collection was the contribution made by way of VAT, which generated balances of $ 745,416 million and represented near 27% of the total paid by the Chains. In third place is the Income Tax, with a contribution throughout the year of $ 542,107 million, representing 19% of the total balance.

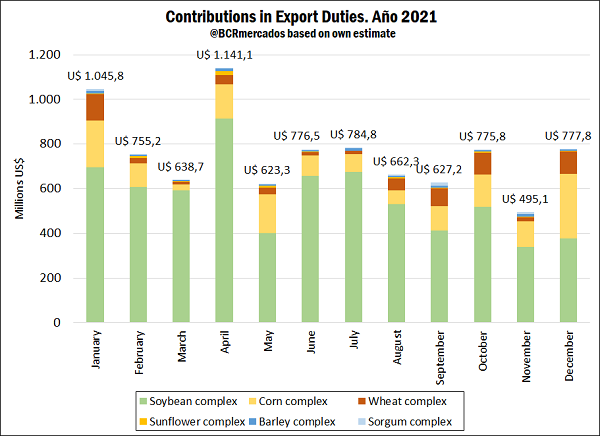

We can see in the chart how the participation of the chains ranged between 21% and 29% of the monthly total collected throughout the year, matching the seasonality of the country’s main agribusiness productions. It can be noticed that the tipping point is found in April, in full development of the coarse crop. At that moment, the share of the agribusiness activity on the total economy increases, and consequently, its share on tax collection. As we can estimate from the National Accounts, in the second quarter of 2021, the primary agricultural activity came to represent almost 15% of the total gross added value of Argentina, marking a seasonality that matches our months of highest tax collection incidence.

Contributions in Export Duties

According to our estimates based on the Export Sworn Statements (DJVE, for its Spanish acronym) made by the export sector, in December the sector paid Export Duties (DEX) for a total of $ 79,252 million, or about US$ 778 million. This was the fourth highest record in the year that just ended, being mainly supported by the increase in withholdings paid by the corn chain, which had its export sales strongly boosted during the last month. In December, the corn chain recorded exports for about 9.8 million tons; in that month alone, near 20% of the total exportable balance forecast for the 2021/22 crop season was recorded.

With the estimate for the month of December, we are now able calculate the total taxed in Export Duties during 2021 in the six chains identified. In total, the sector has paid taxes to the National State for $ 861,093 million in the year under this concept, a total close to US$ 9,104 million.

The soybean complex was the one that paid the highest percentage of Export Duties, also being the complex that endures the highest tax rate of withholdings on its products. Soybean provided resources to the State for US$ 6,721 million, 74% of the contribution of the analysed chains. Next in importance was the corn complex, with taxation under this concept for a total of US$ 1,560 million, and representing 17% of the estimated total for the main chains. In third position was the wheat complex, with US$ 600 million in withholdings, and a 7% share.

The month with the highest individual collection of Export Duties in all of 2021 was April, in which, due to the large number of trades recorded by the soybean complex, and as a result of the prevailing strong international prices, a total close to US$ 1,141 million was collected. We need to remember that in that month the price of soybean was reaching its highest in almost a decade in Chicago, having recorded in the fourth month of the year about 20% of the exportable balance of soybean meal for the 2020/21 crop season.

Methodological Annex

Due to the lack of disaggregation in the available statistical information, the contribution of the Agribusiness Chains was estimated by applying a series of assumptions, which we consider faithfully and approximately reflect the taxation of the sector at the national tax level.

In order to elaborate the monthly taxation index, six links that make up the Agribusiness Chains are analysed: (1) the primary sector, (2) the industrial sector (manufacturing of goods of industrial origin), (3) the trading sector, (4) the transport sector, (5) the agricultural machinery sector and (6) services related to the activity. With different weighting factors, the activity sectors that are considered when building the assignable balances for each Link are the following:

Also, the taxes considered were the ones with the highest incidence on revenue: (I) Value-Added Tax, (II) Export Duties, (III) Corporate and Personal Income Taxes, (IV) Taxes on Bank Debits and Credits, and (V) Social Security Contributions and Payments.

We first proceeded to estimate a balance attributable to the national Agribusiness Chains as a whole for year 2020 through the AFIP statistical yearbook, the last available at disaggregation level.

In order to analyse the corporate and personal income tax, statistical information from the AFIP tax yearbook was used, disaggregated by economic sector in the case of corporate income tax, and taking into account for each identified category the sub-items that completely or partially concern (applying share) the Link under study. In the case of personal income tax, the same distribution as for corporations was assumed.

In order to analyse Social Security Contributions, we proceeded in a similar manner to the methodology applied for income tax, taking advantage of the sectoral breakdown of the AFIP statistical yearbook and taking into account the same sectors and shares.

In the case of the Value Added Tax, the information was taken in large items, without breaking it down, and different factors were applied in order to obtain the share of the Agribusiness Chains in the total. An average of three weights was used to assign the corresponding share to the categories in which VAT is disaggregated. We used: (I) share in the Corporate Income Tax, (II) share in Social Security Contributions and Payments, and (III) share of the Value Added of the sub sector in the total national Value Added.

At the time of estimating the amount corresponding to taxes on Bank Debits and Credits, an indirect estimate had to be made, since the form of presentation of the collection under this concept by AFIP does not present disaggregations by sector. Therefore, the share of each link in the total national Gross Added Value was used, assuming that this share can be considered a good proxy to assign balances of what is collected under this tax.

Once the weights were generated for each link and for each tax considered, they were updated for each month. This makes the weighting more flexible, so that it is possible to follow the share of the agribusiness sector over the total of the national economy. That is, the weights are higher in times when agribusiness represents a greater share of the national economy, and lower in the weakest part of the business cycle. For this purpose, two sources were used: the estimate of the quarterly Gross Added Value prepared by INDEC, and the publication of the Monthly Estimator of Economic Activity (EMAE, for its Spanish acronym), published by the same organization. Through these two reports, we can measure the changes in the share of the sector in the economy, and with this proceed to update the weights used.

When calculating the balances paid by the Agribusiness Chains as Export Duties, a different approach was used. It is easy to notice that the chains considered when composing this balance are more restrictive than those considered when calculating the rest of the taxes (only the soybean, corn, wheat, barley, sorghum and sunflower complexes are considered). This was done in this way due to the representativeness of the calculated complexes, and due to the gains in precision of a direct calculation on this tax.

To calculate the amount paid by the chains as Export Duties, we first calculated the volume recorded as Export Sales in each month for each of the products that make up each complex, both for the current crop season and for the new crop season, and multiplied it by the average FOB price given by the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), both for nearby shipment and for the new crop, as appropriate, and then applied the corresponding Export Duty tax rate to each product. To obtain the value in pesos, it was multiplied by the average exchange rate for the month.