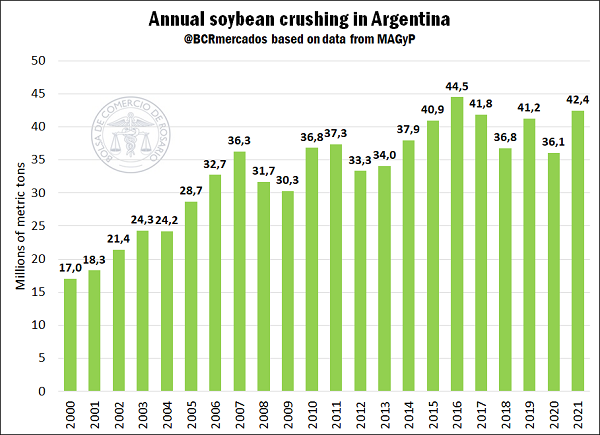

Argentina soybean crush in 2021 reached highest volume since 2016

The soybean complex in Argentina is largely supported by an industry whose international relevance is well acknowledged. The industrial role within the soybean productive framework makes our country the main exporter of meal and oil from this oilseed, while contributing enormously to the generation of foreign currency in the Argentinian trade balance. For this reason, the level of crush acquires a remarkable relevance when evaluating the sector’s performance.

With the crushing data for December 2021 published on Friday, January 21st, the calendar year with the highest local crush since 2016 has been closed. In this sense, during the last month of last year, 2.95 Mt of soybean were processed, reaching a total of 42.4 Mt for the annual aggregate. This record exceeds the previous year by 17.7%, after crushing in 2020 was 35.1 Mt due to the COVID-19 pandemic and the consequent social and economic impact it implied. Then, with the partial normalization of working conditions, a good crop season in terms of soybean production during the 2020/21 harvest, and the increase in the international value of commodities, a favourable context was presented for the crush of soybean. In this way, we have concluded the best calendar year for soybean crushing since the historical record set in 2016, when annual crushing was 44.5 Mt.

As mentioned before, the figure corresponds to the calendar year. If the crush figures are analysed, while from one calendar year to the next industrialization increased by 6.4 Mt, from one crop season to the next one the figure only grew by 1.7 Mt. In this case, the lower total supply (similar volume of imported soybean but lower domestic production) is partially compensated by a lower output of soybean exported as unprocessed raw material.

On the other hand, facing the next crop season, the current situation maintains a certain level of uncertainty due to the drought that occurred between December and January. The forecast productive results of the primary sector of the soybean complex had cuts in recent weeks due to the lack of rain. However, in the last few days, rainfall was present in a good portion of the central region of the Pampa Húmeda, giving some of the summer crops a break. The main beneficiaries in this chart are second-crop soybean and late corn, whose yields have yet to be defined and this increase in humidity has given them vital reinforcement to continue in the productive race. On the contrary, despite these precipitations, it is forecast that the probability of generating changes in the scenarios for first crop soybean and early corn is low. In this sense, it is estimated that a share close to half of early harvest cereals presents conditions between bad and less-than-adequate, with yields that will be between 4 and 6 t/ha, while 40% would have a good average yield close to a range of 8 to 9 t/ha and only 10% of the planted area will exceed these volumes. On the other hand, first crop soybean will also present conditions between less-than-adequate and highly bad, approaching 30% of the land planted with the oilseed without a previous winter crop, estimating losses between 10% and 50%, depending on the condition of these crops. The local market is faced with this scenario, still waiting for new rains to guarantee the yields of late and second crops.