Analysis of “Cereal and Oilseed Crops" sector foreign currency income and exports during period 2003-2019

Introduction:

The following article is meant to show the importance of the “Cereal and Oilseed Crops” in Argentinian external sector as the main supplier of foreign currency. Contributions made by the sector from year 2003 until year 2019 were assessed, resulting in a total of U$S 385,817 million for the period. At the same time, statistics of exports of goods were compared to foreign currency settlements.

For the specific analysis of “Cereal and Oilseed Crops”, the Central Bank of the Argentine Republic (BCRA, for its acronym in Spanish) conducts a follow-up of the mentioned sector in the “Report on Foreign Exchange Market Evolution and Balance", currently published on a monthly basis. According to explanations made in those reports by the BCRA itself, with the purpose of being able to compare exports in that sector with foreign currency settlements, the BCRA takes as a basis for calculation of exports the total value of shipments made by the same group of companies classified within the “Cereal and Oilseed Crops” sector.

They insist that, although those companies account for most of the product shipments in the applicable export complexes (such as soybean, corn, wheat, sorghum, barley and sunflower seeds), Foreign Exchange Balance not necessarily matches accurately the balance shown at product export level by the National Institute of Statistics and Census (INDEC, for its acronym in Spanish), neither in quantities nor in time. (BCRA, 2017).

For that reason, the methodologically correct thing to do is to compare the exports in the "Cereal and Oilseed Crops” sector estimated by the Central Bank on its "Report on Foreign Exchange Market Evolution and Balance” to the foreign currency settlements informed on the same report. That is what has been made at the bottom part of this article. In this sense, circumstantial differences in the foreign currency settlements versus shipments made can be due to established settlement deadlines, plus plausible payment times of loans taken with banks abroad with the purpose of pre-financing exports.

Broadly speaking, we can glimpse a vast regulatory framework for the Cereal and Oilseed Crops export sector in Argentina by contemplating the whole origination process of goods destined to the foreign market. Starting with the export sworn statements, deadlines to settle export duties (DEX) before shippings that have as a taxable base official FOB prices, and not the actual prices of the different trades done, fines for non-fulfillment of shippings in due time, strict obligation of foreign currency settlement through the Single Open Foreign Exchange Market (MULC, for its acronym in Spanish) few days after shipment for most of the products, a heavy tax burden that contrasts with the rest of export goods, etc.

Comparison of Argentina total exports registered by the National Institute of Statistics and Census versus total foreign currency settlements from exports in the Central Bank of the Argentine Republic (BCRA) Exchange Balance during period 2003-2019. Importance of the "Cereal and Oilseed Crops” sector.

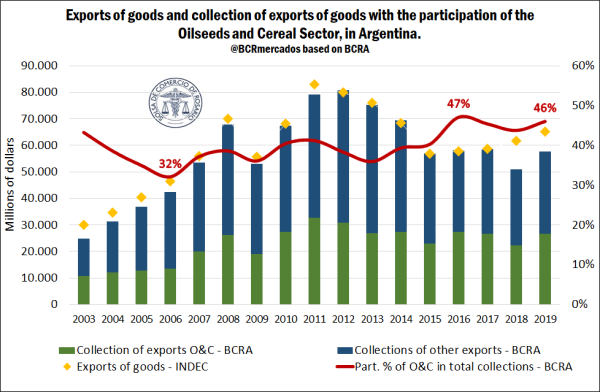

In the following chart it can be observed the evolution of Argentina's total export of goods according to INDEC data and export settlements based on BCRA's methodology reflected in the Exchange Balance. As can be noted, for the group of years under consideration (2003-2019) there is no exact match between both statistics due to the methodological registration differences mentioned above.

Broadly speaking, by observing the exchange balance there can be noted two periods as far as foreign currency settlements in our country:

Years 2003-2012: with a path of notable growth in export settlements due to the rise of value exported by Argentina, with the exception of a setback in 2009 on account of the global impact of the international crisis with epicentre in the United States.

Years 2013-2019: present a declining trend in export settlements until year 2015, with a virtual stagnation until year 2019.

Taking into account BCRA's sectorization, it is worth noting the importance acquired by the main agribusiness sector, “Cereal and Oilseed Crops”, in foreign currency settlements/export settlements during the mentioned periods.

In the first subperiod, until year 2006 there is a fall in the relative annual share of the Cereal and Oilseed Crops sector, reaching 32% of the total dollar export amount. From that point on, except for year 2009, there is a steady absolute increase of total exports in that sector, just as in relative terms, reaching a top share of 41% in year 2011 and slightly dropping to 38% the following year. Whereas in the second subperiod (2013-2019), in spite of the strong fall of total exports and the subsequent stagnation, the Cereal and Oilseed Crops sector had an important rise in its relative representativeness reaching the series maximum in 2016 with 47% of the national total on annual terms. In the last year analyzed, a share of 46%, close to the series maximum, can be noted.

Comparison of “Cereal and Oilseed Crops” exports estimated by the BCRA on its monthly reports of Foreign Exchange Balance versus foreign currency settlements from exports of the same sector in the mentioned report during period 2003-2019. Accumulated foreign currency settlements amount to U$S 385,817 million.

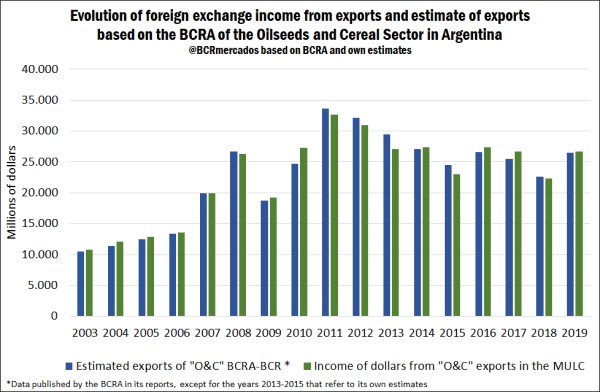

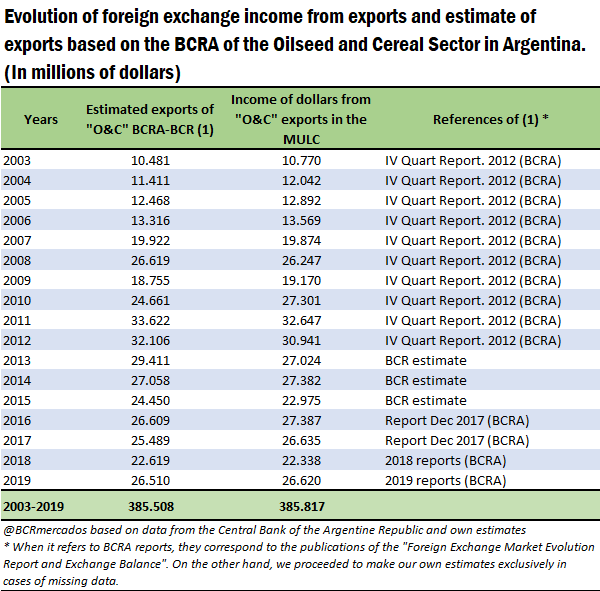

It is usually a subject of great interest (especially for the balance of Argentinian macroeconomics) the correlation between the pace of exports in the “Cereal and Oilseed Crops” sector, linked almost exclusively to the agribusiness cereal cluster, and the evolution of foreign currency settlements. In that sense, in the following graphic we have compared the historical settlement of export foreign currency by the mentioned sector in the Single Open Foreign Exchange Market (MULC) according to BCRA data and its correspondence with the estimation by the BCRA itself regarding the exports of this sector, based on the value of shipments of these companies. On this last point, it is important to highlight that the estimated export value of the sector is not published on a statistical series, but it emerges from the compilation of data published through time on the Report on Foreign Exchange Market Evolution and Balance by the BCRA, except for years 2013-2015, which are estimations made by Rosario Board of Trade (BCR, for its acronym in Spanish), due to the lack of information for that period. We would like to emphasize the methodological care we have put in calculating the data mentioned as missing, since we have used official information of shipments provided by the Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym) and export quote data provided by the National Institute of Statistics and Census (INDEC) regarding the pertinent products of the sector.

In this way, two comparable series are obtained: exports and foreign currency settlements of that sector by the same source. It is interesting to observe the following: between year 2003 and the last month of 2019, export estimations amount to US$ 385,508 million, while foreign currency settlements rise to US$ 385,817 million, indicating a marginal difference between the value shipped by the sector and the evolution of the foreign currency income under the same concept. The graphic and the charts with the annual records are included below:

In this way, it can be noted the importance of the sector's contribution to foreign currency generation, which, during the period 2003-2019, represented 40% of the country's total export foreign currency settlements.

Last, it is noteworthy mentioning that this sector is the most representative of the agribusiness. Nonetheless, “agribusiness” encompasses a larger number of sectors besides “Cereal and Oilseed Crops” and, in terms of exports, together they reach an even higher representativeness. According to data published by the Ministry of Agriculture, Livestock and Fisheries (MAGyP) on its report named Monitor of Agribusiness Exports, during year 2019 this sector exported US$ 42,247 million. In that sense, if compared to total export of goods for that year (US$ 65,115 million), the agribusiness sector represented nothing less than 64.9 % of the total.

References

BCRA (2017). Evolución del Mercado de Cambios y Balance Cambiario [Foreign Exchange Market Evolution and Balance]. December 2017. Available in PDF: http://www.bcra.gov.ar/Pdfs/PublicacionesEstadisticas/Informe_Diciembre_17.pdf [Last review 06/08/2021]

BCRA (2021a). Metodología de Compilación de las Estadísticas del Mercado de Cambios y Balance Cambiario [Methodology for Compilation of Foreign Exchange Market and Balance Statistics]. Available in PDF: http://www.bcra.gov.ar/Pdfs/PublicacionesEstadisticas/Metodologia-del-balance-cambiario.pdf [Last review 06/08/2021]

BCRA (2021b). Texto ordenado sobre de las normas sobre “exterior y cambios” [Rearranged text on foreign exchange market regulations]. Updated on 05/08/2021. Available in PDF: http://www.bcra.gov.ar/Pdfs/Texord/t-excbio.pdf