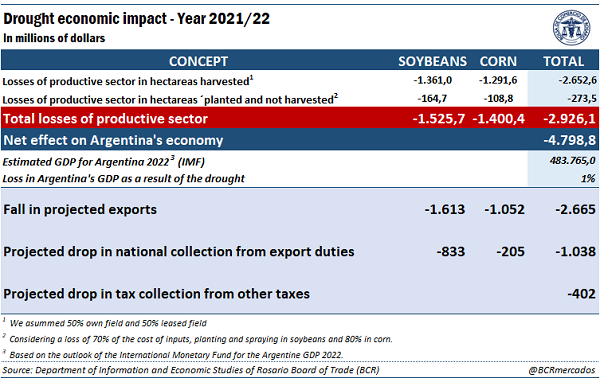

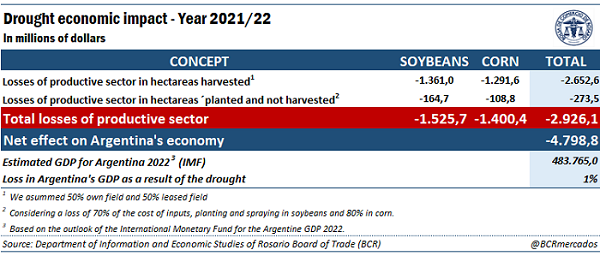

2021/22 drought will cost farmers US$ 2.93 billion

The summer water stress brought down the forecast soybean and corn harvest by 9 and 8 million tons, respectively. Even with the recovery of prices, the loss of producers’ net income already amounts to US$ 2.93 billion, which will result in less freight, less financial and intermediation services, and less consumption. All in all, the impact on the Argentinian economy is estimated at US$ 4.8 billion, or 1% of its potential GDP.

On the external front, exports of the main products of the soybean and corn complex will fall by 13 million tons. If we value the sector's net exports at current prices, it is forecast a loss of income of US$ 2,665 million for the country, a 10% drop compared to the total forecast by the end of last year.

Moreover, the State will suffer a reduction in tax-collection for US$ 1.44 billion, of which US$ 1.04 billion correspond to lower tax income from export duties, and the rest to other taxes.

1- Estimated direct losses of the productive sector

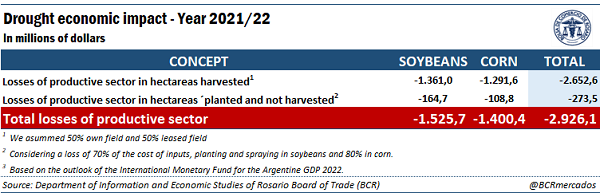

Although the water stress in South America has supported international prices of agricultural commodities, this rise is not enough to compensate the lower production and costs of the productive sector. The drop in yields in a context of rising costs is too acute, showing net losses for US$ 2.9 billion.

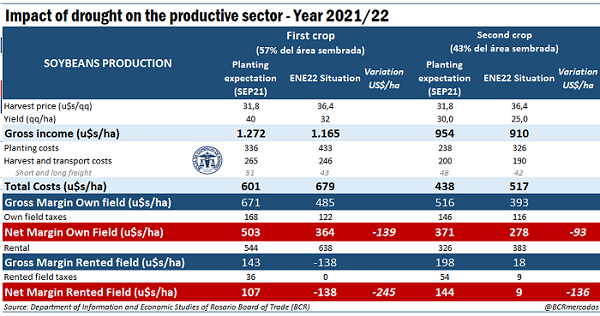

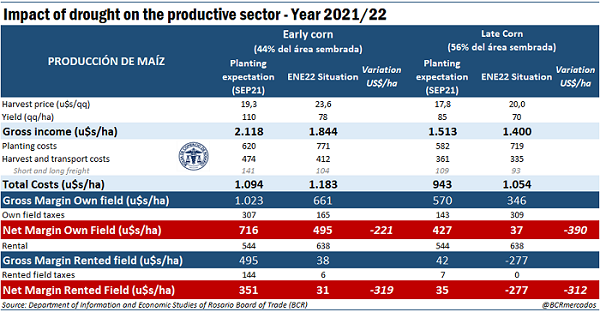

Breaking down this result, although the price in MATBA-ROFEX of soybean at harvest (May 2022) increased 14% between September of last year and January 2022 and corn rose 23% for the early variety and 12% for the late, the soybean yield has already lost an average of 19% with respect to the potential with which estimations were made at the time of planning 2021/22 sowing. In the case of corn, the loss of yield potential for those that will be harvested next April reaches 29%, while for the one that will be harvested as of July of this year, 18% of its tons in the core area. With these numbers, the total expected gross income per planted hectare has lost 7% in the case of soybean and 10% in the case of corn, weighted by the number of planted hectares of each variety.

Meanwhile, total costs had an average increase of US$ 78 for each hectare planted with soybean, and of US$ 98 for each hectare planted with corn. Although part of the inputs has been bought previously, escaping the increase in products such as urea, another large portion of the logistics and commercial costs are paid when the grain is harvested at the prices in force at that time.

With these numbers, the farmer who owns the land has lost in net terms US$ 139 for each hectare that he planted with first crop soybean, and US$ 93 for each hectare that he planted with second crop soybean. In the case of corn, the loss amounts to US$ 221 per hectare planted with early corn, and US$ 390 per hectare planted with late corn.

In the case of the leasing farmer, the losses compared to what was expected at the beginning of the campaign are even more dramatic: US$ 245 per hectare for early soybean and US$ 136 for soybean that follows wheat or other winter crop. For corn, the drop in the net margin amounts to US$ 319 for each hectare devoted to first-crop grain and US$ 312 for each hectare planted with late corn.

For him, the acres that he allocated to first-crop varieties of both oilseed and cereal will have a negative net margin in the developing cycle; that is, the income will not be enough to cover his costs.

Now, apart from the lowest yield with which the inputs, taxes and services must be paid for each harvested hectare, the cost of implantation in the hectares that were sown must be considered, but they will not be threshed because of the total loss of plants. According to forecasts by the Agribusiness Strategy Guide (GEA, for its Spanish acronym), this amounts to 800,000 hectares in the case of soybean, and 227,200 hectares in the case of corn (computing only the increase in unharvested area between the forecasts for December and January, assuming that the rest can be reused for chopping, silage, and others). On this surface, 70% of the cost in inputs plus planting and spraying in soybean, and 80% of them in corn are imputed as losses (if by not threshing, the rest of the expenditures they will not be effective).

In the global calculation of losses for the farmer, we will assume that 50% of production is carried out under lease and 50% in own field. With this assumption and weighing by the hectares planted at a national level for soybean and early and late corn, we conclude that direct total losses for farmers because of the complicated state of the crops already amount to US$ 2.9 billion by January 2022.

2- Global losses for the domestic economic activity

The lower income of the productive sector due to the loss of production results in fewer freight trips, less financial and intermediation services, less demand from the construction sector, etc.; in short, less investment and consumption that end up having an impact on the general economic activity.

Using the Leontieff coefficient estimated based on the simplified input-output matrix that the OECD estimated for Argentina in 2019, this multiplier effect of agriculture on the national economic activity can be estimated at 1.64. That is, for every $ 1 that the demand for final goods in the Agriculture, Forestry and Fishing sector rises (falls), economic activity grows (falls) by $ 1.64. In this way, the loss of income for US$ 2,926 million from the primary sector will impact on a fall in the Argentinian Gross Domestic Product of US$ 4,799 million; that is, 1% of the estimated potential GDP for Argentina in 2022 according to the International Monetary Fund, which amounts to US$ 483,765 million.

For greater detail, among the negative economic impacts due to the loss of income of the productive sector, the direct, indirect, and induced impacts1/ include:

a) Increase in forage costs for livestock and meat chains

b) Less activity in transport

c) Lower consumption of Gas-Oil in the automotive transport of loads

d) Possible drops in sales of agricultural machinery, equipment, pick-ups and trucks

e) Probable lower sales of inputs in the next crop seasons

f) Lower income in the sector of storage and conditioning service providers

g) Lower gross income of rural contractors when harvesting due to lower yields

h) Lower activity in the oilseed industrial complex

i) Lower income for service providers associated with exported merchandise

j) Fall of income received by providers of port services and/or on vessels

k) Problems in the fulfilment of the field lease contracts

l) Problems in the fulfilment of the payments of the financial system and problems for refinancing debts Need for greater financial leverage in the next crop season

m) Possible impact on the quality of the seed for the next season

n) Possible impact on the commercial quality of soybean for export

o) Various macroeconomic effects

3- Fall in dollar income from agribusiness exports

Re-estimating the Supply and Demand Balances for corn, soybean and their by-products, the forecast of soybean exports and oilseed processing are corrected downwards by 3.3 and 2.1 million tons. These two concepts would finally be located at 4 Mt and 36.4 Mt, respectively, because of the lower production due to the drought. In the case of corn, the export forecast for the 2021/22 season falls from 41.1 million tons to 33.5 million.

In addition, the forecast of shipments of soybean meal and oil, star products of the Argentinian Trade Balance abroad, fall from 26.2 to 24.8 Mt and from 5.6 to 5.3 Mt, respectively. Valuing the export volumes estimated at the beginning of the crop season at the prices in force at that time, and the quantities forecast to date at the current prices, to net the "lower quantity" effect with that of the "higher prices", the drop in the export estimate of the main products of the soybean and corn complexes amounts to US $ 2,209 million. On the other hand, the adjustment of the available domestic supply will make it necessary to recalculate the required imports of soybean, which would increase by US$ 456 million.

In this way, the adjustment of 13 million tons in exports causes that the forecast total income of foreign currency from export of beans, soybean meal and oil plus corn implies a net loss of income of dollars of US$ 2.665 million, which equals 10% of what was forecast for the month of September.

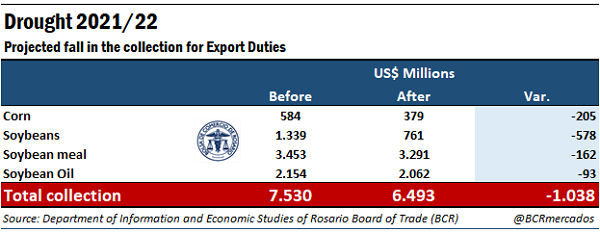

4- Fall in tax collection because of the drought

With an average tax burden of 30% of GDP, the global loss of US$ 4.8 billion forecast in this analysis would imply a decrease in the collection of national, provincial and city taxes that would reach US$ 1.44 billion due to the dramatic state of crops.

If we analyse specifically the tax revenue for export duties, if we compute what remains to be sold abroad (that is, subtracting the sales already effective that arise from the registry of Export Sworn Statements) from the total forecast exports for the crop, and we estimate its monthly distribution based on seasonal indicators, when valuing them by the FOB in force for each period, it is clear that US$ 833 million will cease to be collected for the soy complex, while for corn exports the fall amounts to other US$ 205 million. In total, due to the drought, the National State will stop collecting export duties for US$ 1,038 million.

Technical Team*:

BSc Emilce Terré - Head of the Department of Information and Economic Studies

BEng Cristián Russo - Head of Agribusiness Strategy Guide (GEA)

BSc Federico Di Yenno - Market Analyst - Department of Information and Economic Studies

BSc Tomás Rodríguez Zurro - Market Analyst - Department of Information and Economic Studies

BSc Guido D’Angelo - Market Analyst - Department of Information and Economic Studies

BEng Florencia Poeta - Production Analyst - GEA

PhD Julio Calzada - Director of Information and Economic Studies

Patricia Bergero – Deputy-Director of Information and Economic Studies

1/ When talking about economic impacts, reference is made to:

Direct economic impact: Production (added value), gross and net income, profits and employment generated in those sectors that are direct recipients of the expenses and investments of agricultural producers.

Indirect economic impact: Production (added value), gross and net income, profits and employment generated by those sectors that indirectly benefit from investments and the expenditure of farmers. That is, those that supply the sectors directly affected with the goods and services necessary for their activity.

Induced economic impact: Production (added value), gross and net income, profits and employment that is generated by the consumption of goods and services by employees or human resources of the sectors that benefit, directly or indirectly, from the investments and expenses of farmers. It would also include other impacts that are generated outside of the direct and indirect ones.