In 2021 Argentina shipped the largest volume of grains in history

After a 2020 marked by the impact of the COVID-19 pandemic on consumption and the key variables of the domestic and global economy, 2021 brought a strong recovery in world economic activity and the normalization of the flow of international trade, which was reflected in a strong increase in the demand for food that impacted both the prices and the volumes of grains traded.

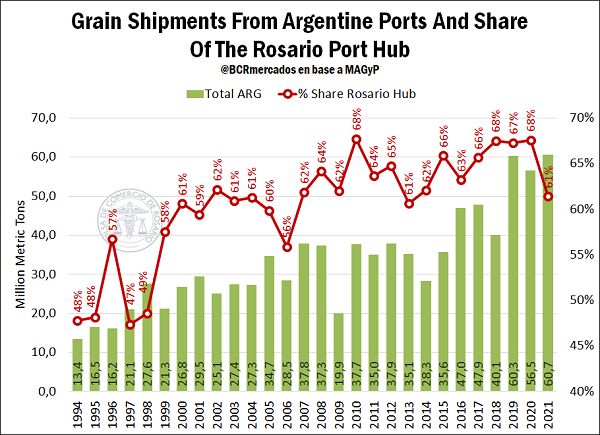

In this context, and despite the difficulties imposed by the level of the Paraná River and the production setback suffered by some of the main crops during the last crop season, the country shipped grains for 60.66 Mt from all its port terminals in 2021, 7% above everything shipped in 2020, reaching a historical record by surpassing the 2019 mark (at that time, 60.3 Mt were shipped).

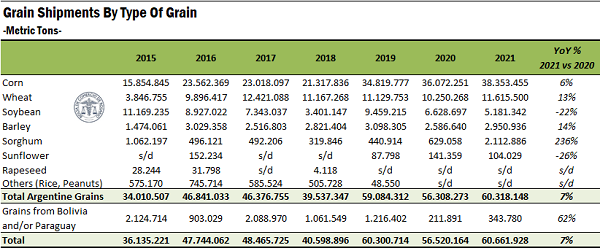

Disaggregating by type of grain, shipments of Corn totalled 38.4 Mt, over 2 Mt more than the amount shipped during 2020 (↑6%) and thus reaching the highest volume in history. Bread Wheat exports by vessel totalled 11.6 Mt, increasing by 13% compared to the volume shipped in 2020 and just below the record for 2017. Soybean, in the meantime, totalled shipments of 5.2 Mt, registering a drop of 22% compared to the figure reached during the previous year. Barley shipments totalled 2.95 Mt, a 14% improvement over the 2020 mark, while Sorghum shipments totalled 2.1 Mt, a record since 2013. Last, 0.1 Mt of Sunflower were shipped from the country's port terminals, 26% below the amount registered the previous year.

Also, to the 60.32 Mt of Argentinian grain that were shipped from all the country's port terminals during the last year, we can add the 0.34 Mt of goods of Bolivian and/or Paraguayan origin that also had as place of shipping the port terminals located in national territory. This allows to reach the aforementioned record of 60.66 Mt.

If we observe the amount shipped by port area, it can be seen that the terminals of Rosario city area hub the ones that had the greatest share in the 2021 total. However, it is the lowest since 2012 and the second lowest since 2006.

During recent times, the terminals of the Up-River (whose strength has historically been the shipment of products obtained from the processing of grains, mostly meals and oils, among others) were positioned as the largest gateway to the world for Argentinian cereals and oilseeds, hand in hand with the growth of agricultural production in the centre and north of the country. Although this continued to be the case during last year, the region's ports lost importance in 2021 at the expense of the southern ports of Buenos Aires, mainly.

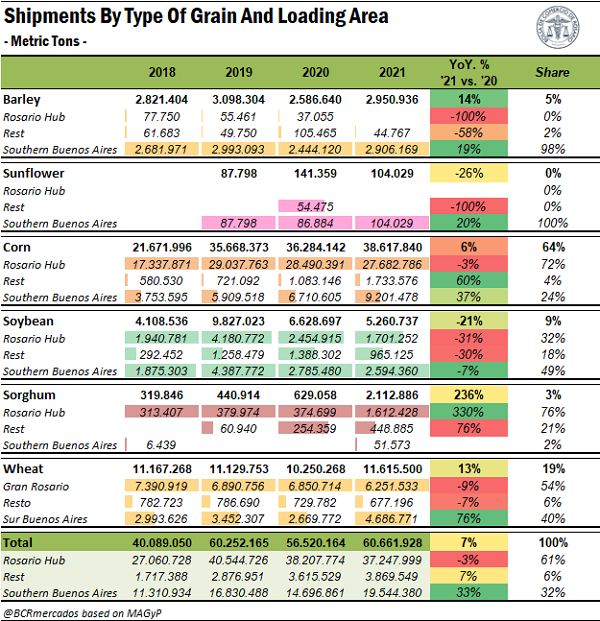

Firstly, one of the elements that stands out is what happened with wheat. Although winter cereal shipments increased by 13% year-on-year during 2021, the ports of Rosario city area shipped 9% less, while terminals in southern Buenos Aires increased 76% compared to 2020. This is because 2020/21 wheat suffered a productive setback in the central and northern regions of the country, which are precisely the areas that, due to their geographical proximity, have the Up-River port terminals as the main way out of their production. At the same time, production in the southern region, which is shipped for export to the southern ports of Buenos Aires, was considerably bulging in historical terms. Thus, higher grain availability in these areas increased shipments from Bahía Blanca and Necochea/Quequén.

Secondly, mention should be made of what happened with corn. Shipments of yellow grains grew by 6% year-on-year, but shipments from the Rosario city hub fell by 3%, while from the south of Buenos Aires grew by 37%, and from the rest of the terminals, by 60%. In this case, this does not respond to the same reason as with wheat, since corn production in the central region was high, particularly late/second-crop corn. In fact, the best 2020/21 corn yields were in the provinces of Córdoba and Santa Fe, which belong to the central region.

One of the reasons why a higher volume of corn was shipped from the south of Buenos Aires and a lower amount on the Up-River was due to the level of the Paraná River in the last year. Another factor is the fact that the late and second crop corn were the best performing (since they received better rains than the early/first crops at critical times), which caused the bulk of the goods to be harvested in the months of July and August. Those were precisely the most complicated months regarding the level of the river.

In the third place, soybean shipments from Rosario city terminals fell more than proportionally compared to total shipments: -31% for ports in the region vs -21% for all Argentinian ports. In this respect, the main reason would be that, given the lower soybean production obtained during the last crop season (45 Mt in 2020/21 vs. 50.7 Mt in 2019/20) and Rosario city hub concentrating the largest number of oilseed processing plants, most of the soybean that arrived at the port terminals of the region was industrialized and then shipped as oil and meal/pellets. At the same time, since the southern ports of Buenos Aires have a lower crushing capacity, the grain originating in its region of influence is exported mostly unprocessed, reason why there is no drop as big as that recorded in the Up-River (Soybean shipments from Bahía Blanca and Necochea/Quequén in 2021 fell by only 7%).

Finally, for the other grains, barley and sunflower kept the sea ports of Buenos Aires as the main shipping nodes. This is consonant with the strong weight that the south of Buenos Aires has in the production of both crops. As for sorghum, the highest volume was shipped from the terminals of San Lorenzo and Rosario, as was the case in previous years. In addition, one point to mention is that it is the only one of all grains for which there is a year-on-year increase in shipments from the ports in the region.

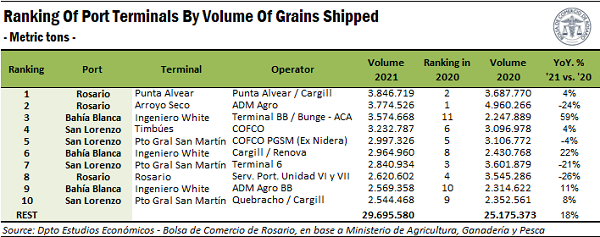

If we look at the port terminals that shipped the highest volume of grains in 2021, the two leading the list were located in Rosario: the Punta Alvear pier operated by Cargill, with 3.85 Mt, and the Arroyo Seco pier operated by ADM with 3.77 Mt. In addition, these two terminals exchanged their position in the previous year's ranking. In the third place was the Bahía Blanca Terminal operated by Bunge/ACA, which increased its shippings by 59% in 2021 and climbed from the 11th position reached the previous year.

On the other hand, it is the first time since at least 2015 that a terminal of the Bahía Blanca port node is in the podium of terminals that shipped the largest volume of grains in the same year. The hegemony of Rosario city hub was such in recent years that between 2015 and 2021 only once a terminal of another port area got to the podium: the Terminal Quequén, in 2016.

Finally, with regard to grain destinations, Asia again emerged as the main destination for Argentinian grain shipments, receiving 52% of the total, equivalent to 31.8 Mt (↑ 6% versus 2020). In the second place, America represented 26% of total shipments (16.1 Mt, ↑18% vs. 2020). Africa ranked third, with shipments of 12.2 Mt (↑ 2% YoY) and Europe ranked fourth and last with 616,419 t (↓28% YoY).

Disaggregating in subcontinental regions, Southeast Asia was the region that received the highest volume of Argentinian grains in 2021, with 12.5 Mt (↓15% YoY). This region remained the main destination for Argentinian grains, just as in the last two years, driven mainly by the shipments to Vietnam (7.1 Mt) and to Malaysia (2.8 Mt), and Indonesia (1.6 Mt), to a lesser extent.

North Africa ranked second, with 9.2 Mt (↓3% YoY) of shipments to Egypt (3.8 Mt), Algeria (3.1 Mt) and Morocco (1.7 Mt). Third we find China, receiving 8.1 Mt (↑28% vs. 2020). Then followed South America (excluding Brazil), with 7.9 Mt (↑6% YoY), in the fourth place. The shipments to Peru (3.4 Mt) and Chile (2.9 Mt) stand out here. The Far East with 7.2 Mt (↑108% vs. 2020) was fifth, with North Korea receiving 2.7 Mt, South Korea 2.1 Mt, and Japan 1.2 Mt. Finally, the sixth of the main destinations was Brazil with 7.1 Mt (↑39% YoY).

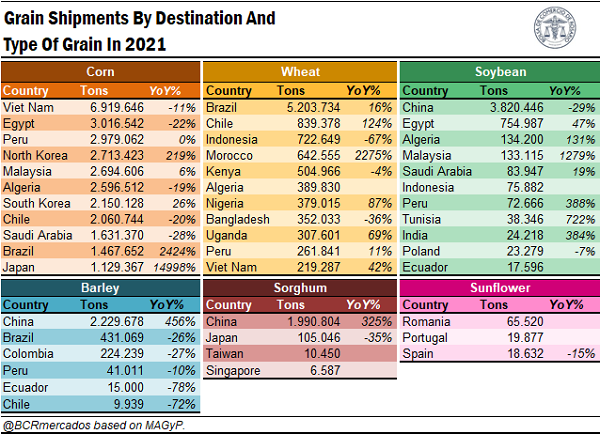

Finally, by analysing shipments by destination and type of grain, it can be observed that Vietnam was the main destination for corn shipments. During the last year, 6.9 Mt of yellow grains shipped to the Vietnamese coast arrived in the country's ports. Egypt ranked second, with 3 Mt, and was followed by Peru, with 3 Mt. Moreover, it is also worth mentioning that 1.5 Mt were destined for Brazil, which increased its purchases by more than 2000%, while Japan also received a large volume of Argentinian corn compared to previous years. Another interesting point to note is that China received only 70,000 t of yellow grains, maintaining a low volume, as in previous years.

In the case of wheat, Brazil unquestionably positioned itself as the main recipient of the Argentinian winter cereal shipments. During the last year, it received 5.2 Mt, up 16% from 2020. In addition, Chile, which received almost 840,000 t, more than doubling the 2016 record, is also outstanding. On the other hand, and as expected, shipments to Indonesia fell sharply. This is because, in previous years, the island country had to go out in search of new suppliers, when Australia (its usual supplier) had serious productive problems due to a severe drought, which was beneficial for Argentinian wheat. However, in the last year Australian production recovered, and thus became the supplier of its usual customers again, to the detriment of domestic wheat. Despite this lower volume, however, Indonesia ranked 3rd as the main recipient of shipments of this winter cereal.

Just as Brazil is the main buyer of wheat, China is the main undisputed recipient of soybean shipments. During the last year, it received 3.8 Mt of the oilseed, and while this represents a 29% drop from the previous year, it continued to account for more than 72% of all soybean shipped from the country in the last year. Egypt remained second, but increased by almost 50 per cent from 2020 to 750,000 t.

With regard to barley, China was also the main destination of Argentinian shipments. More than 2.2 Mt went to the shores of the eastern giant, which is more than five times the volume it had received in 2020. In addition, it should also be mentioned that Saudi Arabia, which had been the main recipient of barley shipments in the past three years, did not receive Argentinian vessels transporting barley during the last year. On the other hand, Brazil remained the second largest destination for barley shipments, but with a lower volume (↓26% YoY).

As for sorghum shipments, China again emerged as the first destination. 94% of the shipments of this gramineous went to that country (2 Mt), while Japan was the second largest destination. One element to highlight is that all sorghum shipments were destined to countries in East Asia. One reason for this may be that this grain is used in the production of alcoholic beverages typical of some regions of Asia, particularly China.

Finally, sunflower shipments were mostly directed to Romania (65,000 t) and to a lesser extent to Portugal (19,900 t) and Spain (18,000 t). Just as sorghum shipments all went to Asia, sunflower shipments all went to countries in Europe, a situation that has been repeated in at least the past four years.