Wheat transportation in Argentina is strongly dependent on adverse weather effects and the volume of purchases

FEDERICO DI YENNO - EMILCE TERRÉ

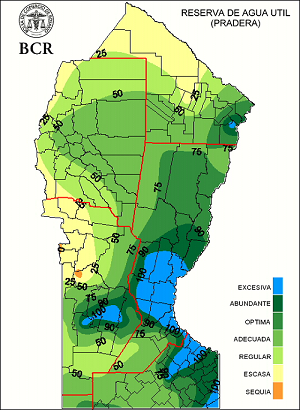

Following the heavy rains in central and southern Santa Fe province and southeastern Córdoba, soil moisture in great part of Argentina's core productive region went from scarce levels to excessive. In a one-week-time period, this region received more than 200 mm rains, largely affecting wheat crops that are currently filling and maturing.

Rainfalls crucially affected those crops that were only a few days from harvest, and those going through the filling stage. As a result, although wheat yields and quality are expected to fall, the quality of the crops is likely to fall the most. As harvest concludes in northern Argentina, the number of trucks entering the Rosario Hub falls. In the first two weeks of November, only 5,830 trucks entered (which is equivalent to 350,000 tons), 15% less than in the previous cycle. It is expected for the greatest volume of grains to begin entering the Rosario Hub in the second half of the month. Given the prospects of greater new crop exports, at least 33,000 trucks should enter in the last fortnight of November. Wheat transportation in Argentina might get convoluted as November export commitments reached 570 tons and December's set a new record by exceeding 2 Mt. The scenario is even tighter if we consider the low stock level informed by the Secretariat of Agribusiness in October. The 1.44 Mt stock is the lowest on record since 2015. Moreover, as the market is aware of this scenario, the number of transactions is increasing. The volume of wheat operated in all segments in the week that goes from November 9 to November 15, is larger than the previous week. Recent rainfalls might delay the arrival of grains into the terminals. Plus, given the large volume of forwards made for the coming months, this could lead to a bottleneck effect in the exporting ports. By November 7, more than 39% of wheat crop has already been committed, a value well above previous cycles. Export sales by November 7 were 5.91 Mt while last cycle's sales were 1.4 Mt. Furthermore, 80% of these export sales correspond to the months of November, December and January.