The price of wheat has renewed its upward trend on previous week both in the local market and in the external reference markets. Some concerns about the possibility that winter wheat in the US suffer from frost damage, while delays in spring wheat plantings in the United States and some areas of Russia justify the cereal's revaluation in the world. For our country, meanwhile, the availability of grain is adjusted as the demand continues to be strong, and the price of the nearest future in MATBA (Buenos Aires Futures Market) touched last Thursday its highest value in almost 4 years. The exportable balance of the 2017/18 campaign was compressed due to the low volume of beginning stocks and limited production caused by excessive water in the middle of last year. With a stable domestic consumption of around 6 million tons, there are no more than 11 million tons able to be shipped abroad. However, the inventory level would again adjust to 0.2 million tons, the lowest volume in at least the last thirty years.

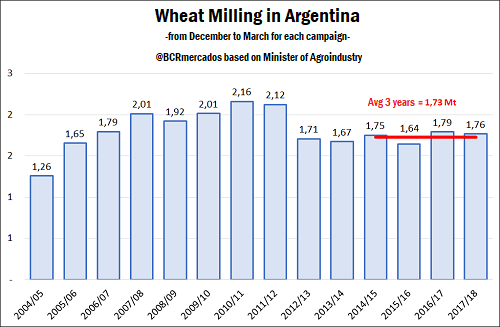

Regarding domestic consumption, the milling data so far in the 2017/18 season (from December to March) is in line with the estimates, slightly behind the previous season but above the average of the last three years, according to the attached graph.

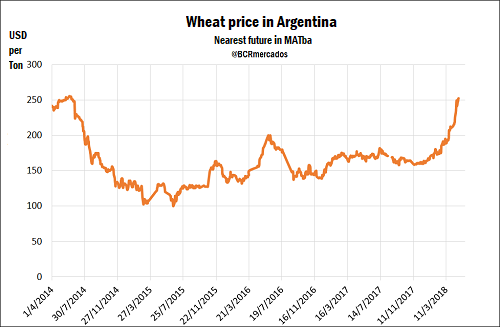

Although 1.76 million tons have been processed, the industry has purchased -according to the latest information available from the Argentine Ministry of Agribusiness- more than 2.5 million tons of 2017/18 wheat, in line with purchases at the same point of the previous year but above the average of the last three years, which is 2.25 Mt. In relation to exports, the sector has already bought close to 10 million tons when there are still 7 months remaining to the end of the campaign, of a projected total exports volume of 11 million tons. The bid for what remains of wheat in Argentina increased and prices rose to its highest value since June 2014 in MATBA, reaching US $ 252.5 / t for May 2018. In the Rosario Board of Trade, the reference price reached on last Thursday a nominal record of AR $ 4,735 / t, increasing AR $ 215 / t on last week. In dollars, the weekly increase was 3% to US $ 231.5 / t.

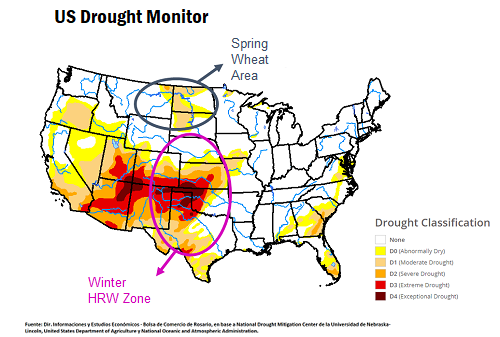

With regard to the situation of wheat in the world, today attention is focused on the production conditions in the Northern Hemisphere, where winter wheat will begin to go through its critical phase of development (heading) around the month of May at the same time that the spring wheat plantings are starting. In Russia, a report by Bloomberg released during the previous week indicates that the start of the spring wheat plantings has been delayed, while the cold weather conditions in some regions are delaying the development of winter wheat. In this context, different analysts have cut their estimates for 2018/19 production to ranges that vary between 72 and 78 million tons, when the USDA had projected at the beginning of the month 85 Mt. In the United States, meanwhile, wheat has faced a prolonged drought in recent months that caused significant deterioration in cereal conditions. According to the USDA, only 31% of winter wheat is in good and excellent conditions, when at this height last year that percentage climbed to 54%. Spring wheat plantings were also delayed, with barely 3% of the intended area being advanced, compared to an average of 25% in the last five years. The map below allows us to verify the difficult situation of wheat in the United States. It can be seen how much of the productive regions of both spring and winter wheat have been dyed red, and today almost half of the territory is under some degree of water deficit.

In Europe, long-term climate forecasts are worrying, pointing to a hot and dry spring in Southern Europe, which would impact even the south of France, which could negatively affect crops in those regions, given the very low humidity of the soils. Although there are long weeks remaining before the climate says its last word as far as yields are concerned, it is clear that at the point of departure the water does not spare in almost any of the main wheat producing regions of the Northern Hemisphere, which gives a price support for the new campaign. This probably reinforces the intention of the Argentine producer to add hectares to the cereal, and in this regard the rainy system in which we are immersed and that apparently will continue, will be able to collaborate in facilitating the final decision.