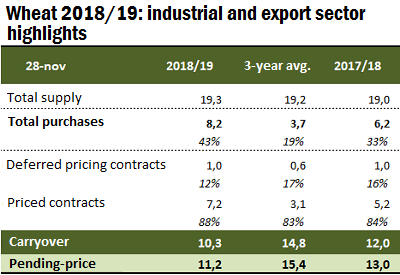

There has been a cut in production projections, from 21 million tons at the beginning of the season to current 18.5 Mt. In addition, beginning stocks are low, which tightens the volume of wheat available . But despite these facts, clear skies across the country favored harvest activities, although there is a high heterogeneity among regions. Yields start at 15-30 bsh/ac and reach maximums of 60-74 bsh/ac. On average, the cycle's performance is behind both, the expectations and last cycle's performance. The most affected crops are found in northern core region, especially in Córdoba and Santa Fe provinces. In those territories, the drought was more severe than in the southern part and consequently the late frost had a greater impact on this area. The average yield fell by 10-15% this cycle if compared to previous season's yields, they do not exceed 45 bsh/ac. The province of Entre Ríos might be the exception. As it did not suffer the drought, local yields -between 45 and 75 bsh/ac- exceed all projections for the region. Nevertheless, the frost affected certain lots, bringing yields down to 30 bsh/ac in the low areas. Meanwhile, in the north of the country (NOA-NEA regions) the harvest is ending with lower-than-expected yields due to the lack of rainfall in the critical period. Finally, wheat crops in the province of Buenos Aires are entering the filling phase with good water reserves and cool temperatures that support optimistic prospects. As for wheat demand, exporters' purchases are showing an unprecedented rhythm this cycle. Anticipated purchases for 2018/19 season –that began on December 1- reached 8.2 Mt, a pre-harvest marketing historic record. Ninety per cent of them correspond to the export sector's anticipated purchases.

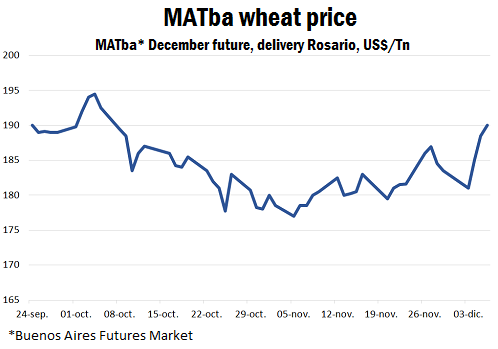

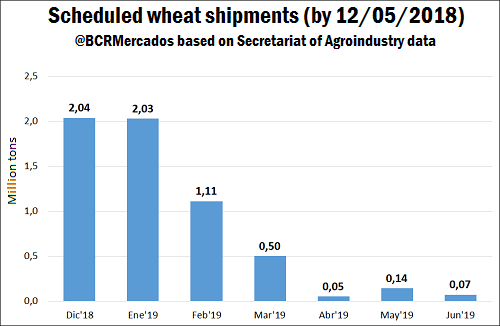

The 8.2 Mt purchases are equivalent to 43% of a total supply of 19.3 Mt and leave only 10.3 Mt of wheat for marketing. This volume is almost 2 Mt below previous year's figure and 4.5 Mt below the last three-year average. Wheat shortage will likely lead to greater bid among potential buyers, which would support wheat prices in the next months. Of the 7.6 Mt of wheat that the export sector has bought, 5.9 Mt have been already sold abroad that is a historical record for early September. Regarding shipment schedule, Secretariat of Agribusiness informed an ambitious program of shipments abroad in the coming weeks. By December 5, more than 2 Mt of wheat were already scheduled to leave Argentine ports in the months of December and January, 1.1 Mt in February and half a million in March.