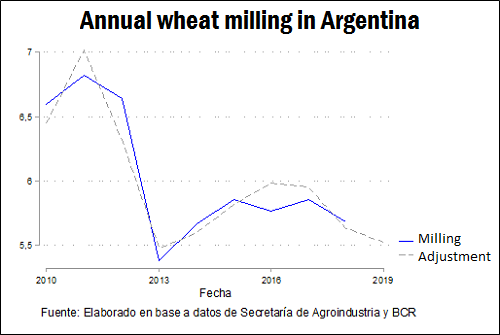

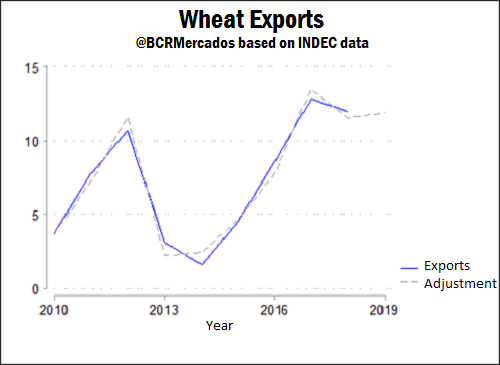

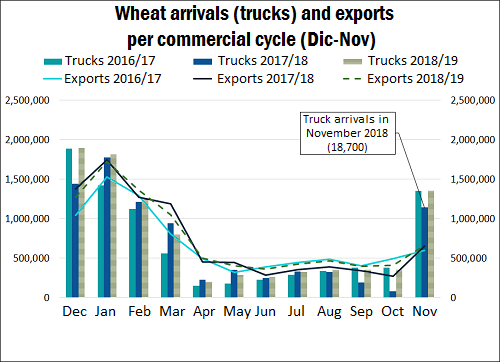

December/November 2017/18 wheat exports would reach 12 Mt, adding November shipments that are around 900,000 tons. The sharp decline in 2017/18 final stocks to about 600,000 tons, would add pressure on the export logistics of the 2018/19 crop and milling industry's decisions. Milling is expected to remain stable to slightly down in 18/19 cycle compared to 17/18 season. Industrial domestic demand for wheat proved to be more inelastic than the external demand, and is directly related to total available supply (initial stocks plus production). Assuming lower beginning stocks for 2018/19 cycle and a total production of 18.7 Mt, therefore total wheat milling would be between 5.6 and 5.7 Mt.

2018/19 higher production is expected to be partly compensated by lower stocks. Export sales would not rise more than 3% to 12.4 Mt; above current cycle's 12 Mt but below 2016/17 12.8 Mt record.

December, January and February are expected to be very busy months for export ports. In addition to this, there was a 16% year-on-year drop in truck arrivals to Rosario Hub ports in November due to weather adversities. The Secretariat of Agribusiness informed export sales of 2 Mt in December, 2 Mt in January and 1.1 Mt in February. According to NABSA, the shipments in the first week of December would reach 224,000 tons and 297,000 tons in the second.

Wheat future prices in the local market showed little fluctuation during the week, in line with international markets. Wheat price in the spot market increased significantly, due to seasonal harvest pressure. Wheat had a US$ 7/t weekly variation, exceeding US$ 180/t. The recovery in MATba futures market, that followed international markets, was softer. The weekly increase was around US$ 2/t.