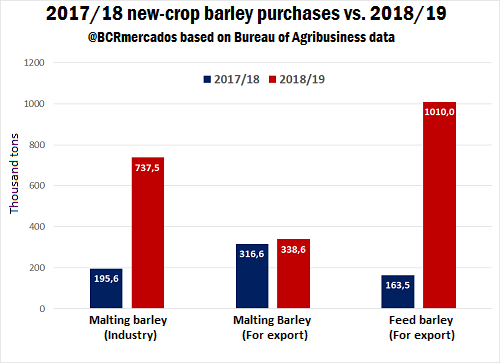

The one million barley-planted hectares promise good productive results in Argentina this cycle. Although winter left short water reserves, low soil moisture limited crop diseases. In addition, as barley's cycle is shorter than wheat's, it does not only require lower amount of water but it also makes a good crop option before late soybean planting. Barely crops in the provinces of Santa Fe and Córdoba, where rains were poor this cycle, show good conditions during the filling. In these areas, which specialize in malting barley production, farmers used cutting-edge technology in order to meet international market requirements. Meanwhile, in feed barely core productive area, in the south of Buenos Aires province, the crops present very good conditions. Given this good production scenario, Argentina could produce about 4 Mt of barley during 2018/19 cycle, a 300 thousand tons increase from the previous season. The industry and the export sector Larger barely production matches a greater demand, as the barley market in Argentina shows great dynamism this cycle. Barley total purchases (both malting and feed) currently exceeds 2 Mt, while last year acquisitions during the same period were 676 thousand tons. The following graph shows each sector's figures for the last two cycles.

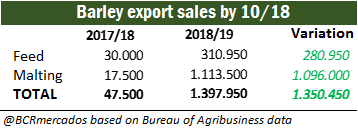

Feed barley exports had a significant increase, going from 163.5 thousand tons in 2017/18 to more than one million tons this cycle. The industry's purchases also increased significantly, this cycle's malting barley acquisitions exceeds 2017/18's purchases by 500 thousand tons. As for malting barley purchases for export, they are slightly higher than last cycle's volumes. Regarding barley exports sales, they reached the 1.4 Mt in 2018/19 cycle. This increase was mainly due to the growth of malting barley exports sales that went from 339 thousand tons in 2017/18 cycle to 1.1 Mt in 2018/19.

The price of barley depends on local stocks levels, the main exporting countries production and the others' feed grains markets. Beginning stocks this cycle are 0.18 Mt, the lowest volume in at least 3 cycles, therefore it could be projected a high demand pressure. In order to increase supply, maltings promoted barley planting by offering a US$ 20 bonus per ton on wheat price to harvest. Argentine barley beginning stocks are projected to recover in 2019/20 cycle. What remains uncertain is whether new foreign markets would demand barley from Argentina. Chances for this to happen are high, as global barley stocks are the lowest in 23 years.