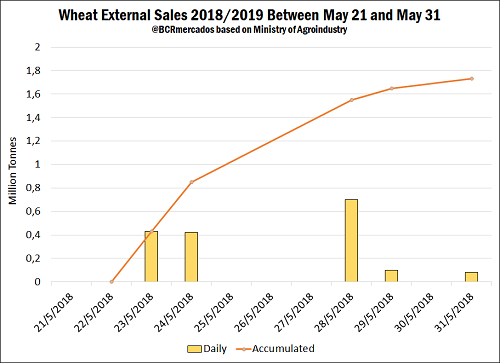

In the international market, wheat production continues to suffer from unfavorable conditions in some key countries. On the one hand, the States of the Black Sea Region are facing a drought that complicates their production prospects. According to the agency Thomson Reuters, dry weather conditions in both Ukraine and Russia have accentuated the likelihood that their crops will be reduced compared to last year. In the first case, they would fall to 24 million tons from the 25.4 tons obtained in 2017; while in Russia - the world's leading exporter - output would fall by 10% compared to last year. Also, the south of US Plains has also been dealing with extreme drought conditions for months, which is detrimental to the already punished winter crops. As reported by the USDA during the last week, only 38% of winter wheat is in good and excellent conditions, well below 50% at the same height of the previous year. Going to the situation in Argentina, the exporting companies increased foreign sales of wheat for the next crop year 2018/19, to the point that as of May 31, 2018 the Ministry of Agribusiness had reported Sworn Declarations of External Sales (DJVE) by 1.7 million tons. A contrast is made with respect to previous commercial years, since in the last 7 of them there were still no declared exports for the cereal to be harvested at this same height of the year. You have to go back to the 2010/11 cycle to find other DJVEs, which as of May 31, 2010 accumulated only 147 thousand tons, well below the current record.

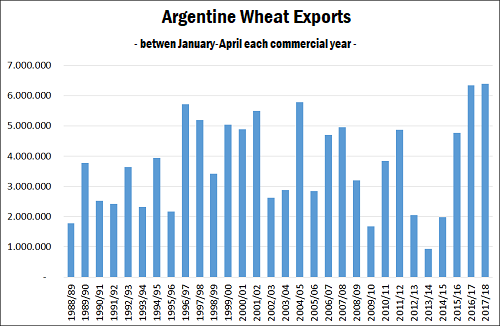

In the current year, exports continue to show great dynamism. According to our Natrional Statistics Institute, INDEC, 622,491 tons were dispatched in April. With this, shipments between January and April total 6.4 million tons, the highest volume in history for the first four months of a commercial campaign, as shown in the attached graph.

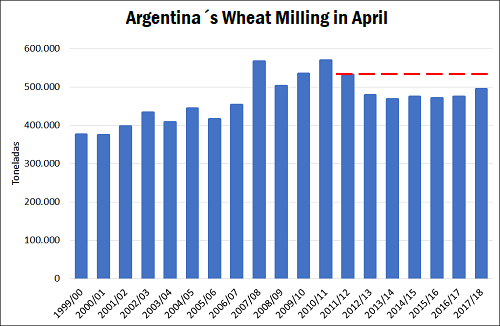

According to own estimates, the theoretical FAS or payment capacity for shipments abroad from the port terminals of the Gran Rosario is US $ 252 / t, when the market price is around US $ 246 / t. For the next harvest, the Theoretical FAS amounts to US $ 184 / t and a price in the domestic market is set at around US $ 190 / t. The strong export demand has not been at the expense of milling, on the contrary, the Ministry of Agroindustry reported the highest processing volume for the month of April of the last six years, with 494,888 tons.