Soybean shipments from South America rise amid US-China trade war

FRANCO RAMSEYER - EMILCE TERRÉ

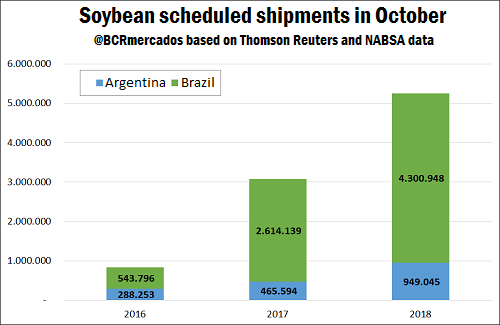

The great number of soybean shipments leaving South American ports this October is particularly striking for this time of the commercial cycle in the Southern Hemisphere. According to NABSA, ports in Brazil and Argentina shipped 5.25 Mt last month, which represents a year-on-year increase of 70% and it is five times October 2016 exports. The shipments destination, of course, was mainly China.

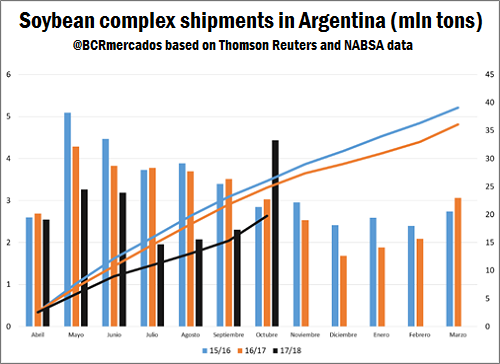

This export rebound in October brought some air to Argentina's main exporting complex. The volumes registered last month even exceeded May shipments, in full harvest season. However, this cycle's shipments are still far behind previous cycles', since between April and October 2018 total shipments were 19.77 Mt, 5 and 6 million tons below 2016/17 and 2017/18 cycles, respectively. The following graph show the evolution of scheduled shipments per month (left axis) during the last three cycles, while the line represents accumulated volume (right axis).

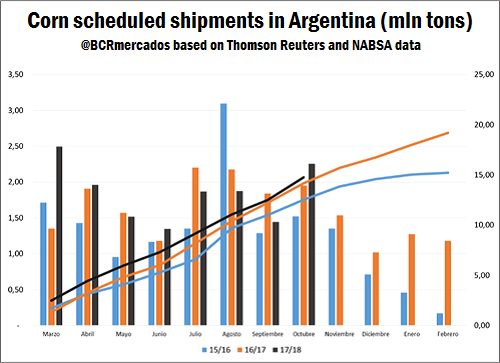

Corn shipments from Argentine ports showed a high pace during this commercial cycle. Despite the 15.8% contraction in corn production due to the drought, foreign exchange remain strong. Thus, scheduled shipments from Argentine ports between March and October this year were 4.1% higher than the previous year, totaling 14.75 million tons. The graph bellow presents the evolution of corn scheduled shipments per month (left axis) during the last three cycles, while the line shows the accumulated volume (right axis).

The greater number of shipments did not affect domestic prices, at least for the time being, since storage, industrial and export plants were well supplied to face this level of activity. In fact, commercial corn stock at the end of September exceeded previous year records. As for soybean, on the other hand, the stocks reached the highest level in the last three years. Therefore, only a sustained external demand would influence prices, especially in a national scenario where exchange rate is being controlled through monetary contraction.