Soybean price strongly depends on volatility

PATRICIA BERGERO - FEDERICO DI YENNO – BLAS ROZADILLA – DESIRE SIGAUDO

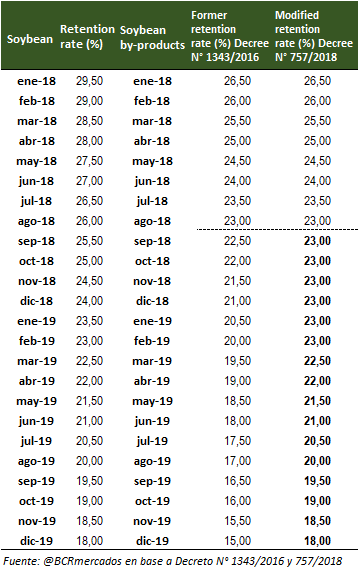

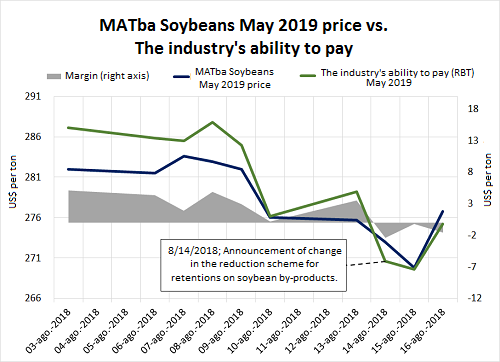

Soybean price in both the spot and the forward markets registered high volatility because of several events. Firstly, on Friday 10, USDA's report estimated a higher production than expected for the US. Secondly, on Tuesday 14, the Argentine Government announced changes in withholding tax on exports for soybean by-products. Thirdly, there were new trade talks between the US and China that rose positive expectations regarding the commercial tension between both countries. This last event allowed the soybean spot price at Rosario's Board of Trade to set at US$ 269/t, US$ 2.5/t below the previous Thursday's price, but US$ 9/t above when compared to its price following USDA report. The Necessity and Urgency Decree N° 757, published on Wednesday, August 15, by the President of Argentina, determined that withholdings tax for exports of soybean byproducts (among them, the most important are meal and oil) will continue at a 23% rate over the FOB price until the beginning of March 2019. This implies a 6 months freezing in the retention reduction scheme, resulting on equaling the withholdings tax on soybean. From that point, soybean by-products and soybeans will follow the same reduction scheme of half a percentage point per month. As the changes on the withholdings tax reduction scheme were leaked a day before the decree was published, MATba (Buenos Aires Futures Market) May2019 futures price fell by US$ 2.7/t to US$ 273/t, while CBOT May2019 futures increased by US$ 3.5/t and the spot US$ 4/t.

Changes in the withholdings tax of soybean byproducts affect the price received by producers. This is so because domestic market price is not only influenced by the FOB price that exporters receive for the grain (in port of origin) and its cost structure (taxes -retentions-, port costs, commercial expenses) but also by the other crucial actor in the demand of the oilseed: the crushing industry. The magnitude of the impact is determined by the relative share of the demand for industrial exports compared to the demand for soybean exports. In Argentina soybean industry absorbs 75%, on average, of national production. Therefore, a change in the retention reduction scheme for oilseed industry depresses prices. The following graph shows the variation of soybean price to be delivered next May in Rosario Hub, according to MATba, and the oilseed industry's ability to pay for the new crop, estimated by the Rosario Board of Trade on a daily basis, after the news is known on August 14, 2018.

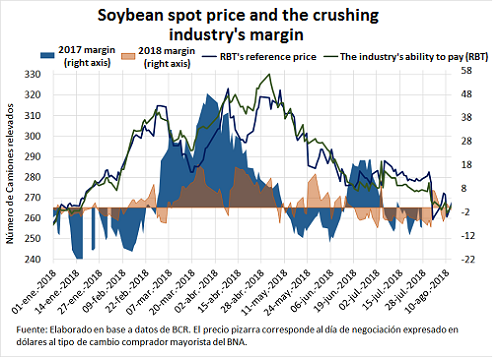

Modifications in retentions regime would not only affect the prices received by producers, but they also increase the cost of exporting by-products, hitting the crushing industry in the medium term. The new regime improves the scenario for soybean exports, while it relatively discourage the incorporation of value added. Furthermore, the crushing industry's margin in 2018 is lower to its previous year's margin. This is the result of a lower supply due to the fall in Argentine soybean production and a lower external demand (the lowest meal sales in at least 8 seasons and the lowest oil sales in the last 6 years by this time of the year). For comparison purpose, the graph below shows the crushing industry's margin -the difference between the industry's ability to pay and the market price in 2018- (orange) and that same ratio for same period of 2017 (blue). The industry's ability to pay is a theoretical construction that aims to estimate the general situation of the market since it must be considered, among other things, that: a) each company has its own cost structure; b) soybean purchases and by-products sales are considered simultaneous in the model while reality is much more complex; c) obtaining a positive ability to pay margin does not necessarily materialize since it depends on the real possibility of buying and selling; d) a positive margin in a period -generally, in harvest- helps to balance the rest of the year.

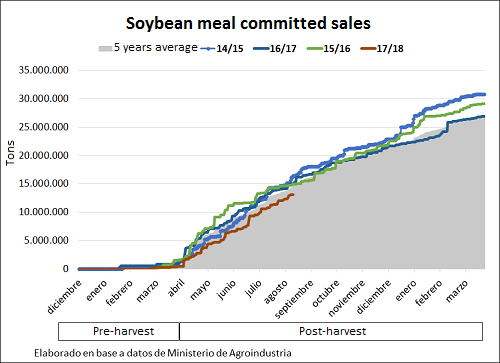

Regarding by-products' external sales, as mentioned, to date there is a sales rhythm far behind other seasons. The committed sales (DJVE) of 2017/18 soybean oil to August 13 reach 2.26 Mt, behind the 2.34 Mt of DJVE at the same date last season. Although this tonnage does not represent a big drop compared to last year, if compared to previous crops the fall becomes more than substantial. At the same date of the 2015/16 and 2014/15 season, the committed sales reached 2.77 Mt and 3.25 Mt, respectively. The sharp fall in soybean oil's exports responds to India's protectionist policies in recent years (increasing import tariffs on different edible oils, including soybean oil) to encourage domestic production. This proves the negative effect of having a concentrated demand, as over the past years, India has captured 50% of Argentina's soybean oil exports. Another example of this is Argentine soybeans' market, where China monopolizes 90% of the country's total shipments.

The case of soybean meal is even more unfavorable, since 2017/18's committed sales at the same date reach 13.11 Mt, well behind the 15.16 Mt of the 16/17 crop.