Soybean and corn prices fall in the domestic market

PATRICIA BERGERO - FEDERICO DI YENNO - FRANCO RAMSEYER

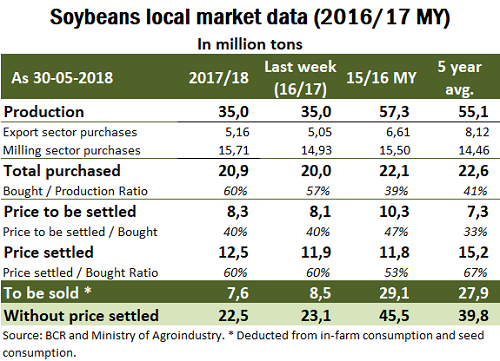

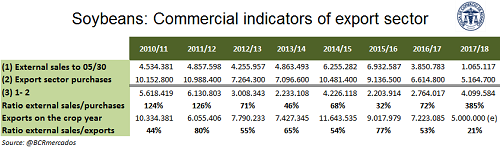

Good rhythm of soybean purchases from the industrial and exporter sectors Soybean purchases from both the export and industry sectors register an accelerated pace so far in 2017/18, which sharply contrasts with the low export sales rhythm presented by both the soybean and its by-products. At the end of May, the export sector had acquired almost all of what is estimated as an exportable grain balance (5 million tons) for 2017/18. These purchases have presented a very fast pace if the indicators of past campaigns are taken into account. It is feasible, therefore, that, from now on, the demand pressure responds more to the requirements of the processing industry. The most important data for the export sector of grain are the sworn statements of sales abroad (DJVE by its name in Spanish). These had reached 1.06 Mt as of May 30, covering only 25% of what is expected to be exported in this commercial year, when the historical average at the end of May was 60% of the projected export sales. The data of DJVE is used on May 30 to compare it with the most recent statistics of purchases in the domestic market. The last figure ascended 1,18 Mt to 6 of June.

On the other hand, soybean stocks in the hands of the processing industry reached 3 Mt at the beginning of May, becoming the second largest volume in historical terms, only surpassed by May 2015. This would be, once again, a indicator of the strong pace of purchases compared to a weak rate of processing in the first month of the 2017/18 campaign (April). The volume of industrialization is well below the expected values, despite being harvest time, due to the fall of the production of the oilseed and the delay in the delivery of the merchandise, all this contributing to the drop in transport of merchandise to the processing plants. This large stocks can also be seen in the difference between the total purchases of the industry and processed by the factories. Supposing for May a processing of 4.2 Mt, there could be a stock of 8 Mt, which would be much higher than the stocks of the last season on the same date (7 Mt).

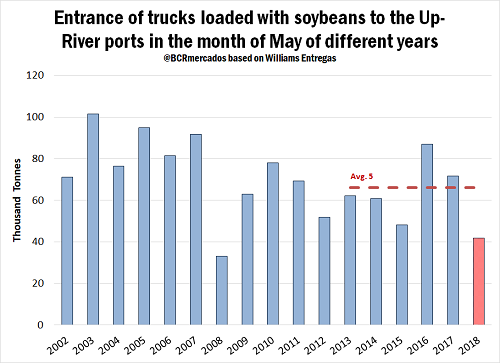

Soybean oil external sales could have a significant chance of rebounding in the year due to purchases that could originate in China. According to sources from the Ministry of Agroindustry, there were sales made to China that would mark an interesting change considering that 2015 was the last year in which the Asian country acquired that product to our country (539,000 t in all of 2015). As of June 6, soybean oil external sales amounted to 1,023,330 tons, while at the same time last year, they amounted to 1,455 Mt. Similar delay occurs in soybean meal where external sales marked 6.75 Mt being that data of 9.84 Mt last year to the same date. According to the DJVE, there are commitments to ship oil and flour and / or soybean pellets through December. Lower soybean deliveries at the start of the 2017/18 commercial year As it is clear from the previous paragraphs, not necessarily the biggest purchases translate into bigger deliveries; since the latter is mostly related to the possibility of dispatching the grain. In this particular year, the transfer of the grain has depended on the rhythm of harvest and the possibility of removing the soy from the field and transporting it to the commercial stores. The entry of trucks loaded with soybeans to the different Up-River ports between April 1 and June 6 has been the lowest recorded, according to information from different suppliers. With an amount of 105.5 thousand trucks, this period of 2018 is a 30% lower than the equivalent of the previous year and 32% lower than the average of the last 5 years.

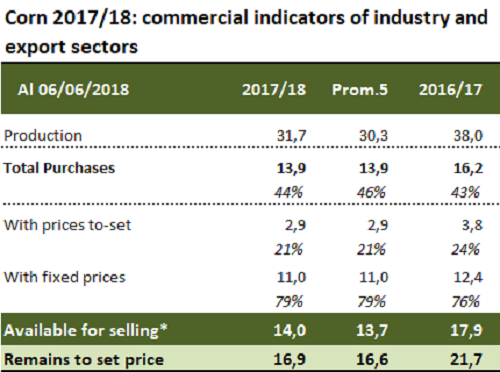

Export activity is concentrated in corn and wheat Like wheat export sales, corn has a very fast pace of sales compared to last year. The Sworn Statements of Sales Abroad (DJVE) in 2016/17 reached 10.56 Mt as of June 6, while in 2017/18 the export commitments total 12.28 Mt. This volume of external sales practically equals the purchases of the export sector. In the table indicating the level of merchandise committed in the domestic market, the data reflect the situation at the end of May, since the latest figures for purchases declared correspond to 30/5.

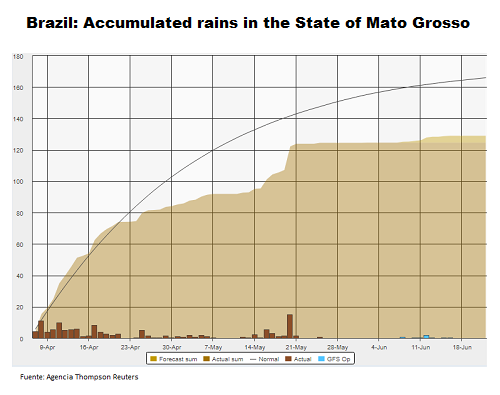

This means that the external sales of the export sector are covered by purchases made in the domestic market. Being 3 months away from the conventional start of the commercial corn crop year, a good performance of the demand can be expected in the remainder of the year, always observing closely the competition that represents the production of second-planting corn in Brazil. Regarding Brazil, it´s worth mentioning the effect of the sharp devaluation of the real in recent weeks and the water deficit suffered by the states of Mato Grosso, Moto Grosso do Sul and Goiás in the last weeks of April and the first week of May.

According to the Thomson Reuters news agency, and the results of its latest survey, the effects of the drought in the state of Paraná and in the productive areas of the central-western states of Brazil have pushed back production expectations for 2017/18 Brazilian corn to 82.88 Mt. There has been a somewhat more favorable recent climate for second-season maize, compared to that experienced in April, with rains reaching the main productive areas during the second and third week of May. On the other hand, there are forecasts of favorable rainfall for crops in the next week, contributing to improve the situation in the lots. Prices on the domestic market Regarding FAS prices offered by buyers in the Rosario Board of Trade, both soybeans and corn fell over the past week. Soybeans felt by 1,3% to reach the price of AR$ 7.200/t last Thursday for the short-term delivery. On the other hand, spot corn also fell, with weekly losses of 3,2% reaching a price of AR$ 4.160/t on last Thursday.