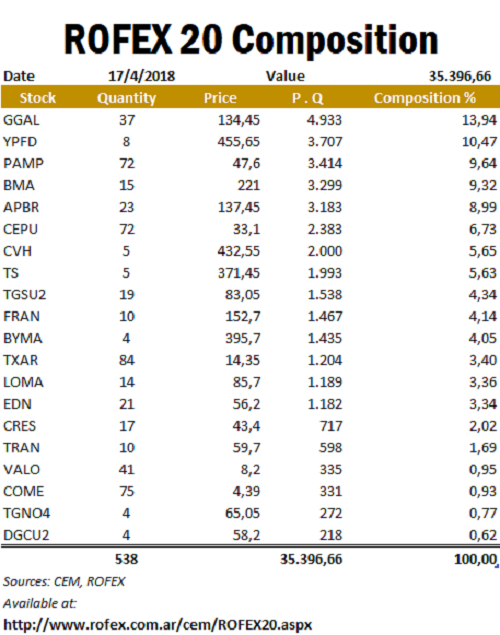

The new ROFEX 20 index (by its abbreviation, R20) has been developed by ROFEX, in order to cover the price risk in stock portfolios at times of high volatility. It began to list in the market from 16 of April of the current year. Its usefulness, at the time of having a set of shares or quotas shares of mutual funds, lies in the coverage of stock market risk in the case of adverse changes in the price of securities. The capacity of our coverage, among other issues, will depend on the relation between our stock portfolio and the stock index that replicates the weighted value of the same. The ROFEX 20 index is composed of the weighting of 20 different Argentine stocks with a quarterly update, being selected based on their liquidity. The weight of each paper in the index is given by its stock market capitalization. This Index, in turn, has a total return, in which, in addition to the capital gains, the dividend payments that come from the shares included in it are added, being theoretically reinvested in the same. As of the 2nd quarter of 2018 (first day of April), you can see in the following table the stocks that comprise it and the composition of each one. The composition of the index and its methodology are easy and public access on the ROFEX website and its Market Statistics Center.

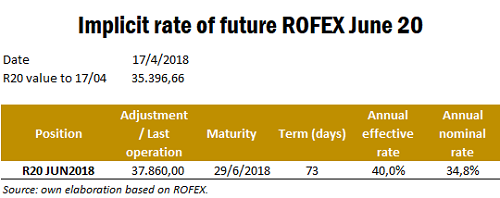

As an example, the price of the future of Index Rofex 20 with expiration in June 2018 on April 17 was 37,860. Suppose we have a portfolio that has a very similar or the same composition of the ROFEX Index 20 noted in the attached table. For further example we can assume that our portfolio consists of 538 shares, having the same composition as the theoretical amount of the Index. Thus, if we multiply the market value by the amount of paper for each type of share, we have in total an investment valued at 35,396.66 argentine pesos. If today, April 17, I decided to cover the value of my shares using, for example, the future R20 of June 2018, operating at the close of day April 17 (AR$ 37,860), we would obtain a nominal annual rate for our portfolio of 34.8%. This rate calculated without taking into account operating costs, we will obtain it regardless of whether the market falls or rises in its course, as dictated by any perfect coverage we make in the futures markets. Comparing over a similar term (64 days), on the same day, bids for Central Bank Bills were carried out with a cut-off rate of 26% nominal annual rate, this yields actually more attractive rates with the Rofex index.

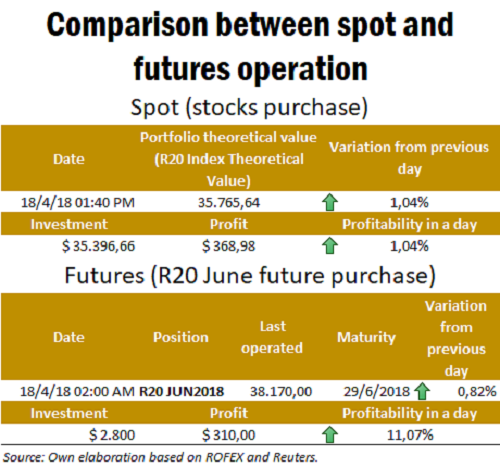

When choosing a future on index such as ROFEX 20 we must take into account "the relation our stocks have" on the index that tries to measure "market performance". In this case, in finance this coefficient is what is known as the "Beta" of the stock or of our portfolio of shares (in this case), which measures the volatility of the assets with respect to a measure of market performance. That is, we want to know what happens with the price of an action that I own when the market on average low (or the Index that replicates the market low) or what happens with the price of our share when the rest of the shares goes up (or the Index that replicates the market rises). Taking into account the weighted Beta of our portfolio, we can use, for example, index futures as a portfolio hedging tool and capture the implicit rates offered by the forward market. Leverage The other attribute that the futures hold on stock indexes, is the ability to position in a diverse portfolio of quoted shares in the market, decreasing the capital requirements and the costs of operating stock per stock. This is so because taking into account the models of futures valuation we can buy or sell a futures contract on a stock index, positioning ourselves to its bullish or bearish movements, and investing a smaller amount with respect to the purchases of the shares that we have to do in the spot. The margin of a R20 futures contract today is AR $ 2,800 as it can be publicly accessed in ACSA (Argentina Clearing). That is to say, that by investing only AR $ 2,800, I have the possibility to participate in the price movements of the shares until the expiration of the contract. Let us suppose that on day April 17our total investment in shares was that mentioned in the previous example. Option B would have bought a future R20 June contract at the end of that day, integrating a margin of AR $ 2,800. On April 18 at 1:30 p.m. our profitability (measured in capital gains) would be ten times higher. It must also be borne in mind that this operation increases our degree of exposure, because if a negative result occurs, the results also multiply in the opposite direction.

This new product from Rofex expands the range of investment alternatives in the Argentine capital market and allows to cover the price risk of those investors who bet on equities in our country. It is an interesting tool for investors, which has been very successful in other countries where they have consolidated the capital markets as a tool at the service of financing the productive, commercial and financial sectors.