Rains allow to recover the illusion of planting wheat for the 2018/19 season

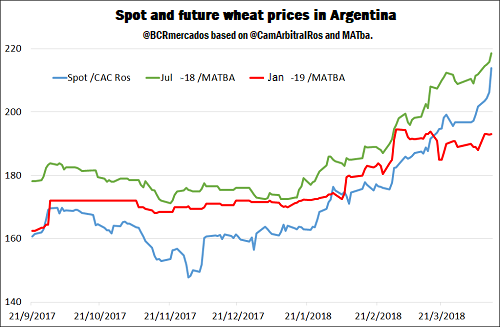

The wheat market starts to recover from the setback suffered at the beginning of the month and closes on last week at similar values to the relative highs reached towards the end of March, affected by the external rise of the cereal. The Rosario Board of Trade's reference price was last Thursday at AR $ 4,300 / t, with a weekly profit of AR $ 300 / t.

The same performance was shown by the futures contracts for both the current and the new campaign. Thus, the future of wheat for unloading in Rosario that expires in July adjusted on Thursday in MATBA to US $ 218.5 / t, rising US $ 7 / t in the week, while the future of January adjusted to US $ 193 / t, earning US $ 4 / t compared to last Thursday.

This value of next season wheat allows the producer to think of an attractive margin of profitability, necessary condition in a campaign as uncertain from the climatic perspective as the current one, to force the balance of the producer in favor of the sowing of the crop in the months of May / June. With the low level of water on soils that left the worst drought in 50 years, the producer is faced with the dilemma of planting wheat and be exposed to the demand of (scarce) water resources of the crop during winter, or not planting, preserving water reserves but resigning an income in the months of December / January, fundamental to close accounts after this difficult 2017/18 campaign that was financially harmful.As an example, the tremendous drought that affected the province of Santa Fe generated significant losses of soybean and corn production. Agricultural producers throughout the province have lost about 3.2 million tons of soybeans and 1 million tons of corn, as a consequence of lost areas (not harvested) and lower yields in the current campaign. This damage amounts to almost US $ 1,360 million if the loss production is valued by FOB export prices. This drought has generated several losses to producers.

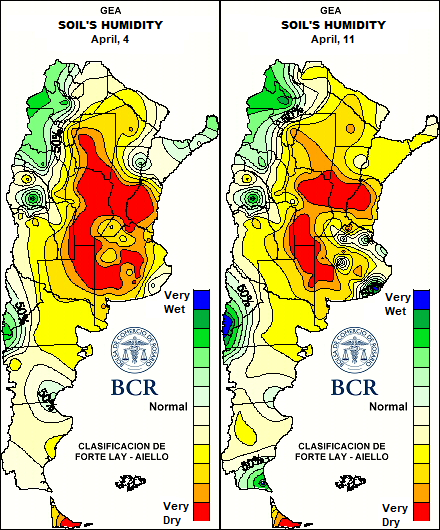

As an additional motivation, the generalized rains last week allowed to recover some humidity to the beaten agricultural soils, especially on the east of the core region. This is clearly seen in the evolution of the soils' condition from April 4 to April 11, even before the intense rains on previous Wednesday in the central regions.

The future market's outlook looks encouraging for the Argentine wheat market. The grain demand by Brazil will be strong, while a notable increase in consumption is expected in some destinations that were reopened for our deliveries, mainly in sub-Saharan Africa. So far in 2018, 15% of our exports went to countries in that region.Although it is expected that the countries of the Black Sea region will continue to gain market share in the international wheat market, this happens mainly at the expense of sales from the United States and the European Union. In this sense, Argentina has a competitive advantage by harvesting wheat very early in the year (months of December / January), while countries such as Russia and Ukraine harvest their cereal between July and August, which allows us to penetrate strongly into the first semester of the year.

Thus, between December and February, according to INDEC official records, Argentina exported more than 6 million tons of wheat, to which another 1.5 million tons in March would be added. At the same time, sworn statements of sales abroad amount to 8.9 million tons, the highest historical record for the date. Thus, the exportable balance that would remain to sell throughout the year is only 2 million tons.

This boost of external demand looks solid for the next campaign 2018/19. Exporters began to make purchases since March, which had not happened for 17 years. To April 4, these purchases accumulate close to 400,000 tons.

On the external front, the market's view was set on the monthly report of supply and demand estimates published by the United States Department of Agriculture (USDA) last Tuesday, which generated a bearish tone in the international market. The final stocks projected for the United States increased with respect to March's value by 860 thousand tons, due to lower animal consumption and residual use, and were above the expectations of market operators.

Global wheat supplies for the current season increased by about 3 million tons (Mt) this month. This is due to the increase in final stocks compared to the March estimates, which went from 268.9 to 271.2, a new record. This data was the one that gave the greatest surprise to the participating agents of the CME, who expected a decrease due to the expectation of a greater demand for the cereal. Although the projected world consumption is higher, mainly due to increases in the European Union and Indonesia that more than offset the reductions in Iran, India and the United States, the increase in world supply still exceeds the additional consumption mainly from the expected increase of production that would reach a record level of 759.75.

As regards the world trade projected for the 17/18 campaign, there are practically no significant changes. The increase in exports from Russia, Kazakhstan and Argentina, compensate for the lower numbers of the European Union and other exporters with lower participation. Russia's external sales rise 1 million tons to reach 38.5 Mt, surpassing the record volume of last year by more than 10 million. The former Soviet Union continues to consolidate world wheat trade as the main reference, stealing markets from traditional exporters such as the European Union and Australia, and gaining competitiveness in Southeast Asia. This thanks to the favorable climate that became present throughout the productive cycle and allowed it to reach a record production of 85 Mt, 12 Mt more than in the previous campaign and almost 24 Mt more than in the 15/16.

In relation to the USDA estimates for Argentina, with the upward revision made by the agency, the total shipments of the 2017/18 campaign would amount to 14.5 million tons (including flour). If fulfilled, this will mean that in four years the country climbed from the tenth position as an international wheat supplier, representing 1% of world exports, to position 7, with a market share of 8%.