Projections on Argentina’s 2018/19 wheat crop supply and demand

FRANCO RAMSEYER - DESIRÉ SIGAUDO - EMILCE TERRÉ

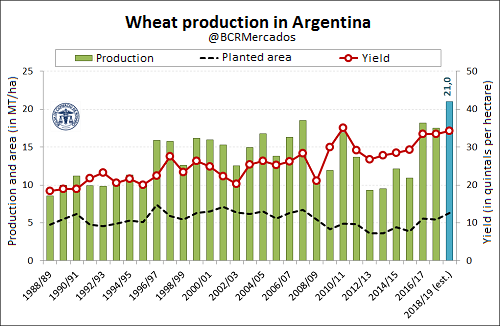

Taking advantage of good weather conditions and soil moisture reserves, Argentine wheat production does not only aim for an increase of 16% of the planted area, estimated at 6.32 MH, but also to enhance the yield as much as possible through investment in fertilizers and management. This framework lead us to anticipate yields that would result on a production of about 21 MT, a historical record for Argentina.

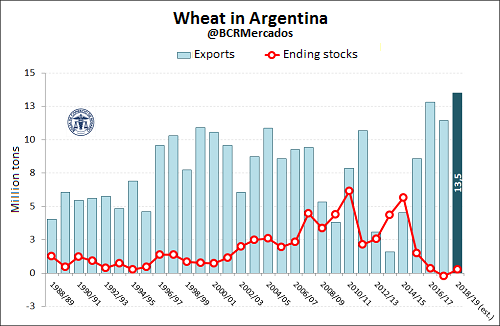

This record production of 21 MT would not only meet the needs of the local crushing industry, but would also provide a record exportable balance for Argentine wheat. Wheat exports could reach a historic record of around 13.5 MT.

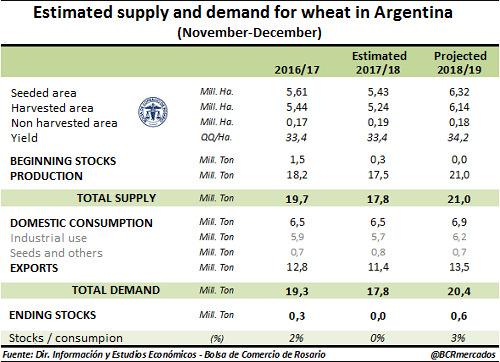

In line with the strong export demand perspective for the new crop, committed sales abroad to the date are the highest registered. They reach 4.3 MT for the 2018/19 season, and they represent over 30% of the exports projected for the entire season. Given these figures, 2018/19 final stock could show a slight recovery compared to previous season's value, although it would still remain 70% below the previous five years period's average. The following table summarizes the supply and demand balance, according to projections made by Rosario Board of Trade.

The main remaining obstacle for Argentine wheat is to reach next season. The fall in production as a result of last winter's excessive rains faced a very active demand in the current 2017/18 season, which would push down the level of wheat stocks in Argentina. Harvest progress this season is expected to equal last season's. By November 2017, 35% of wheat cultivated area was already harvested. Current season's projections, however, depend on the evolution of water reserves in the coming months. Meanwhile, the domestic market echoed the shortage of available wheat while the price in the spot market at Rosario's Board of Trade remained above U$S 217/t from August, 6 th to August, 10th ($ 6,000 all week). During this month, wheat price has already experienced an increase of 5.2% in the spot market, while the price of new wheat crop, taken from MATba (Buenos Aires Futures Market) December wheat futures (with delivery in Rosario), increased by 3.7 % in the same period up to U$S 218/t.