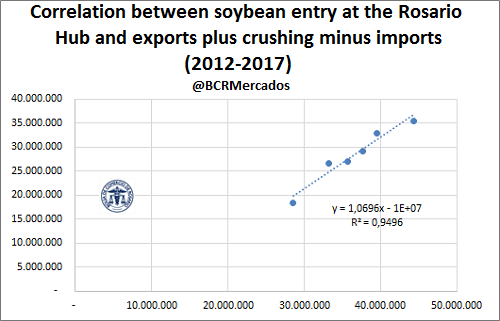

Based on an estimated production of 35 million tons for 2017/18 crop and a projection of 50.7 MT for the 2018/19 crop, this article seeks to make a forecast for the entrance of soybean in the plants located in the Rosario Hub. Argentina is the undisputed global leader regarding soybean meal and oil exports, it supplies about 50% of the world demand for both products. It has a theoretical national processing capacity of 66 million tons per year, while 78% of this capacity is set in the Rosario Hub. There are 29 port terminals located along the 70 km coastline that goes from Arroyo Seco to Timbúes, with its epicenter in the city of Rosario. 19 of these port terminals dispatch grains, oils and by-products, having 12 of them their own processing factories. In addition, there are 8 other oil factories in the area, totaling 20 industries that demand beans to produce oil and meal, among other variety of oil derivatives. Consequently, the exporting cluster of the Rosario Hub surpassed in 2016 all the others around the world, including the Customs District of New Orleans (USA) and the port node of Santos (Brazil). Therefore, it is crucial to project the entry of soybean in the crushing plants located in the Rosario Hub (in the south of Santa Fe province) as it has great impact on economic activity and employment levels of the province. Carriers, brokers, crushers, exporters, intermediaries, financial service providers, among others, depend to a large extent on the dynamic of the sector. The estimates of soybean arrival in the Rosario Hub are based on the processing plants and port terminals needs. This demand is calculated taking into account the tons processed at a national level (weighted by the share of Santa Fe province in the total), plus tons exported (weighted by soybean exports from the Rosario Hub), minus the volume of imports per season. The Truck Arrival Indicator (in tons) developed by Williams Entregas is a good proxy for soybean entry as the grains arrive in Rosario Hub. The Pearson correlation coefficient between both variables for the period 2012-2017 is 0.974.

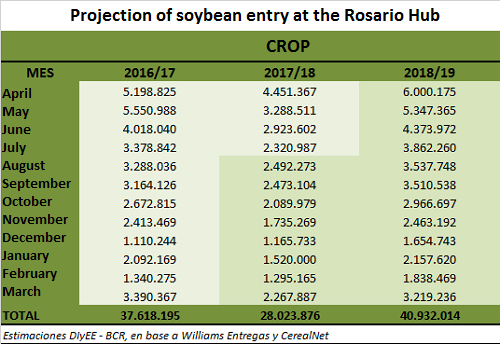

According to these estimations, crushing plants and the export sector could demand more than 28 MT during 2017/18 season and exceed the 40 MT in 2018/19. In addition, it is possible to calculate the monthly distribution of soybean entry based on Williams Entregas and CerealNet records. Therefore, the following table shows the arrival of trucks during the past season, the trucks that entered by this time of the crop (in lighter green), and 2018/19 crop projections.

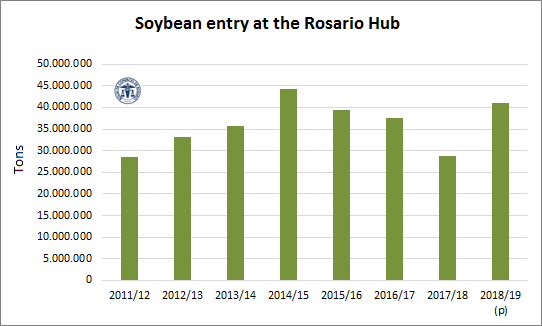

As a consequence of the drought, a retraction of 9.5 MT of soybean entry is expected in the region, although it will be partly compensated by a great liquidation of the remaining stocks from the last crop. In addition, as in dry years the threshing progresses at great speed. Due to fast entry of soybean and the sharp decrease in production, a lower income of the grain should be expected between August and March 2019, about 15 MT, contrasting with previous season's 19.47 MT. It is expected for soybean entry in the Rosario Hub to be over 40 MT, it would be above the volume registered in 2016/17 crop. It is projected a production of 50.6 MT and thus a continuation of stocks reductions. According to this model, the months showing a greater increase would be April, May and June; when there would be 15.7 MT accumulated soybean incomes, 48% higher than the same period this year. This increase is mainly explained by the higher expected production combined with a recovery of the soybean industry's activity. According to the estimations, soybean entry for 2018/19 crop would be 46% higher than 2017/18 crop's entry. Due to the productive loss as a result of the drought first and excessive rains later that affected the crop, it is much more relevant to point out that the entry would be 17% higher than the average deliveries during the three previous years. This recovery will benefit the sector and will contribute to overcome the difficulties that the worst drought of the last 50 years brought.