New soybean crop purchases fall below last year’s acquisitions

JULIO CALZADA - SOFIA CORINA - BLAS ROZADILLA - DESIRE SIGAUDO

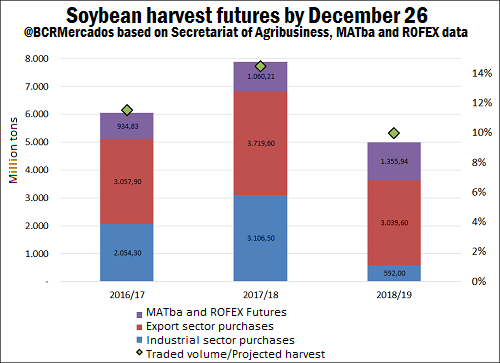

According to the Secretariat of Agribusiness data, by December 26, the industrial and exports sector combined have bought 3.63 million tons of 2018/19 soybean crop that will be harvested in April, 46.8% less than in the current campaign (6.83 Mt) and 29% below the purchases at the end of 2016 (5.11 Mt). Only about 1.2 Mt of the already committed volume are priced contracts, the other more than 2.43 Mt (67%) are pending-price contracts.

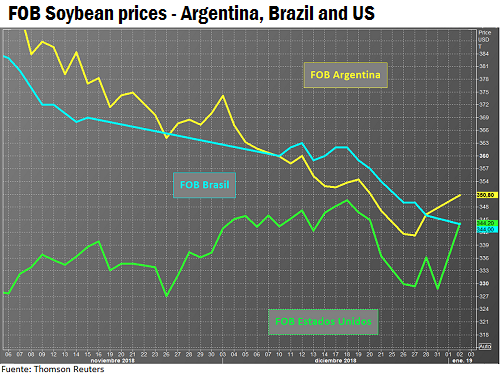

Adding purchases through the futures markets the year-on-year fall is smaller. New soybean crop purchases now account for 4.98 Mt, 36.8% below the 7.88 Mt in 2017. The explanation for the delay in commercialization of new soybean crop can be found in both the demand and the supply side. On the supply side, farmers are not motivated to sell their goods at current prices, which are around US$ 240/t, especially knowing that at the time of making the sowing decision the values were US$ 10-20 above. Furthermore, there is weather uncertainty after the severe drought that hit hard soybean production in the 2017/18 season. In this scenario, farmers are cautious and wait for harvest outcomes and a recovery in prices, hopefully. On the demand side, the outlook is not encouraging either. Argentine industries were negatively affected by the new export duties scheme and the reconfiguration of international markets in the context of the trade war. Current prices do not show positive margins, so factories have no interest in accelerating their purchase pace. The industrial sector is the one that that withdrew the new crop purchases the most compared to the same period last year, as the graph shows, dropping 81%. Exporters, which account for most of new soybean purchases, have lost competitiveness in the international soybean market in the past days as Argentine FOB prices increased. As a result, no major changes are expected in the new soybean market that lacks of reactivation incentives.

Rosario Board of Trade reference price closed the first week of the year gaining US$ 10.8/t, on Thursday 3.